- Rising Fed cut bets and easing US yields weaken the dollar, boosting gold’s safe-haven demand.

- Prolonged geopolitical uncertainties revive gold’s safe-haven appeal against the ongoing economic and political volatility.

- Traders look ahead to the Consumer Price Index and jobless claims for further policy and economic cues.

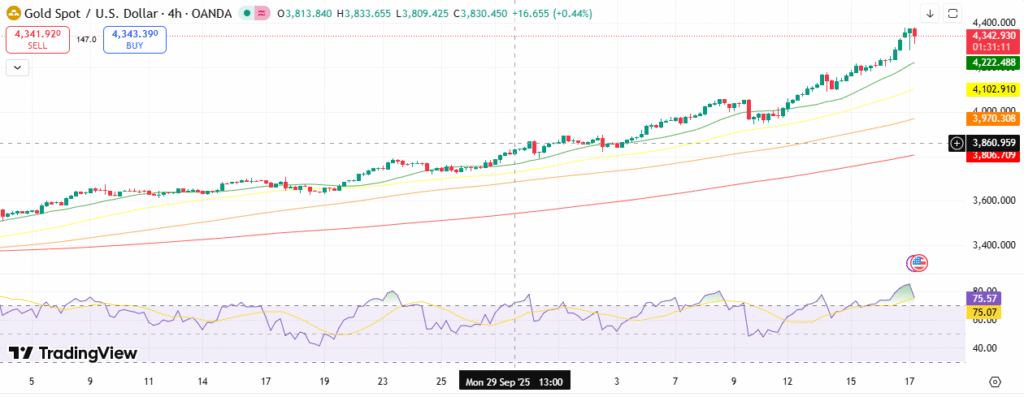

The gold weekly forecast shows a sharp rally to an all-time high around $4,380 before a slight pushback to $4,200 this week, after the greenback and treasury yields recovered. Despite the correction, the yellow metal moves towards its ninth consecutive weekly gain amid safe-haven demand and expectations of Fed easing.

–Are you interested in learning more about crypto robots? Check our detailed guide-

The renewed US-China trade tensions continue dominating the market, with President Trump hinting at a 100% tariff on Chinese exports, responding to Beijing’s restrictions on rare earth exports. Although Trump’s stance eased later on, the markets stayed cautious.

On the geopolitical front, the persistent US government shutdown, heightened tensions between Russia and Ukraine, and the US fiscal deadlock bolstered gold’s safe-haven demand against the ongoing economic instabilities.

The Fed’s Powell and other policymakers emphasized two more 25-bps rate cuts, one this month and another in December, in the remaining FOMC meetings.

Meanwhile, lower US yields and subdued inflation concerns maintain a supportive outlook for non-yielding assets. Meanwhile, the ongoing ETF inflows and persistent central bank gold purchases further revive gold’s safe-haven appeal. Gold now accounts for 30% of central bank holdings.

A potential near-term pullback is likely after a strong uptrend. However, the broader economic and geopolitical instability suggests that any dip in the XAU/USD could lead to renewed investor interest, signaling a firm bullish bias.

Gold Key Events Next Week

The major key events in the coming week include:

- Initial Jobless Claims

- Continuing Jobless Claims

- Consumer Price Index

Traders anticipate the initial and continuing jobless claims and consumer price index next week, as these could give insight into expectations of Fed rate cuts and the economic outlook.

Gold Weekly Technical Forecast: Continues Strong Rally above $4,200

The gold weekly technical forecast shows a strong bullish rally, hovering around the $4,230 level. The daily chart reflects consistently higher highs, revealing an unstoppable uptrend. The 20-day MA at $3,950 and the 50- and 200-day MAs, pointing north, show a solid bullish momentum.

–Are you interested in learning more about buying Dogecoin? Check our detailed guide-

The RSI is above 80, suggesting overbought conditions. A short-term consolidation is likely before the next uptrend. Any pullback towards the $3,950-$3,675 zone in the XAU/USD could draw fresh investor interest, as this zone aligns with key support levels.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.