(Bloomberg) — It’s too early to be worried about a bubble in high-flying US technology stocks.

Most Read from Bloomberg

That’s the view of Goldman Sachs Group Inc. strategist Peter Oppenheimer, who said the record-breaking rally in tech heavyweights has been accompanied by robust earnings growth. In past bubbles, the market was driven higher mainly by speculation.

“Valuations of the technology sector are becoming stretched but not yet at levels consistent with historical bubbles,” Oppenheimer and his team wrote in a note.

Still, the strategist reiterated his recommendation that investors seek diversification to avoid risks around a narrow US stock rally and higher competition in the artificial intelligence space.

A handful of tech giants including Nvidia Corp., Broadcom Inc. and Microsoft Corp. have driven US stocks to record highs as investors bet on sustained earnings growth and improved productivity from AI.

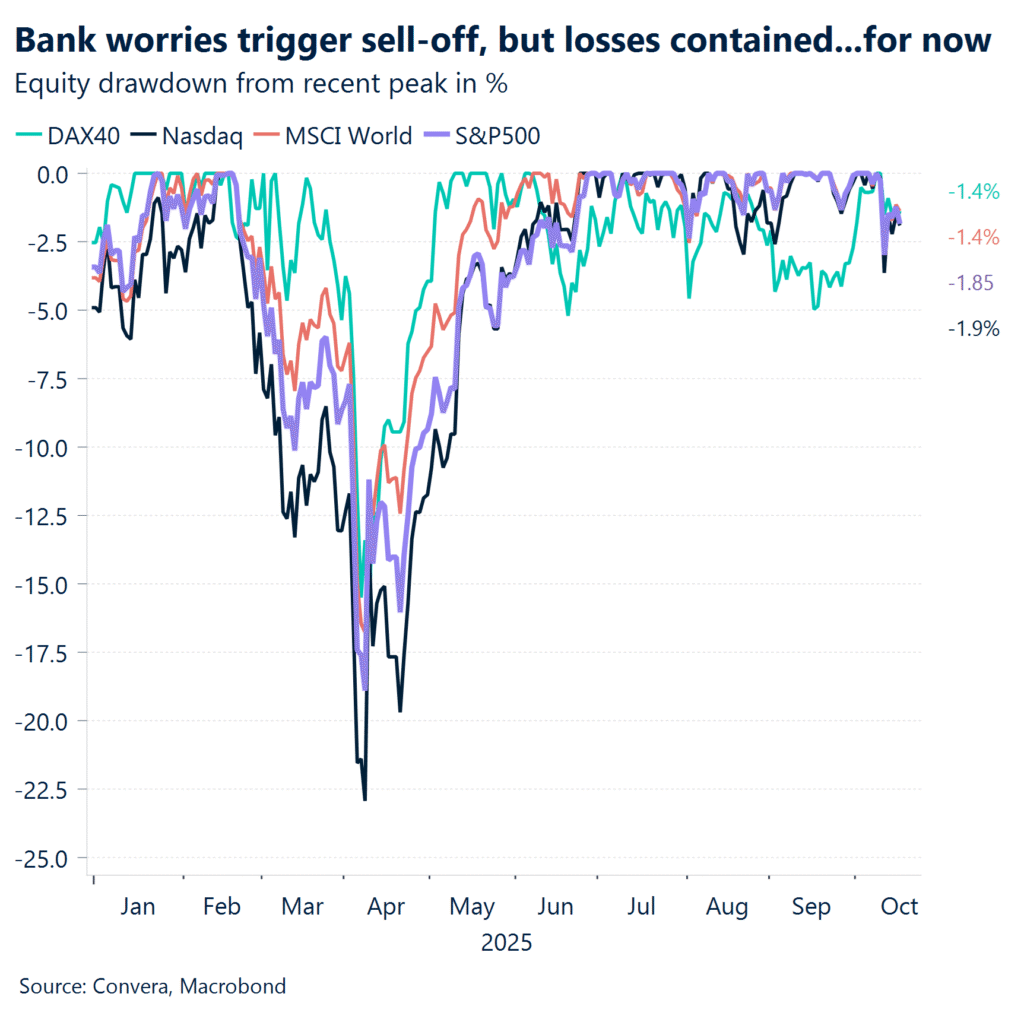

While recent positioning metrics from banks such as Goldman and Barclays Plc suggest investors remain bullish about the outlook for further equity gains, some market participants are turning cautious about the payoff from hefty spending on AI.

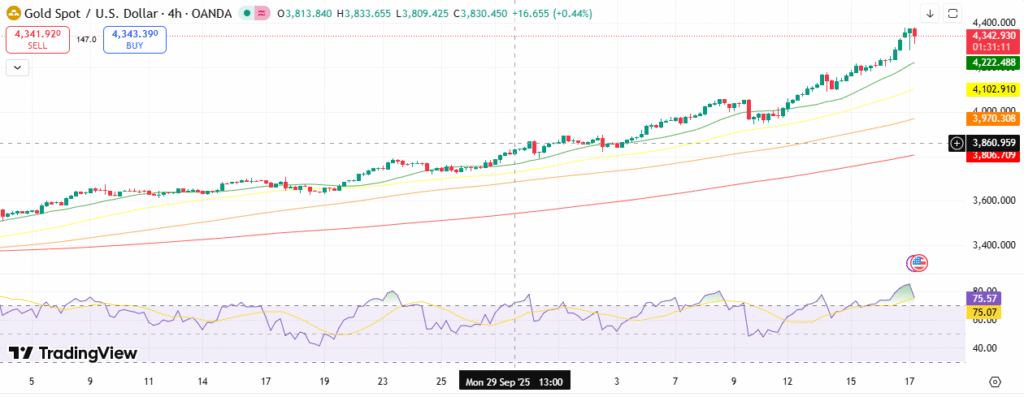

The tech-heavy Nasdaq 100 Index slipped on Tuesday after a report that the profit margin for Oracle Corp.’s cloud computing business is lower than many have been estimating. Meanwhile, data compiled by Bloomberg show mentions of “tech” and “bubble” in news stories have jumped in recent weeks.

Valuations are also on the rise. The Nasdaq 100 trades at 28 times forward earnings, compared with a 10-year average of 23. The All-Country World Index ex-US carries a price-to-earnings ratio of 15.

Goldman’s Oppenheimer said bubbles tend to develop when the average value of companies soars beyond implied future cash flows. This time around, he said, the best-performing tech stocks have “unusually strong balance sheets.”

Moreover, a rise in valuations across equity and credit markets means “this is less about a bubble in technology and more about the general conditions of low interest rates, high global saving and an extended economic cycle,” he wrote.

“This does leave them vulnerable to a correction if confidence in growth fades, but this is less likely to be driven solely by a bubble bursting in the technology space,” Oppenheimer said.