An exchange-traded fund can help smooth out volatility when investing in high-growth themes like artificial intelligence.

Investors can earn a reliable, practically risk-free annual return of up to 5% by purchasing U.S. government bonds, or they can invest in the S&P 500 (^GSPC -0.12%) index, which has delivered a compound annual return of 10.5% since its inception in 1957. But volatility is the price we pay for higher returns in the stock market, so investors will have to stomach regular sell-offs along the way, which sometimes exceed 20%.

Those risks are substantially higher when investing in hyper-growth areas like artificial intelligence (AI). AI software powerhouse Palantir Technologies (PLTR 1.50%) offers a great example — its stock has surged by a whopping 480% over the past 12 months, but it suffered a nerve-racking plunge of 40% between February and April this year, which would have spooked even the most seasoned investors.

Buying an exchange-traded fund (ETF) can be a great way to invest in a basket of high-growth AI stocks, while smoothing out some of that extreme volatility. The iShares Future AI and Technology ETF (ARTY 0.28%) holds 48 different AI stocks, including many of the industry’s leaders, so it can insulate investors from sharp losses if one or two names underperform. Read on to learn more.

Image source: Getty Images.

Palantir, Nvidia, and Alphabet are just some of the AI leaders in this ETF

The iShares Future AI and Technology ETF focuses on the entire AI value chain, investing in companies all over the world that develop the infrastructure, software, and services powering this tech boom. The below table displays 10 of the most notable AI names in the ETF’s 48-stock portfolio, ordered by their weightings:

|

Stock |

iShares ETF Portfolio Weighting |

|---|---|

|

Advanced Micro Devices (AMD 1.15%) |

5.66% |

|

Nvidia (NVDA 2.13%) |

5.04% |

|

Broadcom (AVGO 1.77%) |

4.82% |

|

Palantir Technologies |

3.29% |

|

Alphabet Class A (GOOGL 0.41%) |

3.01% |

|

Microsoft (MSFT 0.10%) |

3.00% |

|

Amazon (AMZN -0.35%) |

2.94% |

|

Snowflake (NYSE: SNOW) |

2.85% |

|

Meta Platforms (NASDAQ: META) |

2.51% |

|

Oracle (NYSE: ORCL) |

0.64% |

Data source: iShares. Portfolio weightings are accurate as of July 25, 2025, and are subject to change.

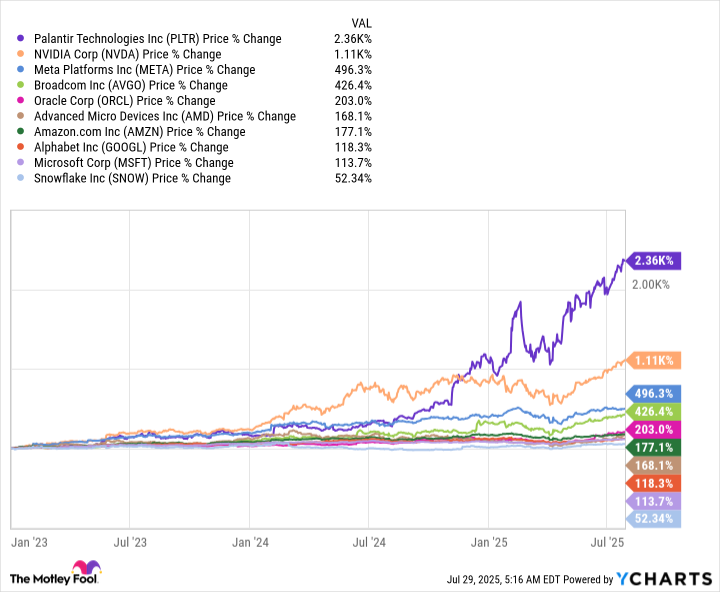

The AI revolution really gathered momentum at the start of 2023, when OpenAI’s ChatGPT application surged in popularity by giving people a glimpse into this technology’s potential. Since then, the above stocks have delivered a blistering average return of 522%, and a median return of 185%, so investors who haven’t owned a slice of the AI boom have almost certainly underperformed the broader market:

AMD, Nvidia, and Broadcom are three top suppliers of the data center chips, networking equipment, and components required to develop AI. Nvidia is the clear leader of that pack because the performance of its graphics processing units (GPUs) is unmatched, and demand for those chips continues to exceed supply. In fact, Nvidia has become the world’s largest company on the back of the AI revolution, with its market capitalization recently topping $4.3 trillion.

Alphabet, Microsoft, and Amazon are some of the biggest buyers of the data center hardware I just highlighted. They each operate cloud platforms where they sell state-of-the-art computing capacity to AI developers, in addition to ready-made large language models (LLMs), which are the core ingredients for creating AI software.

Then there is Palantir, which is a true AI software giant. Its AIP (Artificial Intelligence Platform) platform helps businesses and governments deploy AI into their operations, whereas its Gotham and Foundry platforms help them extract valuable insights from their data. The more than 20-fold increase in Palantir stock since the start of 2023 has catapulted it to a very high — and potentially unsustainable — valuation, but that hasn’t stopped one Wall Street analyst from predicting more upside.

A great addition to a diversified portfolio

The performance of the iShares Future AI and Technology ETF is completely dependent on the success of AI and AI-adjacent technologies, so investors shouldn’t put all of their eggs in one basket even though it’s less risky than buying one or two AI stocks. Instead, they should buy it as part of a diversified portfolio of other funds or individual stocks.

Moreover, the ETF was established in 2018 with a broad focus on robotics and AI, but it was completely reconstructed on Aug. 12 last year to focus on AI specifically. Therefore, it doesn’t have much of a track record for investors to analyze, but it has delivered a massive return of 40% since the changes were made. That’s more than double the 19.5% return produced by the S&P 500 over the same period.

That strong performance does come at a cost, because the iShares ETF has an expense ratio of 0.47%. It means a $10,000 investment will incur an annual fee of $47, which doesn’t sound high at face value, but a traditional index fund issued by a company like Vanguard typically comes with an expense ratio of just 0.03%. This cost won’t matter much if the iShares ETF continues to deliver blistering returns, but it’s something to consider.

One thing is for sure: The iShares ETF currently holds every AI stock an investor could want, so it will make a great addition to a diversified portfolio, especially one that doesn’t already have exposure to this revolutionary sector of the market.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, Palantir Technologies, and Snowflake. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.