When Nvidia CEO Jensen Huang revealed Friday that the company is working with the Trump administration on a new computer chip designed for sale to China, it marked the latest chapter in a long-running debate over how the U.S. should compete with China’s technological ambitions.

The reasoning has sometimes changed — with U.S. officials citing national security, human rights or purely economic competition — but the tool has been the same: export controls, or the threat of them.

Nvidia believes it can eventually reap $50 billion from artificial intelligence chip sales in China. But it so far has been held back by restrictions imposed by President Joe Biden’s administration and then reinforced by President Donald Trump before negotiating a quid pro quo deal.

How did these chip export controls start?

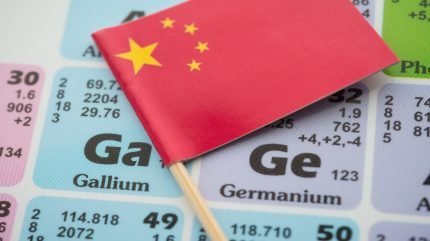

China has its own chip foundries, but they have historically supplied only low-end processors used in autos and appliances. Beginning in 2014, the Chinese government tried to change that with a new “Big Fund” that invested huge amounts of money into hundreds of semiconductor companies.

Meanwhile, the U.S. government, starting in Trump’s first term, began cutting off China’s access to a growing array of tools to make chips for computer servers, artificial intelligence and other advanced applications.

OpenAI’s new open models accelerated locally on Nvidia GeForce RTX and RTX Pro GPUs (Nvidia)

China was particularly irked when it was blocked from buying a machine available only from a Dutch company, ASML, that uses ultraviolet light to etch circuits into silicon chips. The restrictions stalled Chinese efforts to make transistors faster and more efficient by packing them more closely together on fingernail-size slivers.

Chinese telecommunications giant Huawei became the public face of the trade tensions, with U.S. claims of its products’ potential use for espionage a backdrop for a broader struggle for economic and technological dominance.

“We don’t want their equipment in the United States because they spy on us,” Trump said in 2020 as the administration tightened restrictions to block Huawei from accessing chip technology, at the same time as he was threatening to ban TikTok on similar grounds.

Biden ups the ante on chip restrictions

President Joe Biden maintained those restrictions after taking office in 2021, but also ramped them up with a series of export controls that blocked sending to China the world’s most advanced chips and factory equipment.

That affected Chinese sales for California chipmaker Nvidia, the leading designer of the specialized chips needed for artificial intelligence technology.

After the first restrictions took effect in 2022, blocking chips including Nvidia’s H100, the company designed a new kind of chip that was not quite advanced enough to meet the threshold for restrictions.

The Biden administration escalated its restrictions in 2023 to block those newer chips. Then Nvidia again came out with a new kind of chip that could slip into China: the H20.

Trump’s back-and-forth on the H20

The Trump administration in April halted the sale of the H20 and other advanced computer chips to China over national security concerns, but Nvidia and AMD revealed in July that Washington would allow them to resume sales of their chips, which are used in AI development.

After taking a $4.5 billion blow to its finances during the February-April period, Nvidia estimated the export crackdown in China would cost the company another $8 billion in potential sales from May through July.

The squandered opportunities fueled Huang’s efforts to persuade Trump and other administration officials that the restraints would do more harm than good for the U.S.

“The question is not whether China will have AI, it already does,” Huang told analysts during a conference call in late May. “The question is whether one of the world’s largest AI markets will run on American platforms. Shielding Chinese chipmakers from U.S. competition only strengthens them abroad and weakens America’s position.”

Nvidia and AMD also agreed in August to share 15% of their revenues from chip sales to China with the U.S. government, as part of a deal to secure export licenses for the semiconductors.

![[News] TSMC Reportedly Eliminates Chinese Equipment Use in 2nm Production as U.S. Rules Loom](https://koala-by.com/wp-content/uploads/2025/08/TSMC-WAFER-NO6-624x416.jpg)