①Hong Kong equity financing market in the first three quarters: 66 new listings raised USD 23.9 billion. ②Goldman Sachs optimistic about Chinese enterprises going global: Tariffs unlikely to impede ‘going out’ momentum, leading companies in various sectors have bright prospects. ③Apple share price hits record high, report cites strong demand for iPhone 17. ④White House economic advisor: Government shutdown may end this week.

Focus on Hot Topics

Xu Jingwei, Head of Global Listing Services at the Hong Kong Exchange, published an article on the Hong Kong Exchange’s official WeChat account today stating that by the third quarter of 2025, driven by several large-scale IPOs and the overseas expansion needs of Chinese mainland enterprises, Hong Kong’s equity financing market has solidified its position as the world’s top IPO financing hub.

By the end of the third quarter, the Hong Kong market saw 66 new listings raising a total of USD 23.9 billion, firmly maintaining its status as the world’s leading IPO financing hub. The Hong Kong market welcomed multiple IPOs with proceeds exceeding USD 1 billion each, including Zijin Gold International, which raised USD 3.2 billion in September 2025. This IPO was also the second-largest globally this year, following CATL’s listing in May 2025 (raising USD 5.3 billion).

By the end of the third quarter, the Hong Kong market saw 66 new listings raising a total of USD 23.9 billion, firmly maintaining its status as the world’s leading IPO financing hub. The Hong Kong market welcomed multiple IPOs with proceeds exceeding USD 1 billion each, including Zijin Gold International, which raised USD 3.2 billion in September 2025. This IPO was also the second-largest globally this year, following CATL’s listing in May 2025 (raising USD 5.3 billion).

Goldman Sachs released a report stating that investors should focus on Chinese listed companies seeking to expand overseas, as the renminbi exchange rate remains competitive, China maintains a dominant position in the global supply chain, and its products possess both cost and quality advantages. The firm recommended 25 industry-leading companies expanding abroad, including Alibaba, CATL, and BYD, whose overseas revenue now accounts for approximately one-third of their annual income.

Apple’s share price hit a record high on Monday, closing at USD 262.24, up 3.94%, with a total market capitalization reaching USD 3.89 trillion.

With its market value rising to $3.89 trillion, Apple became the second-largest company by market capitalization in the U.S., surpassing Microsoft and trailing only NVIDIA.

According to a report by Counterpoint Research, early sales of the iPhone 17 series were strong in both the Chinese and U.S. markets, with sales volume 14% higher than that of the iPhone 16 series. Notably, sales of the base model iPhone 17 nearly doubled in China.

Kevin Hassett, Chief Economic Advisor to the White House, stated on Monday that the U.S. government shutdown crisis is “very likely to end within this week.” However, he warned that if the deadlock persists, the Trump administration might adopt “tougher measures” to force concessions from the Democratic side.

Global Indices

In the U.S. stock market, at the close, the Dow Jones Industrial Average rose 1.12% to 46,706.58 points; the S&P 500 Index gained 1.07% to 6,735.13 points; and the Nasdaq Composite Index climbed 1.37% to 22,990.54 points.

Major technology stocks generally rose, with NVIDIA down 0.32%, Microsoft up 0.63%, Apple up 3.94%, Google up 1.28%, Amazon up 1.61%, Meta up 2.13%, and Tesla up 1.85%.

Popular Chinese stocks collectively rose, with the Nasdaq Golden Dragon China Index up 2.39%. Alibaba rose 3.84%, JD.com increased by 2.09%, PDD Holdings gained 2.40%, Nio surged 4.59%, XPeng Motors climbed 1.23%, Li Auto edged up 0.09%, Bilibili advanced 1.85%, Baidu rose 1.76%, NetEase grew 3.13%, Tencent Music added 1.70%, and Pony AI increased by 1.76%.

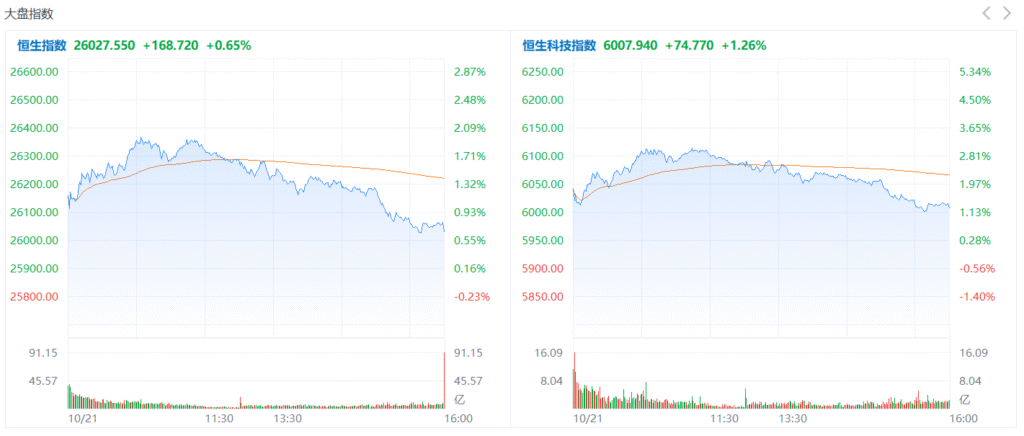

In the Hong Kong stock market, at the close on Monday, the Hang Seng Index surged 2.42% to 25,858.83 points; the Technology Index jumped 3% to 5,933.17 points; and the H-share Index advanced 2.45% to 9,232.67 points.

In terms of market performance, technology, internet, coal, pharmaceuticals, and semiconductor sectors showed strength, while gold and wind power stocks experienced slight pullbacks.

Corporate News

China Mobile (00941.HK): Operating revenue for the first three quarters was RMB 794.7 billion, representing a year-on-year increase of 0.4%; net profit during the same period was RMB 115.4 billion, an increase of 4% year-on-year.

CATL (03750.HK): For the January-September period, revenue reached approximately RMB 283.072 billion, an increase of 9.28% year-on-year; net profit was approximately RMB 49.034 billion, up 36.2% year-on-year.

Huaneng Power International, Inc. (01071): For the first three quarters, cumulative electricity generation reached 201.33 million megawatt-hours, representing a year-on-year decrease of approximately 5.87%. The average on-grid electricity price was about RMB 509.55 per megawatt-hour, reflecting a decline of approximately 2.76% compared to the restated data from the same period last year.

Weimob Group (02013.HK): Plans to initiate business cooperation with Douyin Group.

Yancoal Australia (03668.HK): Total commercial coal production in the third quarter was 12.3 million tonnes, with an overall coal selling price of AUD 140 per tonne. The thermal coal selling price remained stable, while the metallurgical coal selling price decreased by 1% sequentially.

JL Mag (06680.HK): Net profit attributable to shareholders in the first three quarters was RMB 515 million, representing a year-on-year increase of 161.81%.

Sun Art Retail (06808.HK): Expected loss attributable to shareholders for the interim period is approximately RMB 140 million.