I’ll get right to the point: retail Forex is alive and kicking. It has plenty to offer retail traders of all experience levels, account sizes, and trading styles. I believe it will continue to do so for many generations to come. I will lay out my case for why I believe all traders should consider trading Forex.

How Retail Forex Revolutionized Retail Trading

To understand why retail Forex is alive, let’s look at how it’s revolutionized retail trading. I began trading Forex in the early 2000s. Before then, only institutions and high-net-worth individuals, usually requiring a minimum account size of $500,000, were able to trade currencies. At the time, most retail traders focused on equities and equity options, with a small proportion also trading futures contracts. When retail Forex emerged, it immediately exploded in popularity and quickly became the hot new thing.

Retail traders had never seen an asset class like it, and Forex trading introduced many first experiences. For example, Forex was the first time many traders encountered leverage, and the first time they learned about over-the-counter markets that operated without centralized exchanges. In fact, because new Forex brokers advertised heavily to the public, retail Forex encouraged many to try trading for the first time.

The emergence of retail Forex also helped increase the popularity of technical analysis methodology.

Then, in 2005, MetaTrader 4 was introduced, specifically for Forex brokers. Before MetaTrader, most independent trading platforms required costly subscriptions or purchases. MetaTrader was free and used by almost all Forex brokers, making it immediately popular. Traders then started sharing MetaTrader trading templates (e.g., indicator settings) and automated systems (Expert Advisors), subscribing to signals and copying trades from other MetaTrader users. Suddenly, thanks to MetaTrader, many traders began collaborating in ways they never had before.

Retail Forex also introduced many traders to macroeconomic calendars, giving the trading community a deeper understanding of global economies. This trend spread to non-Forex traders, who now often utilize Forex economic calendars for their non-currency trading activities.

In the early 2000s, the minimum account sizes for retail Forex accounts were relatively high by today’s standards, and spreads were also high (I recall typical EUR/USD and GBP/USD spreads being 3-4 pips). Initially, Forex brokers only offered standard lot sizes. Over the years, this has improved significantly, with lower spreads, smaller account minimums, and smaller lot sizes available.

Why the above history lesson? All the innovations that retail Forex brought to the public are still alive today, and that is precisely why Forex remains a valuable asset class. Let’s explore further.

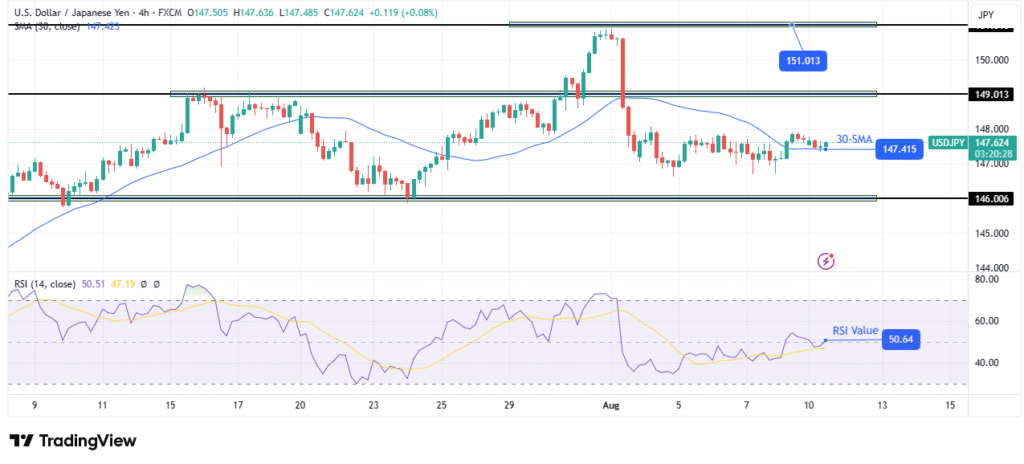

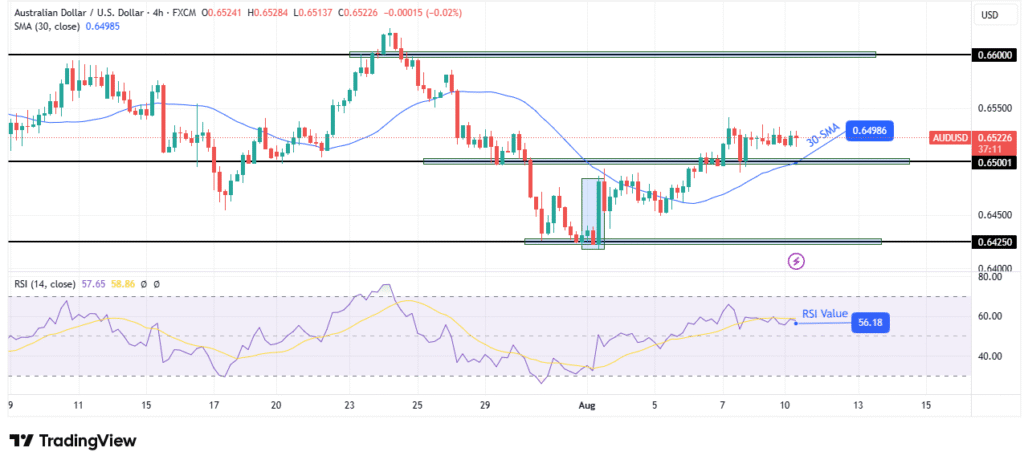

Forex Daily Ranges are Still Strong

When people ask whether a market is dead or alive, often the underlying question is whether the market moves enough to provide trading opportunities. One measure of that is the average daily range. Today, Forex daily ranges are still strong. Taking EUR/USD as an example, from October 2022 to Mid-2025, its average daily range was a respectable 80 pips (and over 85 pips in the first half of 2025). Given that EUR/USD spreads are often less than one pip, this provides ample opportunity for both day traders and swing traders to find profitable movements.

It’s worth mentioning that the famous “carry trade,” which capitalizes on interest rate differences between countries, has become less popular over the years because the interest rate differences are much smaller than in previous years.

Like every other asset class, Forex has experienced quiet periods at times. However, putting this into context, the US equity markets faced a period in the early 1970s when the movement became so low that people doubted the stock market would continue to exist. Decades later, the stock market is as strong as ever, and I believe the same will be true for Forex.

It’s worth noting that there has been a structural shift in Forex since the late 2000s, particularly from 2008 to 2010, compared to now. Between 2008 and 2010, Forex volatility was relatively high, and it was also the peak time of new traders entering the market through retail brokers. So, the first experience of Forex for many new traders was experiencing high leverage with high volatility. These conditions gave stronger trends (i.e., larger and longer trends), and dare I say it, an easier environment in which to make money. However, that exceptionally high volatility was short-lived, and Forex volatility has since tapered off to more “normal” levels. These high volatility levels are now present in today’s cryptocurrency markets. New traders entering the market, most of whom are young, are seeing cryptocurrency as the “hot thing” to trade. Forex is unlikely to match today’s cryptocurrency volatility levels and retake the crown as the “hot” asset. Instead, I feel new traders consider Forex to be a mature asset class like stocks, and maybe even boring by their standards.

Forex Spreads and Costs are Low

Low spreads minimize costs and increase profitability. It allows traders to plan trades with greater flexibility, as they have fewer concerns about trading costs when entering and exiting positions. I recall when GBP/USD spreads were 3.5 pips in the early 2000s, and having 10-15 pip targets was often not feasible due to how much the spreads ate into the profits. Today, the GBP/USD and other majors, such as EUR/USD, often have spreads under one pip, allowing me to easily take smaller profit targets if I wish, or enter and exit multiple trades without the spreads significantly reducing my profits.

Keep in mind that many brokers offer lower spreads and commissions to traders with higher account minimums and larger trading activities. Essentially, the more money you have with a broker and the more you trade, the lower the costs they will offer.

Forex is Still the Most Liquid Market in the World

The liquidity of a market refers to the ease and efficiency with which participants can buy or sell an asset without significantly affecting its price. The Forex market has the highest liquidity in the world, surpassing equities and cryptocurrencies, and is traded globally by central banks, institutions, and retail traders. High liquidity has two major advantages for traders:

- Execution is faster and with less slippage (slippage is the difference between the desired price and the executed price). Liquid markets exhibit more controlled volatility, characterized by more consistent pricing and less gapping, as it takes significantly larger events to cause prices to suddenly gap past price levels without trading through them.

- Highly liquid markets have lower spreads and more competitive commissions. For example, some ECN brokers offer zero spreads during periods of high market liquidity.

Before I traded Forex, I traded individual equities, and I regularly saw equity prices gap past levels. This made trade planning much more difficult as I did not know if I could exit at my stop loss or at a much worse price. I don’t have those problems nearly as much in Forex.

Forex is Great for Technical Analysis

Overall, the Forex market has high trading volumes and market depth, making it an ideal market for technical analysis. In contrast, thin markets often do not respond well to technical analysis because a small group of buyers and sellers can easily alter the picture. Technical analysis relies on crowd psychology to be effective.

In Forex, I have consistently found clean support and resistance levels, chart patterns, candlestick setups, and trends on Forex pairs.

Forex Still Has the Most Reliable Economic Calendar

When I traded other markets, such as equities, unplanned news events or fundamental factors could unpredictably affect the price of an asset. This can still affect Forex—no financial instrument is immune to unplanned fundamental or economic events. However, comparatively, unscheduled events affect the Forex market less than other asset classes, in my experience. That’s because the main drivers of Forex movements are still found in the scheduled economic calendar. These are the planned news releases by central banks and governments of their nations’ macroeconomic data releases. This includes employment data, interest rate announcements, and manufacturing data, among others. Importantly, governments schedule the release of this data in advance, and each data release has a reliable track record of the magnitude of its impact on foreign exchange prices. This predictable schedule of news releases makes it much easier to plan trades because I know what data releases are due, and I can avoid entering at that time if I wish or even plan trades shortly after their releases if I expect a push of momentum to help sustain a trend.

Forex is One of the Easiest Markets to Access

Retail Forex brokers make it easy to start trading. Brokers offer mini, micro and even nano lots, catering to the smallest account sizes. For example, I can open a Forex account with an account size of under $1,000. Whereas if I wanted to trade the most widely traded futures contract in the world, the e-mini S&P 500, I might need a margin of between $ 5,000 and $10,000 just to hold a single contract overnight.

Many Forex brokers offer a choice between a dealing desk model, and an ECN account, which lets traders directly access underlying liquidity without the broker’s intervention in execution. I see more brokers than ever offering Shariah-compliant accounts for those who wish to use them.

This vast range of broker choices, execution styles, and low minimums allows anyone who wishes to trade Forex to access the market in a way that fits their trading style.

Forex Regulation is Strong

When retail Forex started in the early 2000s, there was virtually no regulation. Over the years, most countries have insisted on regulating Forex brokers, which has resulted in safe trading environments. Forex brokers in the US, EU countries, Canada, Australia, New Zealand, and other parts of the world are regulated by national authorities that require the highest fiduciary, compliance, and operational standards. This even extends to requiring fair and transparent pricing and execution that reflect real market conditions, essential for over-the-counter markets. Most importantly, major regulators require brokers to hold client funds in segregated accounts.

Abundant Trade-Copying and Signal Services

Forex has an enormous number of trade-copying and signal services compared to other markets. This is in large part due to the popularity of MetaTrader, which has helped build huge communities of traders and made copying or subscribing to signals a seamless process across MT4 and MT5.

Bottom Line

I’ve seen retail Forex grow from its infancy two decades ago to become an established asset class for retail traders. Over that time, I saw the industry improve in every way possible. Trading costs, fees, and spreads decreased. Account minimums became lower. Brokers introduced mini and micro lots, rather than just offering standard lots. Regulators better protected traders. Importantly, Forex liquidity, volatility, and price movements remain healthy, providing ample profitable trading opportunities. Forex remains a captivating, efficient, active and low-cost market, offering substantial opportunities for those willing to participate.