發佈日期: 2025-10-17 19:54

TVB News

粵

已複製連結

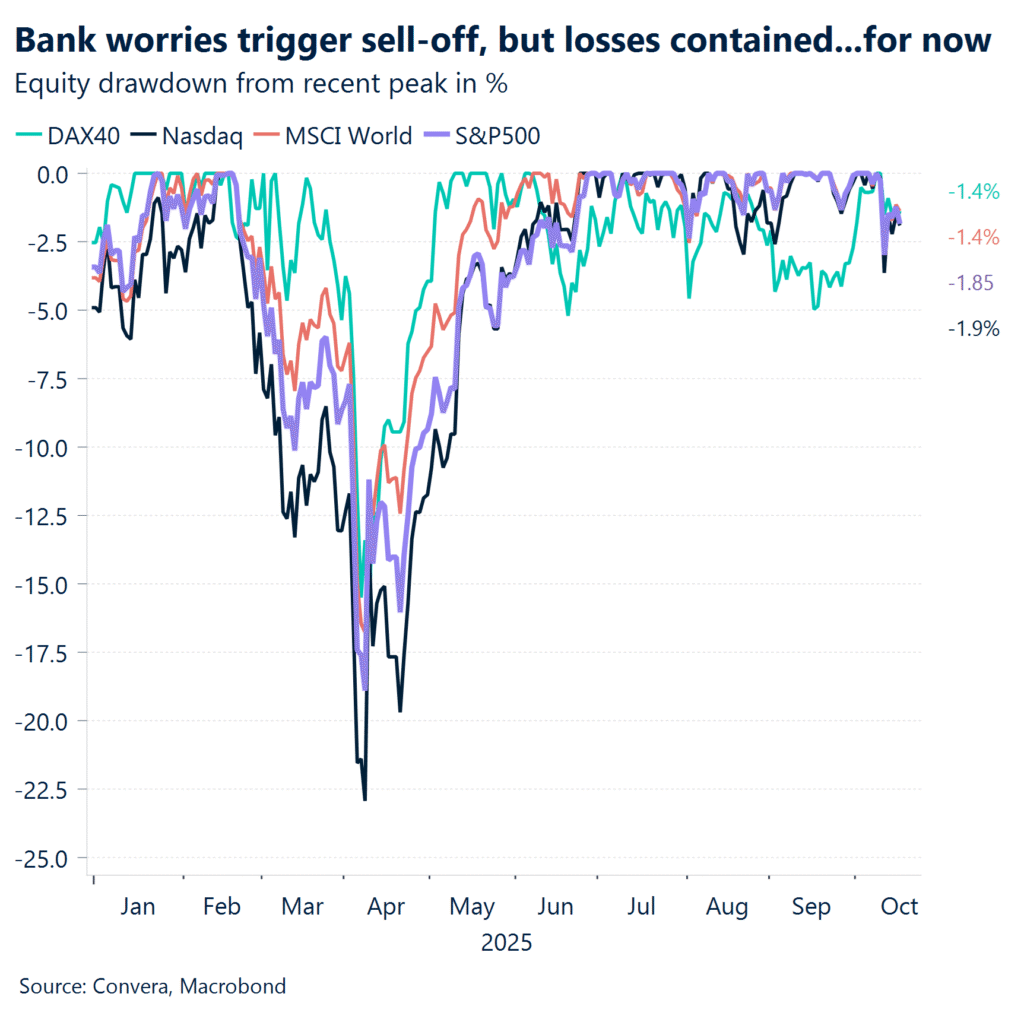

Hong Kong's stock market fell sharply today with the benchmark Hang Seng Index slumping over 600 points -- extending a 2-week losing streak.

That's weighed down by bad debt woes of U.S. banks, sparking renewed fears of a credit crisis.

Beleaguered by mounting bad debt woes among regional banks in the United States, global banking stocks skidded.

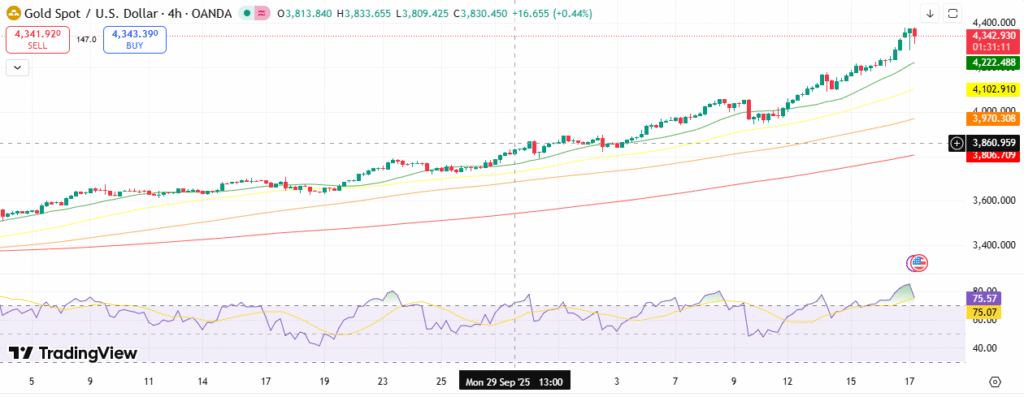

This amid a weakening U.S. dollar driving investors towards safe-haven assets.

As the market opened, Hong Kong stocks tumbled below the 50-day moving average and tracked global losses throughout the day.

At its worst, the benchmark index plummeted as much as 743 points to around 25,100 before trimming losses to close 641 points lower at 25,247 with a turnover of 314.6 billion dollars.

Stock commentator Louie Shum says the panic mainly stems from overseas factors -- tariffs and trade wars no longer play a major role but the fundamentals, including weak economic data or U.S. bank woes present more far-reaching impacts.

He says it's possible the Hang Seng Index could test lower levels to around 24,000 or even 23,000 points.

Tech stocks were hit hard, with Kuaishou, Baidu, Alibaba and Meituan, all tumbling around 4 percent.

BYD Electronics plunged 8 percent, marking the city's worst-hit blue chip.

Chipmaker SMIC dropped 6 percent, sliding to below 70 dollars.

Bucking the market trend were gold jewellery-related stocks with Chow Tai Fook rising by 5 percent.

Bank stocks were under selling pressure with Standard Chartered declining by 5 percent. HSBC fell nearly 2 percent.

Weighed down by recall orders of their vehicles in the mainland, automakers Geely and BYD closed the week dipping 4 percent in stock prices.

Visited 4 times, 4 visit(s) today