Forex traders said the local unit is trading in a range-bound manner as investors weighed the latest global trade developments.

At the interbank foreign exchange, the domestic unit opened at 86.59 against the greenback, registering a decline of 19 paise from its previous closing level.

On Thursday, the rupee pared initial gains to settle just 1 paisa higher at 86.40 against the US dollar.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.23 per cent to 97.60.

Live Events

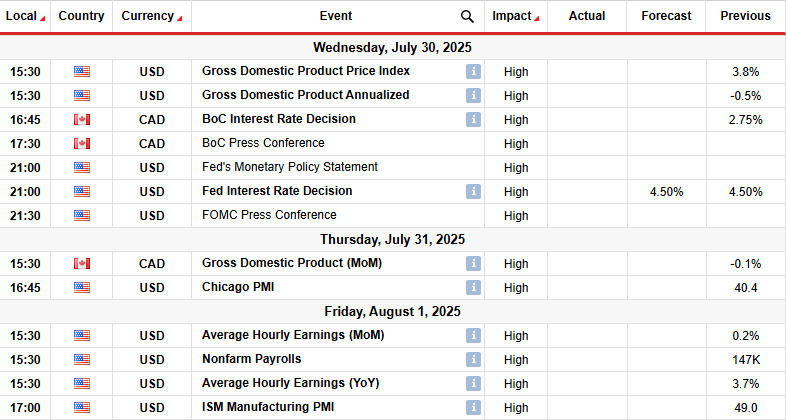

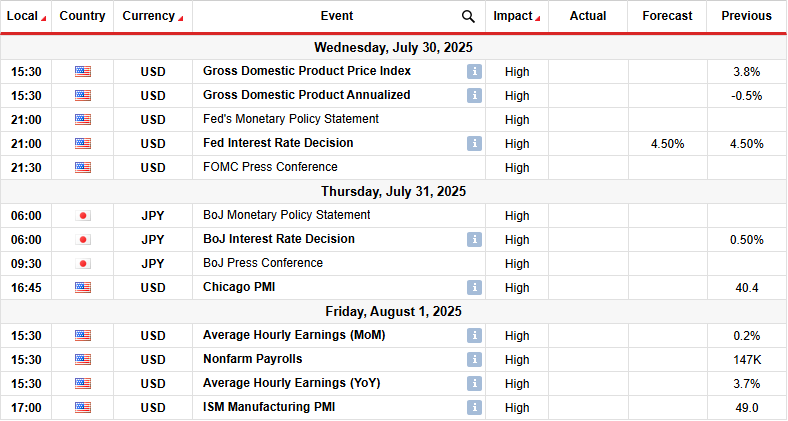

The rebound in the dollar index comes after data revealed the strength of the labour market, with jobless claims falling for the sixth straight week, said Anil Kumar Bhansali, Head of Treasury and Executive Director Finrex Treasury Advisors LLP. Brent crude, the global oil benchmark, went up by 0.49 per cent to USD 69.52 per barrel in futures trade, as developing trade agreements have supported the upward movement in Brent oil prices. “The demand for dollars continues to keep the dollar well bid against the rupee,” Bhansali said. He further noted that the “RBI continues to manage volatility maintaining stability despite the external pressures.”

“The bias for Friday will be negative within a range of 86.10 to 86.60. Importers to buy on the dips,” he said.

Forex traders said uncertainty over the India-US trade deal has been an overhang for the forex market.

If the discussions fail or get delayed, Indian exporters could face fresh pressure — adding to the rupee’s challenges.

However, if a deal is reached, it could offer a much-needed breather. Until then, the uncertainty is likely to keep market participants cautious.

Meanwhile, in the domestic equity market, Sensex declined 440.66 points or 0.54 per cent to 81,743.51, while Nifty fell 139.70 points or 0.56 per cent to 24,922.40.

Foreign institutional investors (FIIs) offloaded equities worth Rs 2,133.69 crore on a net basis on Thursday, according to exchange data.