- Gold forecast intact as safe-haven appeal remains unabated amid Fed easing and the ongoing US government shutdown.

- The US-China trade frictions and the Russia-Ukraine war remain key risk factors, adding more to bullion’s safe-haven appeal.

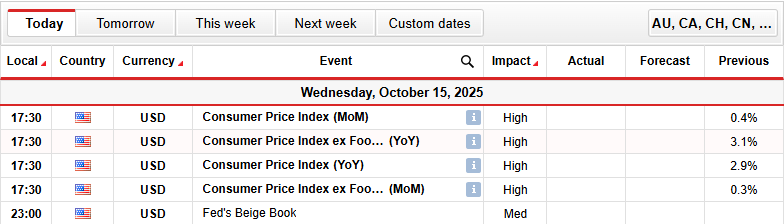

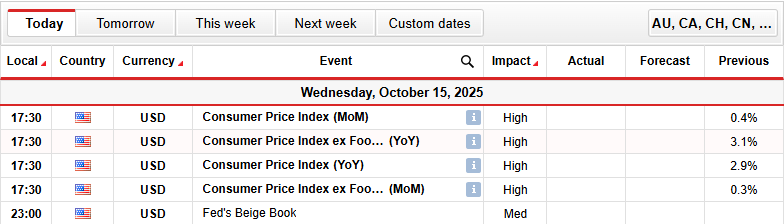

- Traders anticipate the Consumer Price Index for a clear view of the US economic affairs and Fed rate cuts.

The gold forecast remains bullish, rallying above $4,200 as the safe-haven demand remains intact amid a storm of global uncertainty. Geopolitical uncertainty, the persistent US government shutdown, revived US-China trade frictions, and expectations of Fed easing together contributed to the rally while slowing the US dollar.

–Are you interested in learning more about forex conventions? Check our detailed guide-

Additionally, markets are pricing in a nearly certain 25 basis point rate cut this month and another in December, keeping gold’s safe-haven demand intact. Moreover, gold continues the bullish bias amid heightened trade tensions. President Trump warns of severing all ties with China. Revised tariffs and port fees act as the key catalysts.

From the US, the prolonged government shutdown has delayed key economic data while the federal policy outlook remains vague. China’s yuan fix, on the other hand, further contributed to gold’s uptrend and weighed down the dollar.

Furthermore, the IMF has upgraded its global growth forecast to 3.2% and maintained caution that the growth can slow down if the US-China trade persists longer. Similarly, Russia-Ukraine geopolitical risks and US support to Russia continue to add to gold’s safe-haven appeal.

Overall, gold’s dip-buying strengthens amid heightened global instability and continued buying interest by central banks and funds. If the expectations of Fed easing remain unchanged, gold is likely to continue its bullish momentum.

Gold Key Events Ahead

- Consumer Price Index

- Fed’s Beige Book

Traders look ahead to the Consumer Price Index and the Fed’s Beige Book to get insights into the expectations of Fed rate cuts and the US economic conditions, respectively.

Gold Technical Forecast: Strong Momentum Aiming for $4,200

The XAU/USD 4-hour chart signals that gold continues to break record highs and holds near $4,200. The metal remains above the 20-,50-, and 100-MAs, suggesting strong upward movement.

–Are you interested in learning more about Ethereum price prediction? Check our detailed guide-

The RSI is at 72, indicating overbought conditions with no signs of resistance. Immediate support sits near the $4,090-$4,100 levels. A decisive break above $4,200 could extend to $4,250 or higher levels. Whereas, a drop below $4,080 could lead to a short-term correction towards $4,015 before buyers reclaim control.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.