EUR/USD Analysis Summary Today

- Overall Trend: Neutral with a bullish bias.

- Today’s Support Levels: 1.1680 – 1.1590 – 1.1540.

- Today’s Resistance Levels: 1.1780 – 1.1860 – 1.1910.

EUR/USD Trading Signals:

- Buy: Buy EUR/USD from the 1.1640 support level with a target of 1.1820 and a stop-loss at 1.1580.

- Sell: Sell EUR/USD from the 1.1820 resistance level with a target of 1.1600 and a stop-loss at 1.1900.

Technical Analysis of EUR/USD Today:

By the end of last week’s trading, the EUR/USD exchange rate had risen to a five-week high, surpassing the 1.1750 resistance level. This occurred after U.S. jobs data showed only 22,000 new jobs in August, and the June data turned negative for the first time in four years. With markets fully pricing in a Federal Reserve interest rate cut this month, and expectations that the European Central Bank (ECB) will hold steady, the EUR/USD pair is testing the 1.17-1.18 resistance area. This fuels speculation that the euro’s rise could extend through the end of the year.

EUR/USD Forecast after Recent Gains

According to forex market trading, the EUR/USD exchange rate approached the psychological resistance of 1.1700 before the New York market opened on Friday, then jumped to a high of 1.1750 after the latest U.S. economic data, before trading at around 1.1730. Its gains primarily came as the U.S. dollar’s performance was negatively impacted by another weak non-farm payrolls report, which included the first negative figure in over four years, even though some other data was less damaging. Financial markets now see a Fed rate cut as inevitable, while the ECB is not expected to make any further rate cuts.

According to currency trading experts, the interest rate policy divergence between the ECB and the Fed should provide strong support for the euro in the coming months. Technically, a breakthrough of the low 1.17 resistance level would be a strong signal for a continued euro rally. The rally will focus on the 45-month high of 1.1830 recorded in early July. Currently, the 14-day RSI is around a reading of 56, moving away from the neutral line, and the MACD lines are ready to move upward, awaiting a stronger catalyst.

Trading Tips:

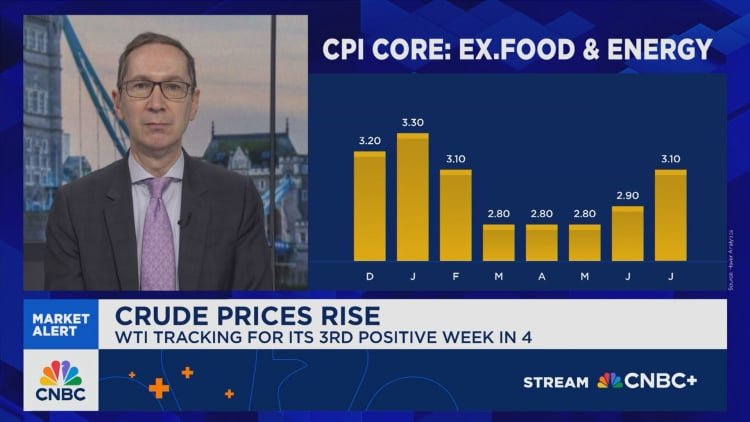

Traders are advised to watch for the EUR/USD to achieve more gains to confirm the strength of the bullish shift. I expect a neutral performance within narrow ranges until the U.S. consumer price numbers and the ECB’s decisions are announced.

According to the economic calendar, the latest US labor market report recorded an increase in non-farm payrolls of 22,000 jobs for August, compared to the consensus forecast of around 75,000 jobs. There was a slight upward revision for July to 79,000 jobs from the previous 73,000. However, there was another downward revision for June, with the Bureau of Labor Statistics now reporting a decrease of 13,000 jobs, the first contraction since late 2020. Manufacturing jobs have also declined by 78,000 jobs so far this year. Ultimately, the country’s unemployment rate rose to 4.3% from 4.2%, the highest rate since late 2021.

Following the data release, markets were highly confident in a U.S. rate cut this month and place a low probability on a larger 50-point cut. In general, comments from Federal Reserve officials and the administration will be closely watched. The U.S. dollar is not awaiting significant economic releases. From the Eurozone, German industrial production rates and trade balance figures for the Eurozone’s largest economy will be announced at 9:00 AM Egypt time. Then the Sentix consumer confidence reading for the Eurozone will be announced at 9:30 AM Egypt time.

Regarding the expected currency prices in the coming period, some experts suggest that the U.S. dollar remains very resilient amid reluctance to deal with worst-case scenarios. According to forecasts, if financial markets bet on a negative scenario, for example, where the Federal Reserve loses its independence and is forced into an excessively loose monetary policy, the consequences could be severe—such as a significant currency weakening. But few investors are likely willing to bet on such a scenario lightly, as long as hope remains that things will not get that bad.

In another context affecting EUR/USD trading, the European Central Bank will announce its latest monetary policy decision this week, with expectations that the deposit rate will remain at 2.0%.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.