THE perception of Hong Kong’s decline as a financial hub and desirable place to live is both understandable yet overstated. During a recent business trip to Europe, one consistent reaction stood out: Clients’ faces flashed with concern and sympathy when I mentioned I was based in Hong Kong.

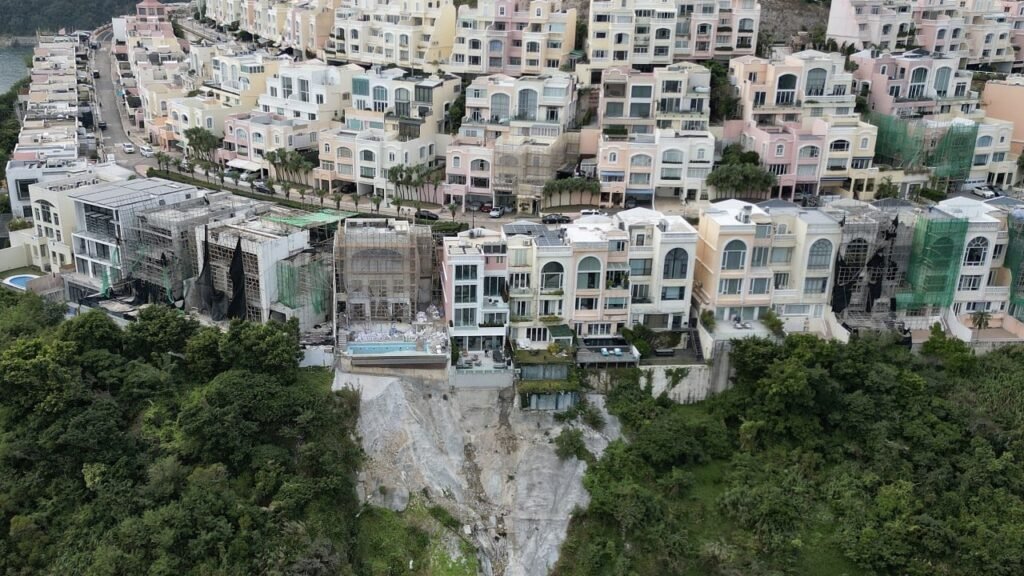

I get it. For years, the narrative around Hong Kong has been relentlessly downbeat: falling property prices; the 2019 protests; Covid lockdowns; expat departures; strained US-China relations; and renewed worries about the stability of the HKD-USD peg. The concerns are valid but, as I argue below, also misplaced.

Which major equity market has outperformed most others in 2025? Which market ranks fourth globally by capitalisation, trailing only the United States, mainland China, and Japan? Which market raised more in IPOs than Europe’s exchanges combined this year? And which economy welcomed more tourists than Japan from January to May 2025? If you answered Hong Kong to all, you’re absolutely correct. Surprised? Let me explain.

Golden goose

My optimism about Hong Kong’s future hinges on its currency: the Hong Kong dollar (HKD). Within the Greater China region, no other city matches its currency’s liquidity and convertibility (with apologies to Macau’s pataca). Corporate China’s unquenchable demand to recycle hard currency is well known, and until the renminbi becomes convertible – likely a distant prospect – Hong Kong’s role as China’s premier funding conduit remains secure.

But what about the HKD-USD peg’s vulnerabilities? Recent media reports have highlighted pressures on the peg, and these concerns are reasonable. Yet, the strain isn’t from capital flight; it’s the opposite. Inflows from IPOs, dividends, and investment opportunities are so robust that the Hong Kong Monetary Authority (HKMA) had to sell some HK$47 billion (S$7.6 billion) in May 2025 to temper HKD appreciation.

Of course, an appreciating currency is a nice problem to have, as are interest rates at – or close to – record lows. But, either way, both are still problems if allowed to endure, potentially distorting the allocation of capital.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

To be fair, the allure of a USD carry trade (selling HKD and investing in US money market funds for example) has seen the HKD’s value normalise. But even two weeks on from the last mega-IPO, the monetary system remains awash with liquidity, allowing banks to reset mortgages rate lower and allowing refinancing opportunities for the beleaguered commercial real estate sector.

Local hero

With roughly comparable populations, land mass, and economic size, the friendly competition between Hong Kong and Singapore as rival business centres is as storied as it is long-running. Anyone who has recently visited Singapore will have been mightily impressed by the energy, opportunity, and confidence that the city state currently exudes; and might conclude – reasonably – that Hong Kong has (temporarily) lost its mojo to its ascendent challenger.

Yet, Hong Kong’s role as China’s financial gateway also gives it both a role and an edge, certainly in the ability to offer local companies liquidity for financing purposes. For example, Hong Kong’s stock market has a total market capitalisation of US$6.3 trillion, entirely dwarfing Singapore’s at merely US$0.5 trillion, a 13-fold difference. As China corporates consider delisting from the US or dual list in Hong Kong, one can assume Hong Kong’s market capitalisation may likely increase.

Admittedly something of a stealth rally, the Hang Seng Index (HSI)’s year-to-date performance – largely complementing and reflecting renewed interest in China – may also have attracted international investors. At time of writing, the HSI was up 21 per cent on the year, outperforming the majority of competitor markets. My sense is as investors rotate thematically from US exceptionalism to – among other things – (China-centric) emerging market opportunities, local equities may further benefit in the months and quarters to come.

Canary’s fragility

Yet for all Hong Kong’s recent positives, as a financial entrepot it is both sensitive and vulnerable to the volatilities of global trade. And that is unlikely to change anytime soon. Thus, strained trade relations between the US and China – and the risk of high tariffs being imposed by the former on the latter – will negatively impact the city’s fortunes.

Inevitably, Hong Kong reliance on mainland inflows – with some 80 per cent of Hong Kong Exchanges and Clearing’s market cap tied to Chinese firms – exposes it to China’s economic slowdown risks. Escalating geopolitical tensions or a faltering Chinese economy could trigger occasional liquidity shocks, potentially derailing Hong Kong’s markets for a while.

At Lombard Odier, we are overweight equities, including those in emerging markets. Our preferred way to access China risk is via Hong Kong’s H Share market. Thus far, it has been a satisfactory trade. But Hong Kong’s East-West history positions it – somewhat uniquely – in the crosshairs of tensions between the world’s two great superpowers. Hong Kong’s resilience is well known and well regarded; but shouldn’t be taken for granted.

The writer is chief investment officer, Asia, at Lombard Odier