GBPUSD has been fun to trade this week, with the pair nearing a critical area. What’s next for the pound, and how does it tie in with the DXY?

Get the answers in today’s video:

GBPUSD is approaching my target at 1.3384. I discussed this short idea on Monday and also shared my entry, stop loss, and take profit with VIP members in real time.

There were several factors leading to my short entry earlier in the week. The first was the retest of the 1.3580 range highs. The second factor was the lower high on August 15th, and the third was the break of the August 5th channel support.

We discussed all of this in the VIP Discord on Monday in preparation for the trade. I even commented on Monday how the 1.3529 single print could offer a second chance short opportunity, which played out nicely.

Fast forward to today, and GBPUSD is trading below the 1.3468 key level. I discussed this level in Wednesday’s mid-week outlook ahead of Thursday’s PMI numbers.

This week’s price action presented several chances to get short GBPUSD. However, traders shouldn’t chase, especially as the pound nears the 1.3384 support region.

That’s the single print from the August 7th break and a key level from June. Given the significance of the level, I’m anticipating a bounce from the 1.3384 area.

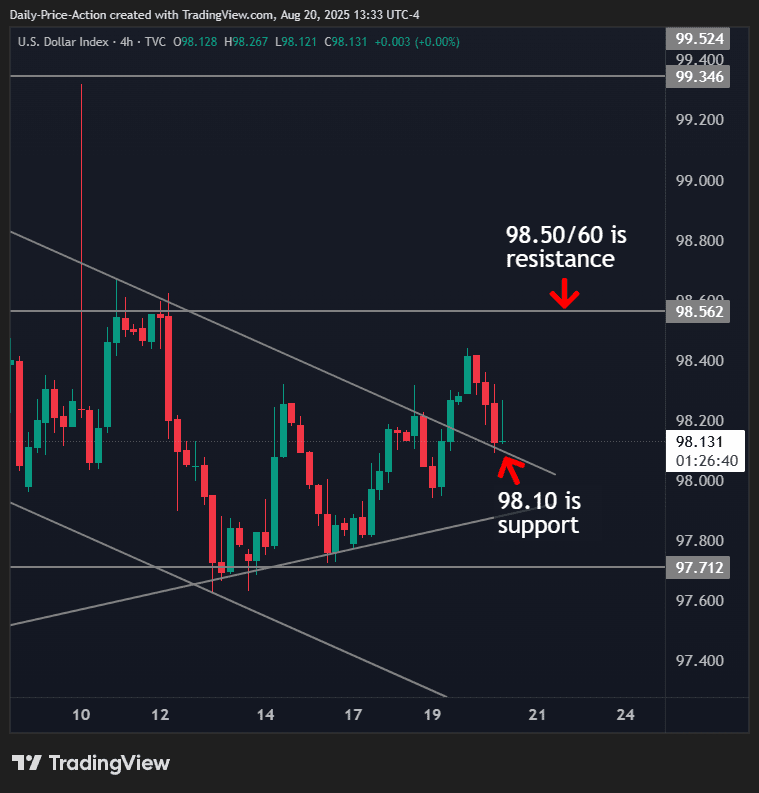

It will be interesting to see where that puts the DXY. Currently, the US dollar is testing key resistance in the 98.50/60 region, so a sustained break above would flip it to new support.

If the DXY breaks 98.60 ahead of a GBPUSD 1.3384 retest, the bounce from the pound sterling might be short-lived.

Either way, I’ll be out of my short trade at 1.3384 for a 3R profit. I will get back in if we see some relief from GBPUSD in the coming days.

Join us in the VIP Discord group for real-time updates on GBPUSD and other markets, which includes VIP-only videos, my trades in real time, and the complete trading course.