Grocery prices jumped 0.6% in August, fueling a sharper-than-expected jump in inflation last month.

Frederic J. Brown/AFP

hide caption

toggle caption

Frederic J. Brown/AFP

Inflation inched higher last month as Americans closed out the summer paying more for both groceries and gasoline.

Consumer prices in August were up 2.9% from a year ago, according to a report Thursday from the Labor Department. That’s a sharper annual increase than the previous month, when inflation was clocked at 2.7%.

Prices rose 0.4% between July and August, compared to a 0.2% increase the previous month. Prices for groceries jumped 0.6% while gasoline prices rose 1.9%.

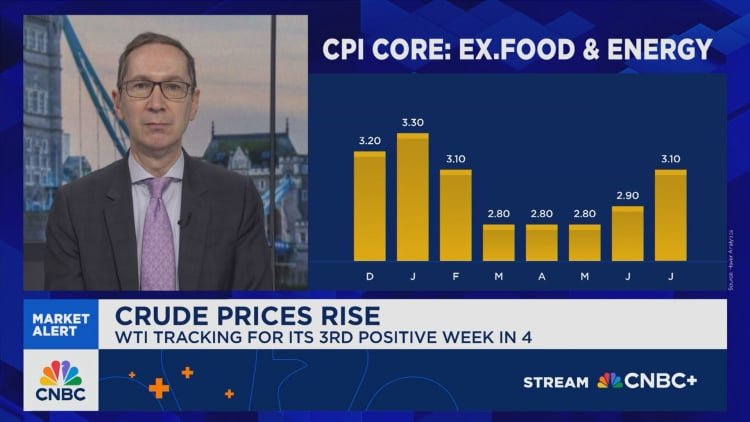

Consumers also saw higher prices for new and used cars, clothing and airfares in August. Stripping out volatile food and energy prices, “core” inflation was 3.1% for the last 12 months.

The Federal Reserve faces a challenge

The continued rise in prices poses a challenge for the Federal Reserve as it weighs what to do about interest rates. Policymakers are widely expected to lower their benchmark rate by a quarter percentage point next week to prop up the sagging job market. But Fed officials may be wary about additional rate cuts in the face of stubborn inflation.

The August cost of living figures cover a month when President Trump raised tariffs on goods from many U.S. trading partners. The tariffs may have contributed to higher prices for imported goods such as coffee (up 3.6% last month), bananas (up 2.1%) and apparel (up 0.5%).

A federal appeals court ruled late last month that many of Trump’s tariffs are illegal, but they remain in effect pending a review by the U.S. Supreme Court. The high court has scheduled oral arguments for early November.