US stocks have fallen for five days running as traders nervously await a speech from Federal Reserve chairman Jerome Powell.

Central bankers are gathering for an annual summit in Jackson Hole, Wyoming, where Mr Powell could indicate whether interest rates will be cut soon.

The Fed hasn’t reduced the cost of borrowing since December – despite repeated calls from Donald Trump to do so.

By contrast, the European Central Bank has slashed rates four times in 2025, with the Bank of England opting for three cuts so far this year.

Federal Reserve chairman Jerome Powell. Pic: Reuters

Money blog: Top tips for entering US under Trump

The US president has nicknamed the Fed chairman “Too Late” Jerome Powell on social media – and has repeatedly called for his resignation.

But Mr Powell has argued that interest rates can only be lowered when there are clear signs that inflation is returning to its 2% target.

Today will mark his final keynote speech at Jackson Hole before his eight-year tenure at the Federal Reserve ends in May 2026.

Past addresses have been known to move the markets, with reaction often amplified because of lower trading volumes during the summer months.

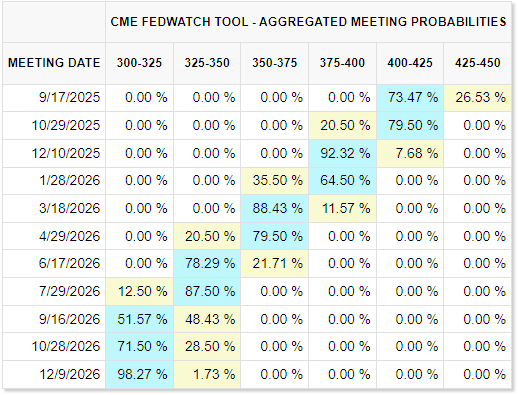

Figures from the CME FedWatch tool show expectations for a US interest rate cut when policymakers next meet in September are on the decline.

One week ago, the probability of a 0.25 percentage point cut was priced in at 85.4%. But that fell to 82.4% on Thursday – and has dropped further to 73.3% at the time of writing.

It comes as other senior officials within the Federal Reserve, speaking on the sidelines of the three-day summit in Jackson Hole, continued to express caution.

Read more business news:

Major steel producer pushed into compulsory liquidation

London Underground workers to strike for seven days

Please use Chrome browser for a more accessible video player

1:35

1 August: New tariffs threaten fresh trade chaos

Beth Hammack, president of the Cleveland Fed, told Yahoo Finance: “With the data I have right now and with the information I have, if the meeting was tomorrow, I would not see a case for reducing interest rates.”

Of particular concern is the impact that Donald Trump’s tariffs are having on inflation – both in terms of costs for businesses, and what consumers ultimately pay.

Just this week, Walmart – the world’s biggest retailer – warned tariffs are squeezing its profit margins and leading to higher prices at the till.