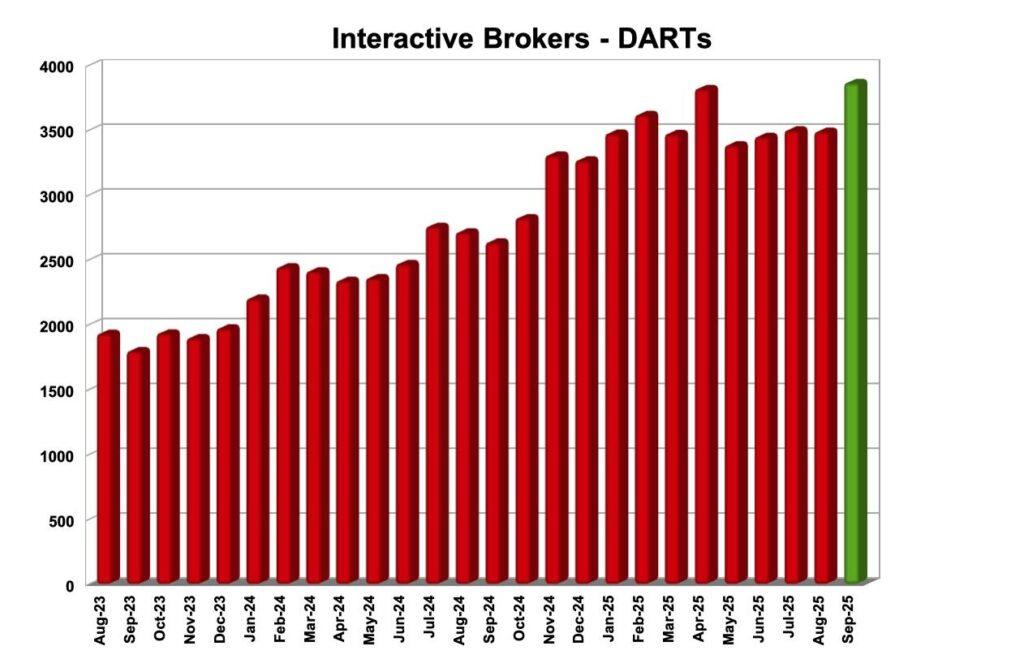

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just reported its key operating metrics for September 2025.

The brokerage posted 3.864 million Daily Average Revenue Trades (DARTs) for September 2025, 47% higher than in September 2024 and 11% higher than in August 2025.

Ending client equity amounted to $757.5 billion, 40% higher than prior year and 6% higher than prior month.

Ending client margin loan balances reached $77.3 billion, 39% higher than prior year and 8% higher than prior month.

Ending client credit balances were $154.8 billion, including $6.2 billion in insured bank deposit sweeps2, 33% higher than prior year and 6% higher than prior month.

The broker reported 4.127 million client accounts, 32% higher than prior year and 2% higher than prior month.

The real account growth in September was 111.9 thousand accounts vs the calculated change in accounts of 73.1 thousand. The difference is attributable to the withdrawal of one introducing broker with 38.8 thousand accounts and $413.5 million of customer assets by a Futu subsidiary. Interactive Brokers expects an additional 2.9 thousand account closures to complete this action after September 30.

Speaking of Interactive Brokers’ performance, let’s note that the broker posted reported and adjusted diluted earnings per share of $0.51 for the second quarter of 2025. Reported and adjusted net revenues were both $1,480 million for the second quarter of 2025.

Reported and adjusted income before income taxes were both $1,104 million.

Commission revenue increased 27% to 516 million on higher customer trading volumes. Customer trading volume in stocks, options and futures increased 31%, 24% and 18%, respectively.