Indian equity indices are expected to open on a positive note following mixed global cues. The Asian indices were mixed in morning trade. The GIFT Nifty was trading 0.15% higher at 25,532. Here are key global cues to watch before the market opens that include crude oil prices, FII and DII data, business groups that most, sectoral performance, etc.

Earlier on Thursday, the NSE Nifty 50 closed the session 48 points or 0.19% lower at 25,405, while the BSE Sensex declined 170 points or 0.20% to close at 83,240.

Key global and domestic cues to know on July 04, 2025

Asian Markets

Asia-Pacific markets traded mixed on Friday morning as overnight US markets surged to a record high on the back of better-than-expected job claims. Japan’s Nikkei 225 benchmark was flat in choppy trade while the broader Topix index added 0.15%. In South Korea, the Kospi index fell 0.56% while the small-cap Kosdaq declined by 0.8%.

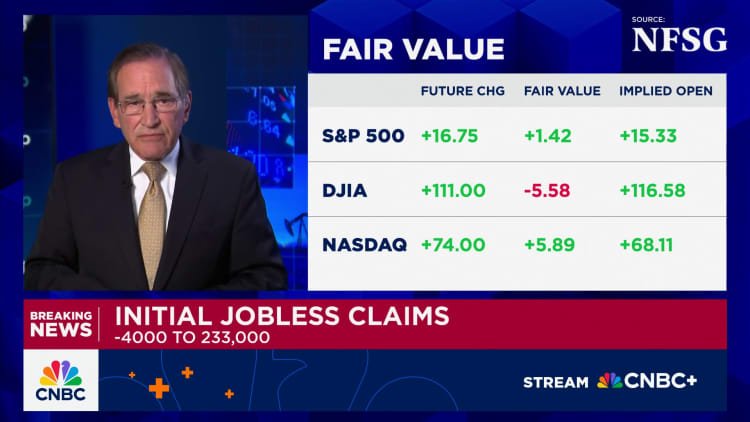

US markets

The US markets closed Thursday’s session on a record note as the job claims data came better than estimates, easing concerns of a slowing US economy. The Dow Jones Industrial Average advanced 344.11 points, or 0.77%, settling at 44,828.53. The S&P 500 added 0.83% to close at 6,279.35, while the Nasdaq gained 1.02% and ended at 20,601.10. Both the S&P 500 and the Nasdaq Composite also closed at records.

Apart from that, the US stock markets will be closed on July 4 in observance of Independence Day. It also closed earlier on July 03 for the same reason.

US dollar

The US Dollar Index (DXY), which measures the dollar’s value against a basket of six foreign currencies, was trading flat at 97.01 on Friday morning. The index evaluates the strength or weakness of the US dollar in comparison to major currencies. The basket contains currencies such as the British Pound, Euro, Swedish Krona, Japanese Yen, Swiss Franc, etc. The rupee appreciated 0.47% to close at 85.31 to the dollar on July 03.

Crude oil

The crude oil prices continued to trade on a lower note on Thursday morning. WTI crude prices were trading at $67.02, up by 0.29%, while Brent crude prices were trading at $68.75, up by 0.15%.

FII, DII data

Foreign institutional investors (FII) were the net sellers of shares worth Rs 1,771.25 crore. On the other hand, the Domestic institutional investors (DII) were the net buyers of shares worth Rs 1,078.51 crore on July 03, 2024, according to the provisional data available on the NSE.

Gold rate today

The rate for 24-carat gold today is Rs 97,080 per 10 grams, consolidating near its all-time high. The safe haven’s price is near the Rs 1 lakh mark. The rate of gold has surged by 1.37% in the past one week. The 22 kt gold rate today is Rs 88,990 per 10 grams. The 18-carat gold price today is Rs 72,810.

Top sectors in Thursday’s trade

The consumer durable sector’s stocks surged the most in terms of market capitalisation by 1.33% in Thursday’s trade, and cable stocks followed the auto ancillaries sector stocks. The textiles sector stood behind the alcohol sector, climbing 0.8%, and it was followed by rubber stocks that rose 0.74%.

Best and worst performing business groups

The IIFL Group’s market capitalisation has risen the most in the previous session, gaining almost 3.2%. Essar Group surged 2.9%, following IIFL. Further, the DCM group rose 2.9%. On the other side, the Anil Ambani Group fell the most, followed by the Manipal Group.