The Chainlink (LINK) token has steadily gained over the past week, and despite resistance capping its upside, buyers remain firmly in control of the broader trend.

LINK Price Steady After Recent Gains

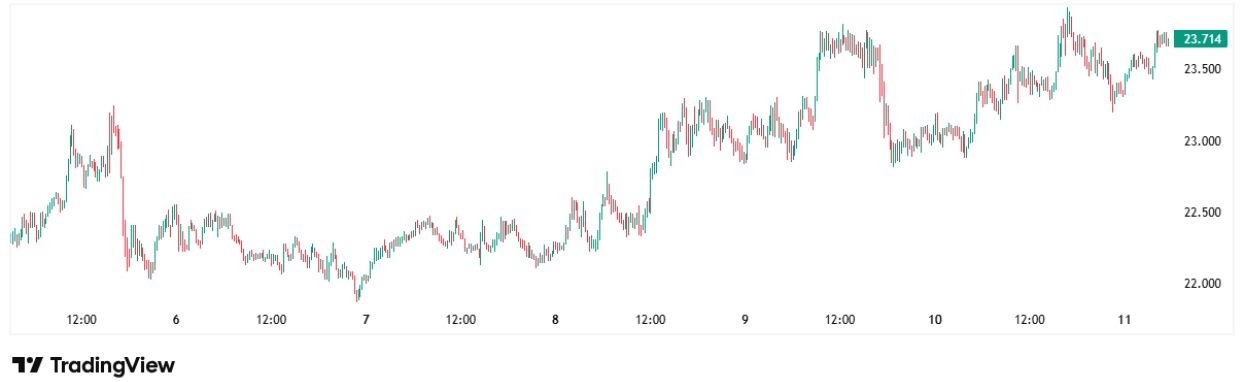

Chanlink price chart | Source: Tradingview

In the last 24 hours, LINK has traded between $23.18 and $23.87, a tight band that reflects a balance between supply and demand.

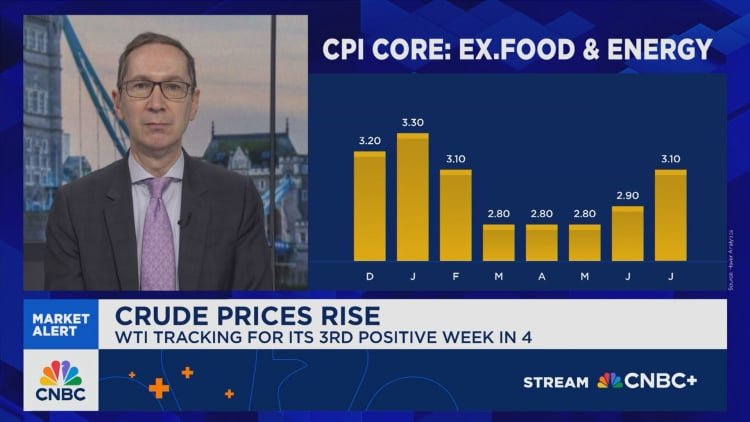

The broader market backdrop has also played its role. Bitcoin’s consolidation above $113K and Ethereum’s resilience near $4.3K provide a stable setting for altcoins like LINK to build without heavy downside pressure. Capital flows remain tilted toward majors, but Chainlink’s resilience suggests patient accumulation.

Repeated rebounds from the lower $22s in recent sessions underscores strong demand at those levels. Meanwhile, every approach toward the $24 mark has met resistance.

This pattern of higher lows and flat resistance often forms the groundwork for an eventual breakout. In other words, while the token appears trapped in a narrow corridor, its steady upward pressure hints at an imminent resolution.

Support and Resistance Define the Trading Range

The most immediate support for LINK lies at $23, where buyers have repeatedly absorbed selling pressure during intraday pullbacks.

This level has become an anchor for sentiment. A decisive break below it would likely shift focus back to $22.5, which served as the base for the most recent rally. Sustained weakness below that zone could unwind momentum and push the market into deeper consolidation.

On the flip side, resistance is concentrated in the $24.0 to $24.2 area. This band has stalled progress over several sessions, turning into a ceiling that buyers have yet to convincingly overcome.

A daily close above $24.5 would mark a structural break and could quickly attract momentum traders. If confirmed, the next technical target sits at $25, with room to extend towards $26 to $28 in the short term.

Technical Indicators Paint a Balanced Picture

The technical setup leans cautiously bullish. Moving averages are aligned in favor of buyers, with the 20-day, 50-day, and 200-day averages all sitting beneath current price action. This alignment is typically associated with the early stages of an uptrend, especially when shorter-term averages continue to slope upward.

Momentum oscillators are more restrained. The Relative Strength Index hovers in the mid-50s, a neutral zone that indicates neither exhaustion nor weakness.

This leaves room for either a continuation higher or a reset lower. The MACD remains in slightly positive territory, but its histogram shows only modest expansion, suggesting conviction is not yet overwhelming.

Trading volumes mirror this narrative of balance. Participation has been steady but has not displayed the surge often seen in strong breakouts. Until volumes expand, LINK may continue to oscillate within its current range, giving buyers and sellers time to reassess.

Sentiment and Fundamentals Support the Bullish Case

Beyond the technical chart, Chainlink’s ecosystem continues to add depth. The Cross-Chain Interoperability Protocol (CCIP) recently expanded to Aptos, broadening its reach beyond Ethereum and EVM chains. This kind of integration strengthens its position as the backbone of tokenized finance.

Chainlink also secures nearly $97 billion in value across more than 450 protocols, a metric that no other oracle provider comes close to matching.

Exchange data shows no spike in inflows, which implies large holders are not rushing to liquidate positions. That stability reduces the risk of sudden downside volatility.

At the same time, institutional interest is quietly emerging. Caliber’s disclosure of LINK purchases as part of a treasury allocation, while small in scale, signals a growing perception of Chainlink as more than a DeFi tool. For firms exploring tokenized assets and interoperability, LINK is increasingly viewed as core infrastructure.

Price Scenarios to Watch

The bullish scenario rests on LINK securing a close above $24.5. If that materializes, momentum buyers are likely to target $25 initially, with scope for $26 to $28 in a more extended move. A surge in volume accompanying such a breakout would provide strong confirmation that new capital is flowing into the market.

The neutral case is simply a continuation of range-bound action between $23 and $24.2. This would allow the token to consolidate, reset oscillators, and build a stronger base for a later breakout.

The bearish scenario will only take shape if LINK loses $23 on a daily close. In that event, the focus turns back to $22.5, where bulls have previously defended aggressively. A breakdown beneath that threshold would represent a structural shift and could invite deeper retracement.

Ready to trade our technical analysis of Chainlink? Here’s our list of the best MT4 crypto brokers worth checking out.