China’s latest move to tighten control over high-energy battery exports has sent ripples across the global electric vehicle (EV) and energy storage industry. For most companies, this creates uncertainty. But for QuantumScape Corporation QS, this could be an opportunity.

Last week, Beijing announced export restrictions on advanced lithium-ion batteries, cathodes, artificial graphite anodes, and related manufacturing equipment. Effective Nov. 8, any company that wants to export these products will need government approval. The rules come on top of earlier limits on lithium iron phosphate (LFP) battery technology exports announced in July.

China dominates the production of lithium-ion batteries and key materials, including graphite. These restrictions could disrupt the global battery supply chain, causing delays, increasing costs and pushing automakers outside of China to seek alternative technologies and suppliers.

That’s where QuantumScape comes into the picture.

Solid-State EV Battery Maker With Differentiated Tech

QuantumScape develops solid-state lithium-metal batteries that eliminate the need for graphite anodes—one of the main materials now under China’s export controls. Its technology promises faster charging, higher energy density and better safety than traditional lithium-ion cells.

The company’s recent progress adds credibility. In July, QuantumScape expanded its collaboration with Volkswagen’s VWAGY battery arm, PowerCo, which will add up to $131 million in new payments over the next two years. QS also signed a joint development agreement with another global automaker, underscoring growing interest from major OEMs.

At the same time, its new Cobra production process—25 times more productive than its previous system—marks a big leap toward commercial-scale manufacturing. QuantumScape expects to ship its first Cobra-based B1 samples this year.

Image Source: QuantumScape Corp.

Financial Cushion for the Long Game

QuantumScape ended the second quarter with about $797 million in liquidity, extending its cash runway into 2029. This gives the company time to execute its capital-light licensing model without risks of immediate dilution. While QuantumScape remains pre-revenue, Volkswagen payments and potential new partnerships could narrow losses going forward.

Final Thoughts

As automakers scramble to secure supply chains less dependent on Chinese materials, QuantumScape’s U.S.-developed, graphite-free solid-state batteries could gain strategic importance. Yes, scaling production may take time. But as battery geopolitics intensify, QuantumScape’s technology is likely to give it a stronger hand in the global EV race.

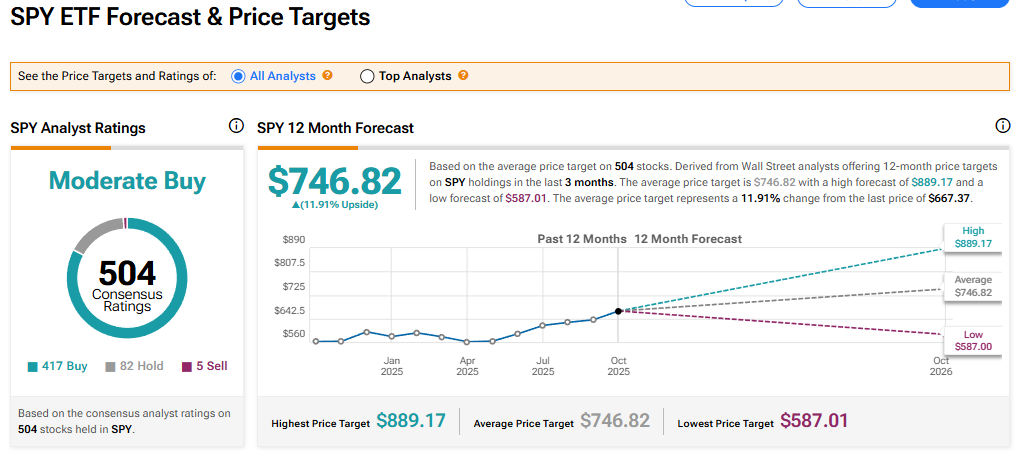

QS’ Price Performance & Broker Ratings

Shares of QS have jumped more than 240% year to date, breezing past the industry’s growth. The stock hit a fresh 52-week high of $19.07 yesterday,

QuantumScape currently has an average brokerage recommendation (ABR) of 3.44 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by nine brokerage firms.

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

![[News] Microsoft Reportedly Moving Most Laptop and Server Production Outside China as Early as 2026](https://koala-by.com/wp-content/uploads/2025/10/Microsoft-20250909-624x458.jpg)