“The gains are driven by a combination of factors,” said Sabina Levy, head of research at Leader Capital Markets. “Most notably, the unprecedented and swift achievements by the IDF, Mossad and other security services, which suggest the conflict could be short-lived and end in a decisive Israeli victory.”

Levy also pointed to growing speculation about a possible breakthrough in the hostage negotiations, as well as increasing optimism over a potential normalization deal with Saudi Arabia in the medium term.

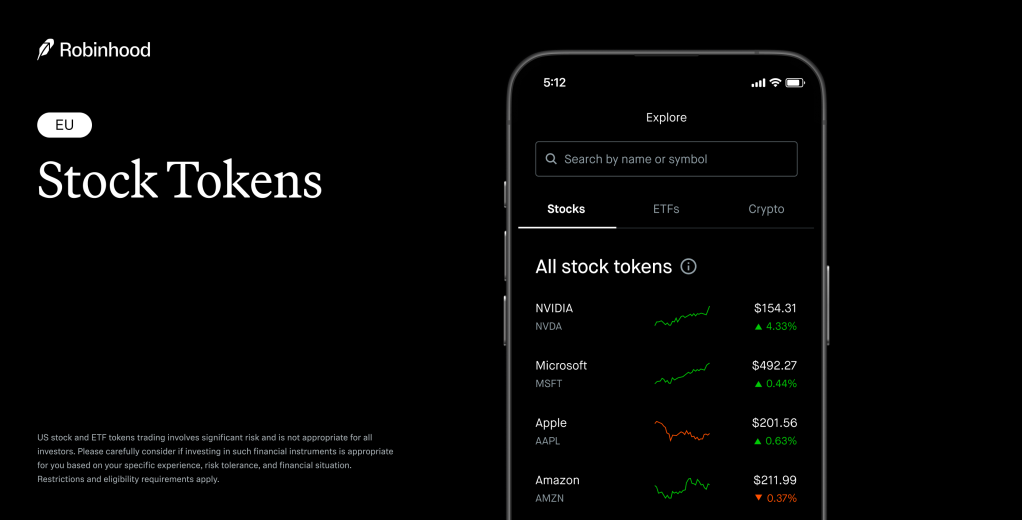

While conventional wisdom might suggest that war—especially with Iran, Israel’s top adversary—would trigger a market plunge, the opposite has occurred. “There’s a strong sense of victory in the market right now, and a prevailing FOMO (fear of missing out) among Israeli investors,” Levy said.

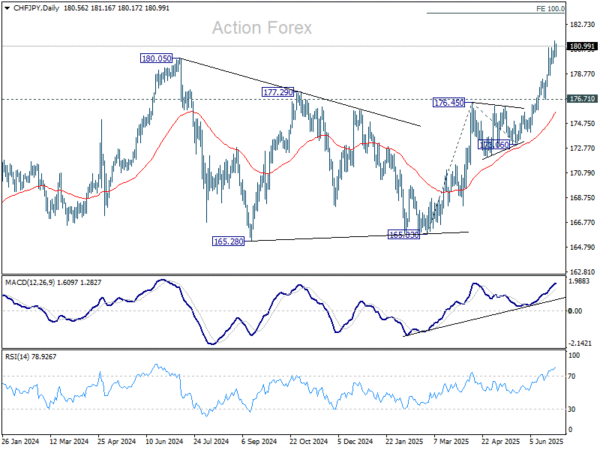

“There’s a widespread belief that a serious blow to Iran’s nuclear threat and leadership could reshape the region—with Israel emerging as a dominant power. Investors are betting on post-war economic growth, renewed foreign investment, reduced risk premiums, a stronger shekel a lower dollar exchange rate and potential interest rate cuts later this year.”

What sectors are leading the rally?

“Buyers are focusing mainly on real estate, infrastructure, energy and insurance stocks,” said Levy. “There’s also strong momentum in the defense sector, including shares of Elbit Systems, NextVision, Bet Shemesh Engines and Ashtrom. Meanwhile, the shekel has strengthened, bond yields have declined and credit spreads have narrowed—all of which support the equity market.”

Still, Levy warned that the situation remains volatile. “We’re still in the early stages of the conflict,” she said. “Yes, the current trajectory exceeds expectations and casualties remain below initial forecasts—but the continued trickle of rocket fire or slower-than-expected progress on the ground could cause investors to reassess risk, focusing on the broader economic impact, disruptions to business operations and the overall cost of war.”

What other risks are on the horizon?

“Foreign investor confidence could erode, especially given the ongoing political uncertainty and the prolonged state of emergency,” Levy said. “There’s also the risk of regional escalation—particularly in the Strait of Hormuz—which could drive oil prices higher and trigger global effects that spill over into Israel’s economy.”

Looking ahead, she said, a slower pace of ground operations and continued Iranian missile fire—even at low intensity—could shift market sentiment, potentially leading to credit rating downgrades, negative equity revaluations and higher bond yields.

“Historically, the local market has tended to react positively to military operations in which Israel is the initiator and appears to be in control,” Levy noted. “Examples include the ‘Pager Operation’ against Hezbollah and high-profile assassinations—such as top Hezbollah commanders or even Hassan Nasrallah.

“In those cases, the combination of operational dominance and intelligence superiority boosted investor confidence and market sentiment.”

“When Israel is caught off guard, like on October 7, markets respond with sharp declines,” she said. “The shock, the scale of civilian casualties and the perception of losing control triggered a steep drop in equities, a rapid depreciation of the shekel and a spike in government bond yields.”