This week presented a paradox that seasoned portfolio and hedge fund managers will recognize immediately: risk is rising, but price action remains oddly composed. With geopolitical tensions escalating in the Middle East, oil surging, and inflation data surprising to the downside, equity markets continued trading with a deceptive calm, masking deeper structural vulnerabilities. Behind the headlines, the mechanics of the market tell a more precarious story: asset managers appear to be increasingly short of their benchmarks, systematic and discretionary shorts remain crowded, and positioning seems light after months of defensive hedging. As we approach Monday’s open, it may serve as a key inflection point where positioning, policy, and geopolitical risk converge. Nevertheless, beneath it all, the AI trade remains as the secular theme and trend underlying driver of markets, in our opinion.

Geopolitics and Risk Sentiment: Asset Markets Shrug—for Now

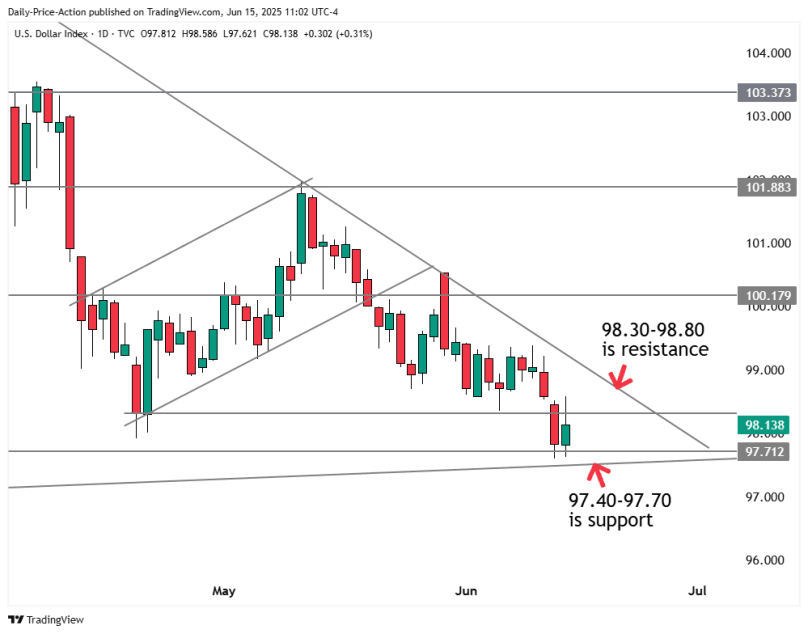

Despite Israel’s direct military strike on Iranian nuclear sites and Iran’s retaliatory missile fire, financial markets barely flinched. Crude oil, however, jumped over 7% on Friday, settling at a four-month high, and gold briefly rallied. However, equity markets, including the S&P 500 (-0.39% for the week) and Nasdaq (-0.63%), showed minimal reaction. However, as Iran’s missiles fell on Tel Aviv late in Friday’s trading session, equities began to wobble with the S&P 500 closing below the key 6,000 level. According to Barron’s, even traditional risk havens such as the dollar and Treasurys saw muted inflows. The message? Investors are treating the latest Middle East clash as a headline risk rather than a macro driver, at least for now.

This complacency belies the risk of escalation. A disruption to the Strait of Hormuz could send oil prices beyond $120 a barrel, which would sharply reprice inflation expectations and destabilize rate outlooks. Strategists from Barclays and T. Rowe Price caution that the current market narrative, pricing in disinflation and Fed cuts, is vulnerable to oil-induced shocks.

Positioning Dynamics: Short Exposure at the Core

The price action doesn’t reflect fear, but it does reflect fragility. Major institutional portfolios remain underexposed to equities. According to data from Manulife and Schwab, large active managers are significantly short their benchmarks, with many hedge funds maintaining net short exposures. Systematic funds, having reduced risk throughout Q2, are underweight equities by the widest margin since 2022.

That leaves markets highly sensitive to squeezes and reactive flows. Friday’s bounce in oil and slight bid in equities may not reflect conviction, but rather a short-covering reflex. Monday’s open becomes the critical test: if geopolitical risk deepens or oil pushes higher, the pain trade could swing in either direction, either a risk-off cascade from re-leveraged volatility funds or a violent rally if shorts are forced to unwind into low liquidity.

Macro Fundamentals: Mixed, Not Assuring

CPI and PPI both came in below expectations, offering temporary comfort. Core CPI rose just 0.1% MoM and 2.8% YoY, reviving bets on Fed rate cuts later in 2025. FOMC members are likely to stay cautious, however, particularly given the risk of second-round inflation effects from energy. Powell’s upcoming press conference and the Fed’s Summary of Economic Projections will likely reinforce the narrative of “higher for longer with optionality,” keeping duration markets on edge. The market is pricing in a 99% probability the Fed does nothing at this week’s FOMC.

Treasury yields fell through most of the week, but rose Friday as the oil spike unsettled rate expectations. Jamie Dimon’s warning that the U.S. bond market is on track to “crack” under the weight of rising debt should not be dismissed. With the deficit now structurally over $1.5 trillion, and tax policy still used as a blunt political tool, the bond market’s patience is thinning.

Policy and Political Volatility: Structural Risk Rising

Behind the immediate headlines, a more concerning trend is reemerging: the growing influence of erratic policy as a macro variable. Trump’s tariff and trade threats, including a fresh proposal to tax EU goods at 50% and Apple devices at 25%, have reignited fears of supply chain disruptions. His past business tactics, such as his aggressive yet self-defeating maneuvering in the USFL, echo today’s approach to policy: short-term vanity wins and optics at the expense of long-term system coherence.

Markets may not be pricing it yet, but these moves risk undermining global trade architecture and investor confidence. Meanwhile, China’s rare-earth export cap and renewed nationalism further complicate the landscape for U.S. manufacturers and multinationals.

Monday as the Moment of Truth

Markets appear calm on the surface, but they are floating on unstable fundamentals and fragile positioning. Shorts are heavy, benchmark underweights are deep, and sentiment remains skeptical. With geopolitical tension simmering, bond market fragility rising, and oil threatening to re-anchor inflation expectations, Monday’s open will be a litmus test. Will shorts cover? Will funds re-risk? Or will volatility return with a vengeance?

For portfolio and hedge fund managers, the message is clear: stay nimble, manage tail risk, and prepare for binary market moves. The surface may look still—but the undercurrent is anything but.

Markets

U.S. Market Analysis

-

Equity markets finished modestly lower amid heightened geopolitical tensions and cautious Fed commentary, with the S&P 500 down 0.39% for the week.

-

The Nasdaq and mega-cap tech stocks showed resilience, while small-cap and cyclical sectors underperformed amid volatility in rates and oil.

-

Positioning remains light and defensive; large institutional asset managers continue to trail their benchmarks, and hedge fund net exposure is well below historical averages.

-

Monday’s open is being closely watched as a potential inflection point, given persistent short interest and asymmetric risks tied to geopolitical news flow.

Global Market Analysis

-

Global equities held steady despite Israel-Iran missile exchanges, suggesting investors currently view the conflict as localized and contained.

-

European markets outperformed slightly, supported by improving services PMIs and relief from falling inflation.

-

Asian markets were mixed, with Chinese equities supported by continued stimulus measures, though investor sentiment remains fragile amid weak industrial and retail data.

-

Oil-sensitive markets showed some resilience following crude’s rally on fears of Middle East supply disruption.

Economics

U.S. Economic Overview

-

May inflation data showed core CPI and PPI readings below expectations, reinforcing market hopes for a Fed pivot later this year.

-

Jobless claims rose modestly, and consumer sentiment dipped, reflecting cautious household sentiment as inflation moderates but wage growth slows.

-

Treasury yields declined on the week, driven by soft inflation and dovish rate expectations, though they spiked on Friday following an oil-driven risk-off move.

-

The Fed is expected to hold rates steady at the June meeting, with markets now pricing in nearly two 25-basis-point cuts by year-end.

Global Economic Overview

-

Eurozone industrial production rebounded modestly, but weakness in manufacturing continues to weigh on broader economic growth.

-

Japan’s economy shows signs of softening as consumer spending stalls and inflation expectations remain elevated.

-

China imposed rare-earth export restrictions while reporting a contraction in exports, signaling both economic pressure and strategic posturing.

-

Oil price volatility remains a key macro risk, particularly for net importers and emerging markets, with Brent crude nearing $85/barrel.

Week Ahead

Key U.S. & Global Events

-

The FOMC decision and Powell’s press conference will be the central focus, especially regarding the tone on inflation risk and growth outlook.

-

G7 leaders will meet to discuss geopolitical tensions and trade realignment in response to China’s export restrictions and the evolving Middle East conflict.

-

U.S. retail sales and industrial production reports will offer further clarity on economic momentum entering Q3.

-

Monitoring for any escalation in Middle East hostilities or new U.S. tariff announcements will be critical to assessing near-term volatility.

Upcoming Economic Data

-

Tuesday: U.S. Retail Sales (May), NAHB Housing Market Index

-

Wednesday: FOMC Rate Decision, Summary of Economic Projections, Fed Chair Powell press conference

-

Thursday: Jobless Claims, U.S. Housing Starts & Building Permits

-

Friday: Flash PMIs for U.S., Eurozone, and UK

Notable Earnings Reports

-

Few major earnings releases; attention remains on forward guidance from companies in retail, energy, and industrials with high input cost exposure.

-

Oracle and Adobe will report earnings, providing insight into enterprise spending trends and AI monetization.