- Gold weekly forecast is bullish amid geopolitical tension.

- Cooling US inflation data, which weighs on the dollar, boosted demand for gold.

- Market participants are now eyeing the FOMC meeting minutes.

The gold weekly forecast turns strongly bullish, with an eye on testing the all-time highs around $3,500. The recent geopolitical tension stemming from the Israel-Iran conflict drove the price above $3,400 level, marking a fresh multi-week top at $3,445 before pulling back later on Friday.

-If you are interested in forex day trading then have a read of our guide to getting started-

The softer US dollar demand, amid cooler US CPI data, boosted gold’s uptrend. The stage is now set for the precious metal for a volatile next week as traders anxiously wait for the Fed’s policy meeting.

The yellow metal remained sideways as the week began, capped by optimism around the US-China trade talks in London. Negotiators agreed on a framework to preserve the tariff truce and ease export controls, including those on rare earth metals. The US President’s announcement to relax control on many Chinese products also lifted the risk sentiment, limiting the upside for gold.

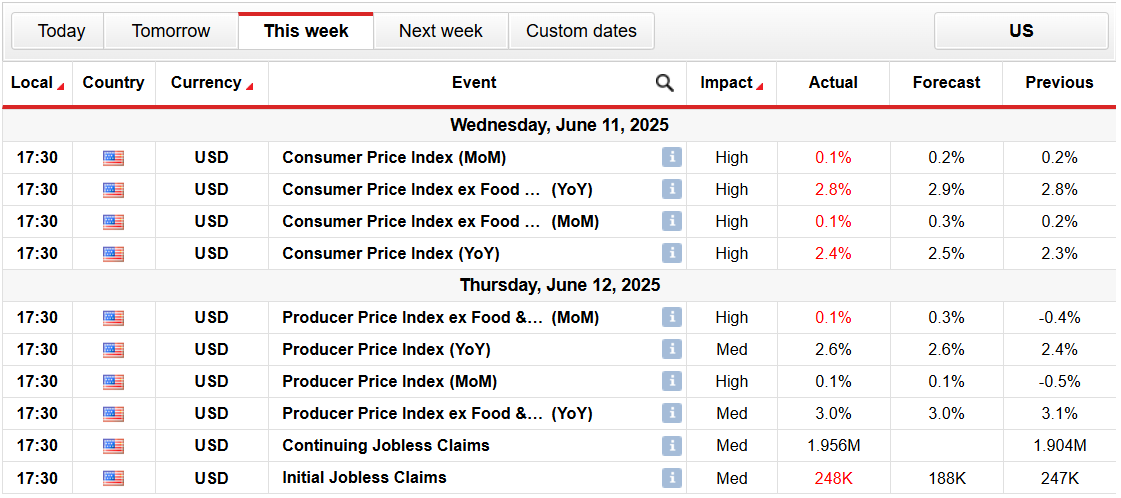

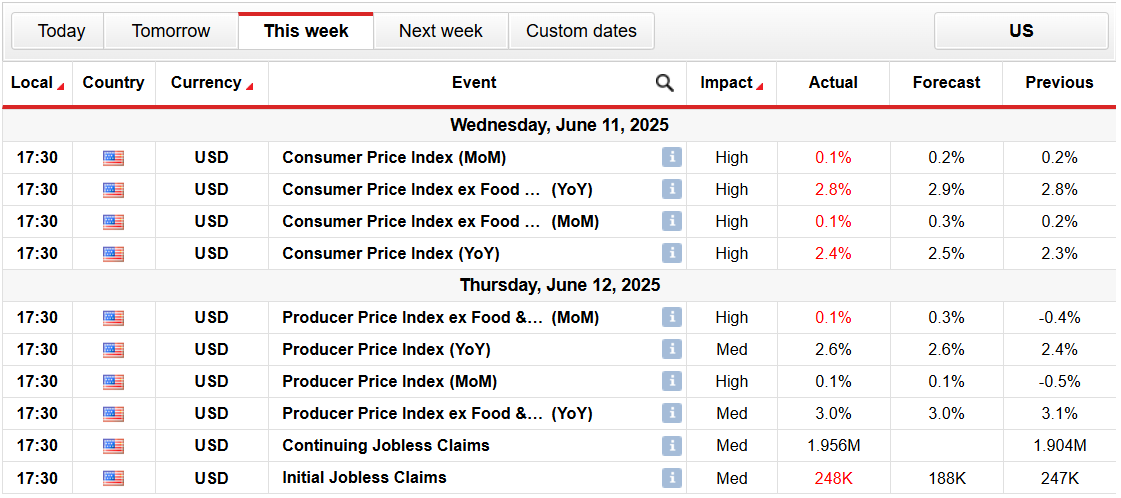

The momentum shifted in favor of gold during midweek as the US CPI data for May slipped, with headline inflation at 0.1% m/m and 2.4% y/y. The core inflation also missed the estimate. The data triggered a sharp decline in the US dollar, resulting in a 1% gain on Wednesday. The bullish trend continued on Thursday as the US PPI and jobless claims data were weak enough to sustain selling pressure on the Greenback. The data fueled speculation about the Fed’s more dovish stance.

However, the decisive catalyst was Israel’s attack on Iran’s nuclear facility and military officials. Israeli PM announced the launch of “Operation Rising Lion,” noting the attack would continue until needed. Iran also retaliated and warned the US and Israel of severe repercussions. The situation sent the gold price above $3,400.

Major Events for Gold Next Week

All eyes are now on the Federal Reserve’s interest rate decisions and the updated release of the Summary of Economic Projections (SEP) on Wednesday. Although no change in interest rates is expected, the new dot plot is key to watch. The US dollar can weaken further if the Fed officials reiterate their call for two rate cuts by the end of 2025. A hawkish tilt, signaling one cut, may strengthen the Greenback, and gold can see a pullback.

Fed Chair Jerome Powell’s commentary will also be closely watched. A dovish tone may accelerate the dollar selling, pushing gold to fresh all-time highs.

Gold Weekly Technical Forecast: Bulls Pushing to $3,500

The daily chart of gold shows the price has briefly broken a double top at $3,440. The downside remains well supported by the 20-day SMA and a rising RSI at 63.0. The price is slowly heading towards $3,500 (all-time high).

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

On the flip side, the $3,400 level remains a strong support for the gold ahead of the $3,320 area where the 20-day SMA resides. Breaking below the level may drift towards $3,300.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.