AI giant Nvidia (NVDA) is heading into its Q2 FY26 earnings report on August 27 with growing optimism from Wall Street analysts. One of them, Baird’s Top analyst Tristan Gerra, just raised his price target to $225 from $195, implying a 26% upside from current levels. He maintained an Outperform rating on NVDA stock, pointing to stronger chip demand and new product launches that could drive further upside.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analyst Lifts Estimates on Strong GB200 Shipments

Gerra said Nvidia’s revenue and earnings outlook is improving after a sharp acceleration in GB200 shipments in July. He expects this momentum to continue into the second half of the year, with xAI-related shipments adding more weight in the fiscal fourth quarter.

He further noted that the upcoming GB300 chip is on track for a late September launch. Early sampling with data center partners has shown no issues, and the chip promises a major performance boost over the GB200. Gerra expects the upgrade cycle to fuel strong orders through year-end.

Capacity Expansion Sets Up 2026 Growth

Looking ahead to next year, Gerra noted that Taiwan Semiconductor Manufacturing Company (TSM), which makes Nvidia’s most advanced chips, is planning to nearly double its production capacity for CoWoS (Chip-on-Wafer-on-Substrate), one of its most advanced packaging technology used to build AI processors.

Gerra said this expansion will be key for Nvidia, giving it the supply needed to keep up with booming AI demand worldwide.

Networking and Cloud Push Gain Speed

Beyond its GPUs, Nvidia is also building momentum in networking and cloud services. Its Spectrum-X platform is being adopted by major cloud providers and partners such as Meta (META) and xAI.

Nvidia’s ConnectX-8 chips are aiming for a dominant share of the AI server market, while its Nvidia Cloud Partners (NCP) program is expanding, giving enterprises access to GPUs and AI tools through cloud services.

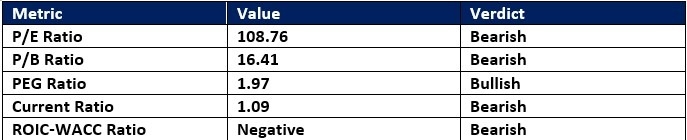

What Is the Target for Nvidia Stock?

According to TipRanks, NVDA stock has a Strong Buy consensus rating based on 35 Buys, three Holds, and one Sell assigned in the last three months. At $198.57, the Nvidia share price target implies an 11.56% upside potential.

Year-to-date, NVDA stock has gained over 33%.