The commerce department and the ministry of external affairs have been involved in seeking time from the Chinese authorities to allow the Indian industry to interface directly with representatives of the Chinese government. “We are mindful of the concerns of the industry, especially as manufacturing schedules are likely to be disrupted if the supplies do not resume in some time,” one of the sources told ToI.

Also Read: Rare earths are not rare: Chinese move can backfire

A senior government official said commerce secretary Sunil Barthwal recently held consultations with representatives of the auto sector. Over the next few weeks, a delegation of industry executives is expected to travel to China, with the Indian embassy in Beijing supporting the exercise. The government has clarified that it sees its role as that of a “facilitator” in this process and not as part of a government-to-government negotiation.

“The idea is to involve the respective stakeholders and ministries for a concerted effort to expedite the approval process. The industry has already submitted the requisite documents related to the matter,” the official said.

Live Events

The development comes in the wake of an order from Beijing, under which exporters shipping medium and heavy rare earth magnets must secure a licence from China’s commerce department, after receiving an end-user certificate from the buyer. This certificate requires the buyer to guarantee that the imported materials will not be used in storing, manufacturing, producing or processing weapons of mass destruction or their delivery systems.Although China’s order was a response to US President Donald Trump’s earlier tariffs, last week the US announced a deal under which China will continue supplying rare earth magnets to the United States.Also Read: India moves to conserve its rare earths, seeks halt to Japan exports, sources say

While automotive parts manufacturers in Europe have recently obtained approvals to source rare earth magnets, the Indian arms of these firms are still waiting for clearance from China’s commerce ministry. Experts say the issue is made more complex by the tense political and business relationship between India and China.

Domestic companies have been pushing to develop in-house capabilities to reduce dependence on imports, but experts say it remains a daunting task.

“Developing indigenous supplies and capabilities is crucial, but it’s a complex process requiring large-scale investments. Also, mitigating challenges of radioactive materials during the extraction process is also a critical factor,” said Alok Perti, former coal secretary and currently a senior board advisor at B2B mining and metal industry body MMPI. “Providing viability gap funding like PLI schemes by the government, encouragement to undertake research with countries like Russia, Australia, is also relevant.”

Rare earth magnets are essential components in permanent magnet synchronous motors (PMSMs), which are widely used in electric vehicles (EVs) due to their high torque, energy efficiency and compact size. Hybrid vehicles also depend on these magnets for efficient propulsion.

The number of India-based companies awaiting approval from China’s commerce ministry to import rare earth magnets has nearly doubled to 21 from 11 two weeks ago, ET reported citing people familiar with the matter. This includes companies such as Bosch India, Marelli Powertrain India, Mahle Electric Drives India, TVS Motor and Uno Minda. Among them is also Sona Comstar, which recently had its application rejected due to procedural issues. The company has reapplied and is now part of the 21 firms seeking approval, a senior industry executive said.

Also Read: Indian firms’ magnet waitlist doubles in 2 weeks

Sources told ToI that auto industry bodies, including the Society of Indian Automobile Manufacturers (Siam) and the Automotive Components Manufacturers Association (ACMA), have been in direct contact with the government over the matter. Although companies have followed the route mandated by Chinese authorities and submitted their petitions accordingly, the issue is yet to be resolved. Officials from at least four large companies told ToI that applications have already reached Chinese authorities and that they are eagerly awaiting progress.

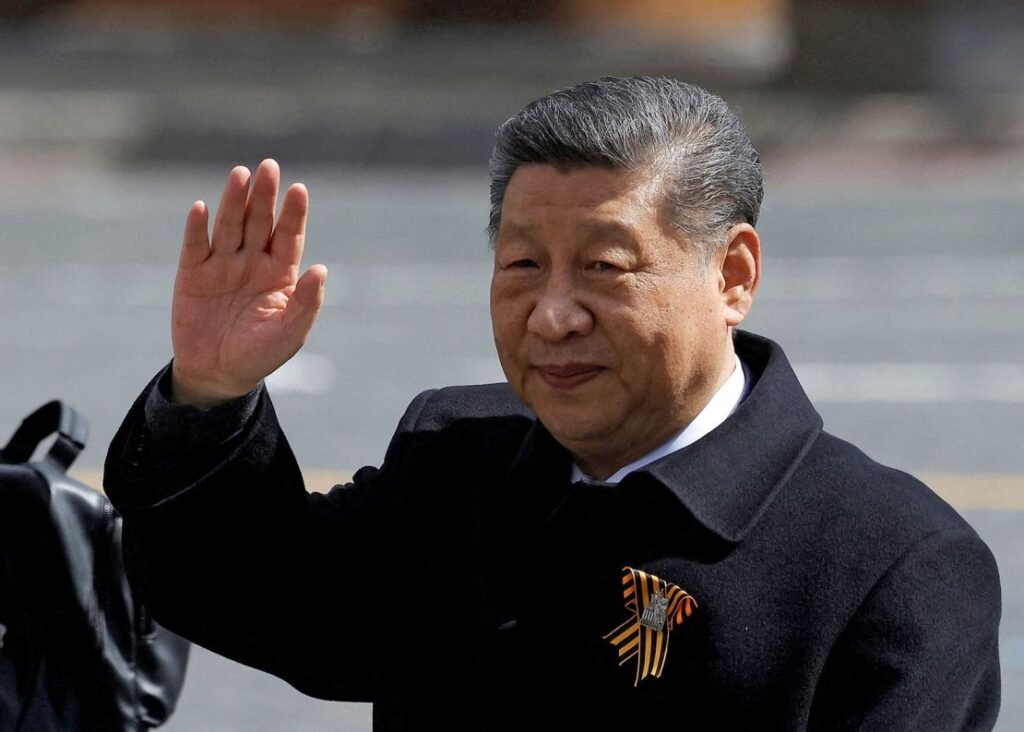

Industry insiders said they are hopeful that a “positive result” may follow the meetings held between Chinese vice foreign minister Sun Weidong and Indian officials during his two-day visit to India.

Time, however, may be running out. Industry stakeholders warned that if the licences are not issued soon, production could be affected, with current stocks expected to be depleted by early July.

India imported 870 tonnes of rare earth magnets valued at ₹306 crore in the financial year 2024–25.

(with ToI inputs)