Billionaire investors Bill Ackman and Warren Buffett both feature a particular “Magnificent Seven” member in their portfolios.

Bill Ackman is a billionaire investor and serves as CEO to the hedge fund Pershing Square Capital Management. Throughout the artificial intelligence (AI) revolution, Pershing Square’s primary exposure to the stock market’s latest megatrend has been through a position in Alphabet.

Recently, however, Ackman made headlines after it was revealed that Pershing Square complemented its Alphabet position with another member of the “Magnificent Seven”: Amazon (AMZN 2.66%). Interestingly, Amazon is one of the few technology stocks featured in Warren Buffett’s portfolio at Berkshire Hathaway.

Let’s explore why billionaire investors like Buffett and Ackman may have taken a liking to Amazon. Moreover, I’ll break down why the e-commerce and cloud computing giant is my top pick among AI stocks.

How did Amazon attract both Buffett and Ackman?

Ackman and Buffett built their fortunes in different ways. Buffett is best known for building positions in globally recognized brands and holding onto these stocks over the course of many years or even decades.

In addition, many of Buffett’s most lucrative investments have come from companies that consistently buy back stock or pay a dividend. Lastly, Buffett generally sticks to industries such as financial services, energy, and consumer goods — rarely exposing Berkshire to more volatile markets such as the technology sector.

On the other hand, Ackman tends to be a bit more industry-agnostic compared to Buffett. Moreover, from time to time Ackman will also profit from more sophisticated trading techniques that involve derivatives.

One philosophy that Buffett and Ackman do share, however, is their love for value stocks. Neither investor is known for chasing momentum or overpaying for a stock trading with a lofty valuation.

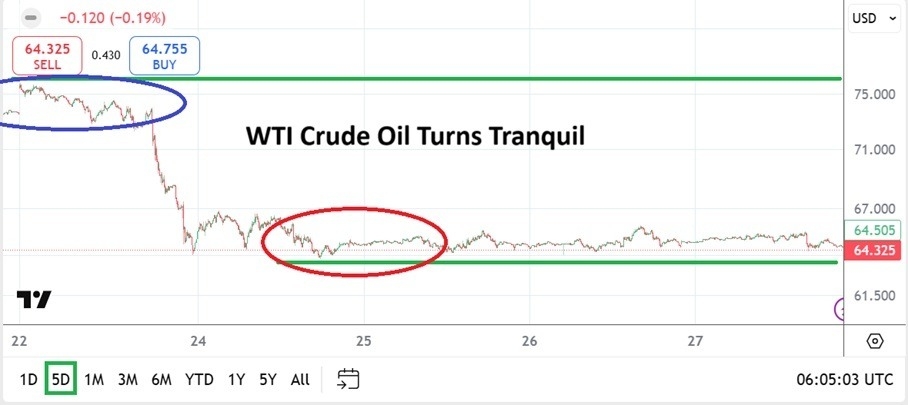

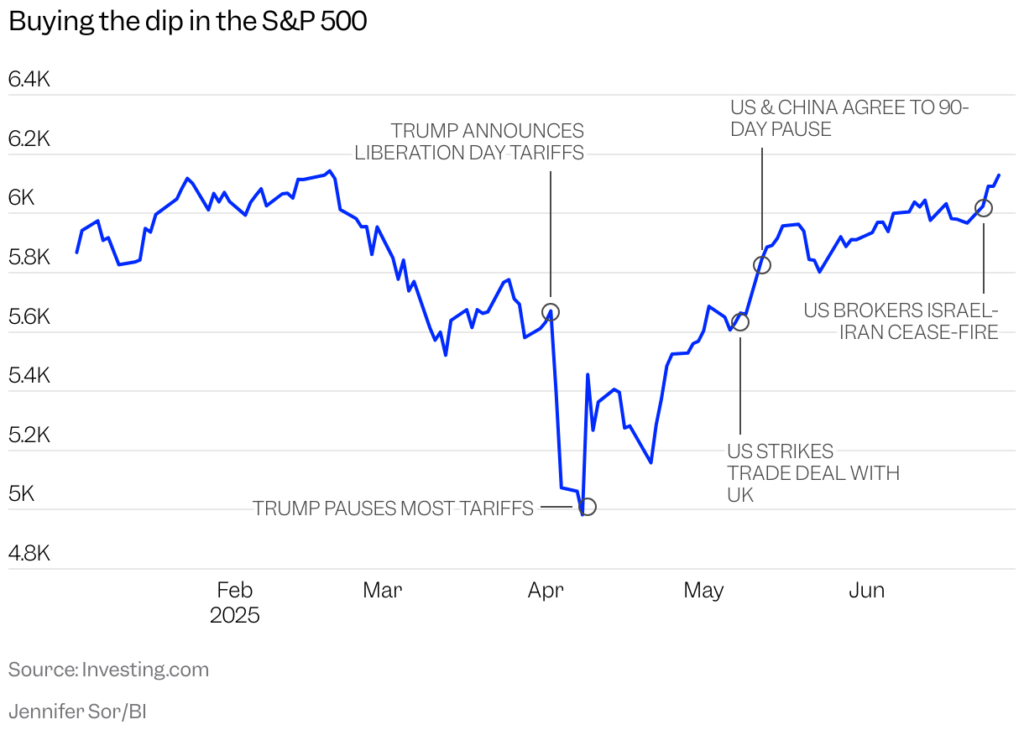

The chart above benchmarks Amazon’s price action relative to other megacap AI and cloud computing stocks. While each stock above faced some pressure earlier this year, Amazon’s decline was more pronounced relative to its peers — specifically throughout April. This is when Ackman pounced, buying the dip in Amazon stock during a period of notable valuation contraction.

Furthermore, I think Amazon’s diversified ecosystem spanning online shopping, cloud computing, subscription services, logistics, robotics, grocery delivery, streaming and entertainment, and more is another factor that played a role in the tech giant earning a spot in both Berkshire’s and Pershing Square’s portfolios.

By operating across so many different end markets, Amazon is able to thrive under various economic conditions while also appealing to several different customer demographics. Buffett and Ackman may favor business models like this as it helps mitigate risk factors such as cyclicality, seasonality, and growth unpredictability.

AI has monster potential to transform Amazon

Given the ideas explored above, Amazon may not appear to be a traditional AI opportunity. But over the last few years, Amazon has quietly been transforming its business through a series of AI-driven investments.

For starters, the company invested $8 billion into a start-up called Anthropic. Anthropic has become a key integration in Amazon Web Services (AWS), leading to sustained acceleration across revenue and profitability in the company’s cloud computing business.

Amazon is also deploying AI robotics throughout its fulfillment centers. This move has the potential to generate significant cost savings by bringing new levels of automation and efficiency to the company’s warehouses.

Moreover, while companies like IonQ or Rigetti Computing fetch the majority of attention in the quantum computing arena, Amazon is developing its own line of chipsets: Trainium, Inferentia, and Ocelot.

Image source: Getty Images.

Is Amazon stock a buy right now?

Based on forward earnings multiples, Amazon stock isn’t exactly a bargain right now. My hunch is that Amazon’s diverse business and robust growth prospects may make the company appear to be more of a safe haven relative to other volatile, unpredictable opportunities in the AI realm.

AMZN PE Ratio (Forward) data by YCharts

Even so, I don’t think Amazon has experienced the same level of valuation expansion that some of its Magnificent Seven peers (e.g., Microsoft, Nvidia) have over the last couple of years.

Furthermore, given how many different businesses AI stands to disrupt within the Amazon ecosystem, I think the company is uniquely positioned for sustained periods of robust growth.

With that in mind, I think Amazon still has significant upside and I see a position in the stock as a superior opportunity compared to its peers. Investors with a long-run time horizon may want to consider initiating a position in Amazon stock despite its slight premium right now.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Berkshire Hathaway, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.