Electronic trading major IG Group Holdings plc (LON:IGG) today issued a trading update for the three months to 31 August 2025 (“Q1 FY26”) covering the first quarter of the fiscal year ending 31 May 2026.

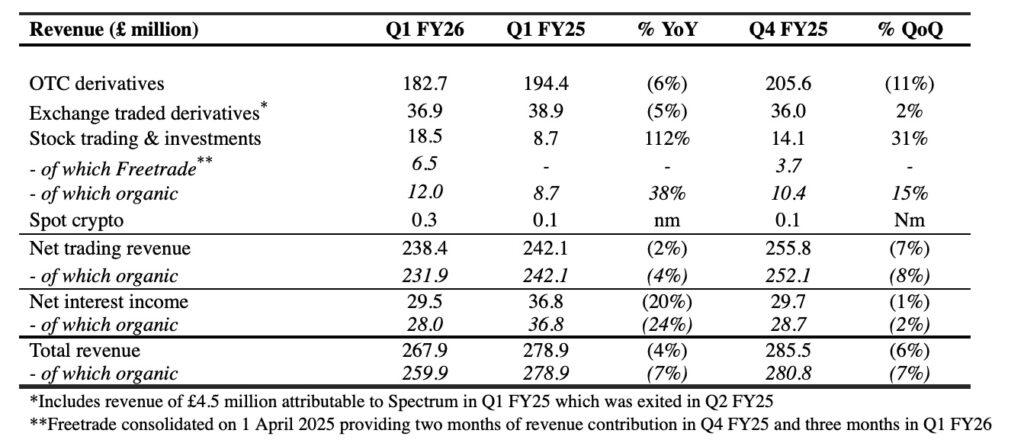

Net trading revenue of £231.9 million declined 4% from the equivalent period in FY25 and 8% from the preceding quarter, as strong OTC customer income retention was offset by lower trading activity in less supportive market conditions.

Average monthly active customers increased 3% on the prior year and remained stable on the prior quarter which were demanding comparatives. First trades increased 42% on the prior year and 2% on the prior quarter reflecting increased marketing activity, greater marketing effectiveness and the early results of strategic initiatives to close products gaps and simplify our propositions to broaden customer appeal.

tastytrade net trading revenue increased 16% on the prior year and 5% on the prior quarter to $54.7 million (Q1 FY25: $47.1 million; Q4 FY25: $52.0 million). On a reported GBP basis, trading revenue increased 11% on the prior year and 3% on the prior quarter to £40.7 million (Q1 FY25: £36.6 million; Q4 FY25: £39.4 million).

Net interest income of £28.0 million was down 24% on the prior year, in line with the Group’s expectations, reflecting lower interest rates and greater pass-through to customers. Customer cash balances at the end of Q1 FY26 were £4.7 billion (31 May 2025: £4.4 billion; 31 August 2024: £4.1 billion)2.

Total revenue of £259.9 million declined 7% on the prior year and 7% on the prior quarter.

The Group completed the acquisition of Freetrade on 1 April 2025 and it sustained rapid growth in Q1 FY26. Strong performance was supported by the rollout of new products and features, including the first phase of its mutual fund offering.

Net trading revenue of £6.5 million increased 32% on the prior year on a pro forma basis, assuming the acquisition took place on 1 June 2024 and therefore including Freetrade for the entire comparative period. Net interest income of £1.5 million increased 8% on a pro forma basis as strong growth in customer cash balances offset lower interest rates. Total revenue of £8.0m increased 27% on a pro forma basis.

Assets under administration in IG’s stock trading and investments business increased to £7.6 billion (31 May 2025: £7.0 billion; 31 August 2024: £3.9 billion), of which £3.0 billion was attributable to Freetrade (31 May 2025: £2.6 billion; 31 August 2024: £2.0 billion).

As announced on 19 September 2025, IG Group has reached an agreement to acquire Independent Reserve, a cryptocurrency exchange based in Australia. The transaction accelerates IG’s entry into cryptocurrency markets in Asia Pacific. Completion is subject to regulatory approvals and currently expected in early 2026.

The Group announced a new share buyback program of £125 million on 24 July 2025. This program began on 4 September 2025 and is expected to complete by 30 January 2026. As of 23 September 2025, 1.5 million shares had been repurchased at a cost of £16.8 million. An extension to the share buyback program will be considered later in FY26, subject to share price performance and other demands on capital.

As at 31 May 2025, Group regulatory capital resources were modestly in excess of the upper bound of IG’s management buffer of 160-200% of minimum requirements, stated pro forma for the £125 million share buyback and the acquisition of Independent Reserve. Pro forma regulatory capital resources are stated prior to cash generation in FY26.

The Group continues to expect FY26 performance in line with market expectations for total revenue and cash EPS. Within total revenue, net interest income is still expected to be approximately £100 million.