Mark SimpsonCommunity correspondent, BBC News NI

Pacemaker

PacemakerA court has been told that the former head of a leading Belfast law firm tried to hide a multi-million-pound payment which was received from Northern Ireland’s biggest property deal.

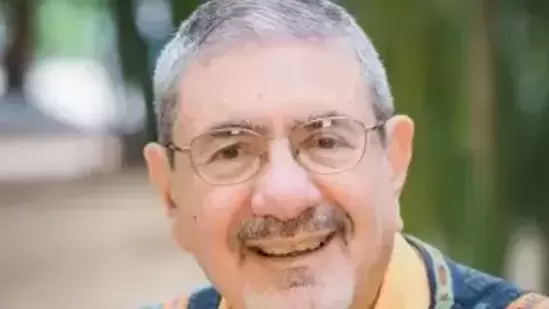

Ian Coulter, 54, of Templepatrick Road, Ballyclare, who used to be the managing partner at Tughans, is on trial in a case linked to the £1.1bn sale of a loan book held by Ireland’s National Asset Management Agency (Nama) in 2014.

He denies five charges, including fraud and transferring criminal property.

Mr Coulter is on trial, along with Frank Cushnahan, 83, of Alexandra Gate, Holywood, who denies two fraud charges. Mr Cushnahan used to be an adviser to Nama.

Both men are accused of wrongdoing linked to the sale of the entire Northern Ireland loan portfolio held by Nama, after the financial crash in 2008.

The purpose of Nama was to take over billions of property development debts held by banks in the Republic of Ireland.

The Northern Ireland loan book involved loans bundled together into an enormous portfolio.

The debts, which were worth about £4bn, were eventually sold to a US investment fund in 2014 for £1.1bn.

Pacemaker

Pacemaker‘Big shiny toy’

The prosecution told the court Mr Coulter tried to “trick” and “distract” senior colleagues at Tughans by giving them some of the money, including £1.5m from £7.5m which was received.

“Like a big shiny toy, he was using this £1.5m to distract the partners,” barrister Jonathan Kinnear KC told the jury.

The court was told the money was later paid back when the partners discovered the circumstances around how the money was received. It is alleged they had not been told the truth previously.

On Thursday, day five of the trial, the prosecution continued its opening of the case.

The prosecution say that after a US investment firm, Cerberus, bought the Northern Ireland loan book from Nama, a “success fee” was paid to two law firms for their work on the sale, which was confirmed in April 2014.

Brown Rudnick, a US law firm which has a base in London, received £15m and agreed to give half of it to Tughans.

‘His story changed’

The prosecution say that Mr Coulter controlled the money and concealed the full details from his colleagues.

It is alleged that he ensured it did not go into the main bank account of Tughans, but a dormant company account instead.

The majority of the money was later transferred to an account in the Isle of Man controlled by Mr Coulter, the court was told.

When questions began to be asked at Tughans about the matter, the prosecution say Mr Coulter was “dishonest” and tried to mislead colleagues.

“Effectively, his story changed as he began to get caught out by his partners at Tughans,” Mr Kinnear told the jury.

One of their meetings between partners was recorded and the court was shown a transcript of what was allegedly said.

The prosecution say Mr Coulter attempted to blame others for what happened as he realised the truth of what he had been doing was starting to emerge.

Mr Kinnear told the jury: “The only person who ruined Mr Coulter’s career was Mr Coulter.”

At the meeting which was recorded, he is alleged to have said: “Every morning I wake up, I go ‘How do I, how do I fix this?'”

The trial is being held at Belfast Crown Court before judge Madam Justice McBride, and is expected to last up to 12 weeks.

What is Nama?

Nama is the Republic of Ireland’s “bad bank”, set up by the Irish government in 2009 in the wake of the financial crisis which broke out the previous year.

Nama’s role was to offload non-performing loans acquired from troubled banks.

Mr Cushnahan and Mr Coulter are both charged with fraud by false representation on or around 3 April 2014.

Mr Coulter faces a further four charges including transferring criminal property, namely money, between 15 September and 1 December 2014.

Between 1 April 2013 and 7 November 2013, Mr Cushnahan is accused of dishonestly failing to disclose information, that he was under a legal obligation to disclose to the Northern Ireland advisory committee and Nama.

He is accused of failing to inform them that he was providing information to a firm called Pimco over the proposed purchase of the Northern Ireland loan book from Nama.

It is alleged his intention was to make a gain for himself or someone else.

Both men deny all of the charges against them.

The trial continues.