(Bloomberg) — Sharp losses in high-flying momentum stocks may present a dip-buying opportunity if history is any guide, according to Goldman Sachs Group Inc.’s trading desk.

The traders cited rebounds after similar prior losses in Goldman’s High Beta Momentum basket, coupled with the current technical setup.

Most Read from Bloomberg

When the long-short momentum basket dropped 10% or more over a five-day span in the past, it proceeded to rise in the following week 80% of the time, the traders wrote in a note to clients on Tuesday. The median return was 4.5% in the next week and more than 11% in the next month.

The sudden unwind in the momentum strategy, which focuses on buying recent winners and selling short those that are lagging behind, first came amid a rally in the basket’s stocks meant to be shorted. But its declines this week were powered more by losses in the long leg of the basket “as themes such as AI feel the pain of this rotation,” Goldman’s traders wrote. The basket fell 13% from Aug. 6 through Aug. 19 after trading near an all-time high.

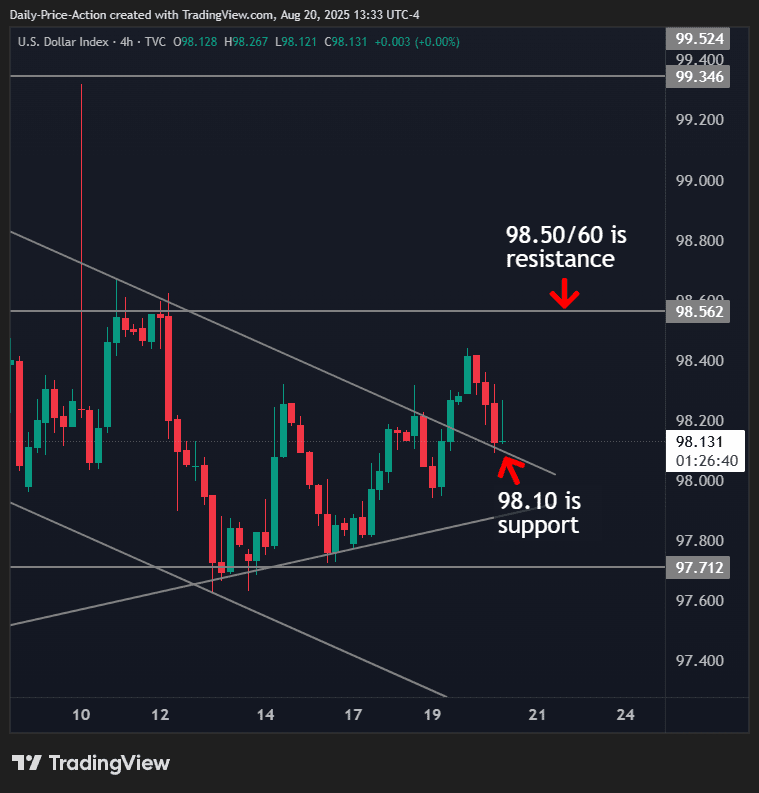

The traders also parsed through technical charts for clues on what could stop the selloff in the momentum trade. The momentum basket is trading near an oversold territory and is approaching the bottom of its so-called regression channel, which is basically the lower boundary of an existing trend. The basket also fell below its 200-day moving average, the level that could serve as a major support.

“It could be a good entry point into the historically rewarded factor, unless tech earnings next week drive a prolonged AI selloff,” Goldman’s traders wrote. Nvidia Corp., the biggest member in both the S&P 500 and Nasdaq 100 indexes, is scheduled to release its quarterly results on Aug. 27.

Some of the stock market’s biggest losers in the past three days include Palantir Technologies Inc., which fell 12%, and Advanced Micro Devices Inc. and Super Micro Computer Inc., which lost 6% or more. Nvidia fell just 2.8% during that time, but its heavy weighting in benchmark indexes made it a drag on the market.

Those stocks “were among the year’s most crowded trades, built on optimism toward AI and speculative momentum, making them vulnerable to swift reversals,” Chris Murphy, co-head of derivatives strategy at Susquehanna International Group, wrote in a note.

The selloff in the momentum factor, which includes high-flying AI stocks on the long side of the basket, comes amid a variety of concerns in the market including soaring valuations, stretched positioning and increasing competition from China.

The Nasdaq 100 Index is trading at 27 times expected 12-month profits, almost a third above its long-term average. Meanwhile, China’s warnings to tech firms to avoid one of Nvidia’s chips and a drop in cloud-computing company CoreWeave Inc.’s shares after its earnings report were among other recent headwinds to momentum stocks.

Another source of concern for tech investors cropped up this week as a Massachusetts Institute of Technology report found that most generative AI initiatives implemented to drive revenue growth are falling flat and only 5% of generative AI pilots are delivering profit.

Still, this isn’t the only stumble for Goldman’s High-Beta Momentum basket this year: This is its fourth retreat of more than 10% in 2025.

“The recent decline in momentum is indicative of how the factor has been trading all year. It’s been a frustrating and choppy trade through all of 2025,” said Bloomberg Intelligence’s Christopher Cain. “While the recent decline could be a tactical opportunity, we also point out that that high momentum stocks are showing some of the most expensive valuations compared to low momentum in history.”

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.