- GBP/USD weekly forecast remains bullish amid broad dollar weakness.

- Weaker US data and easing US-China trade tensions support the pound.

- All eyes are on the BoE and FOMC meetings due next week.

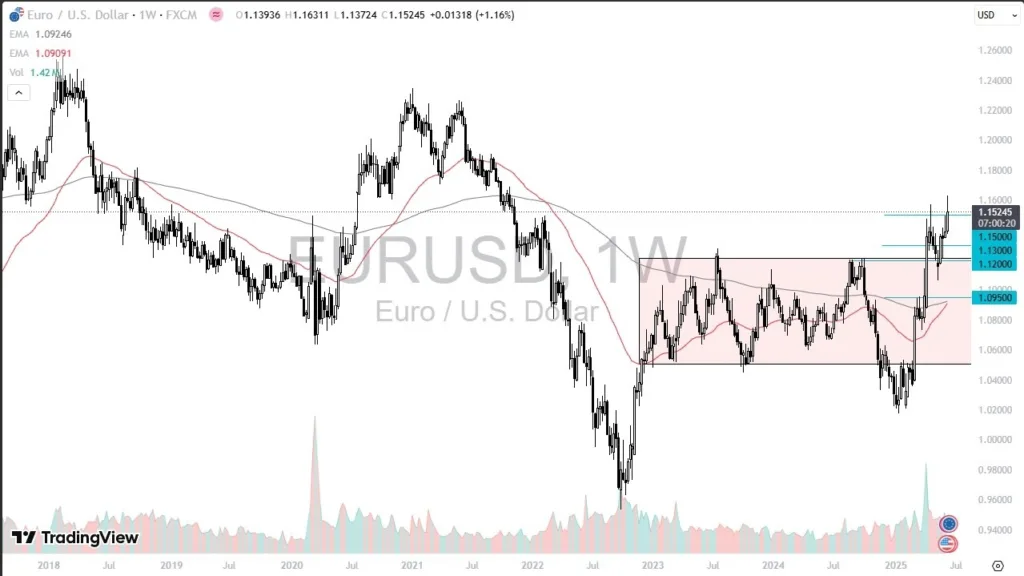

The GBP/USD weekly forecast remains strongly bullish as the pair hits its third consecutive week in gains. The price marked a 39-month top at 1.3635 before pulling back ahead of the weekend.

-If you are interested in forex day trading then have a read of our guide to getting started-

The bullish momentum gained traction after a period of consolidation earlier in the week. The weaker dollar and improved risk sentiment helped the buyers. However, the key catalyst was progress in the US-China trade negotiation, concluded in London with an agreement to ease restrictions on exports, including rare earth metals. Though the announcement had no details, it boosted risk appetite and weighed on the safe-haven Greenback.

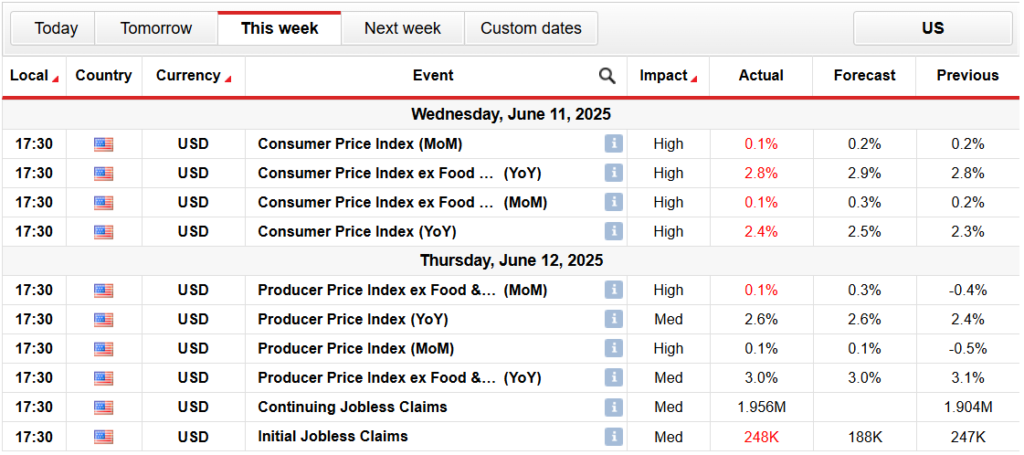

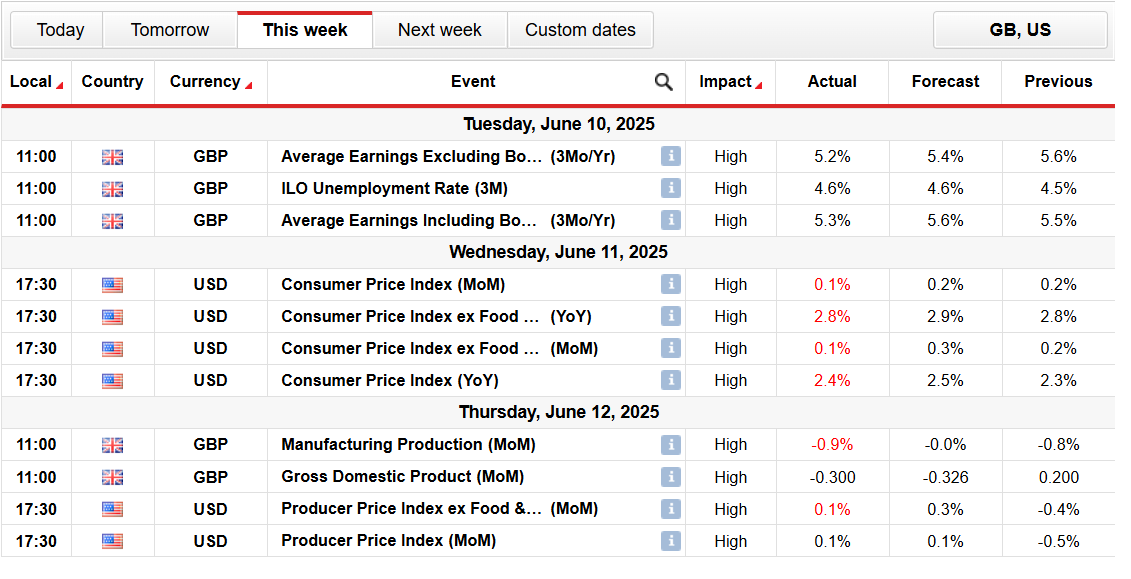

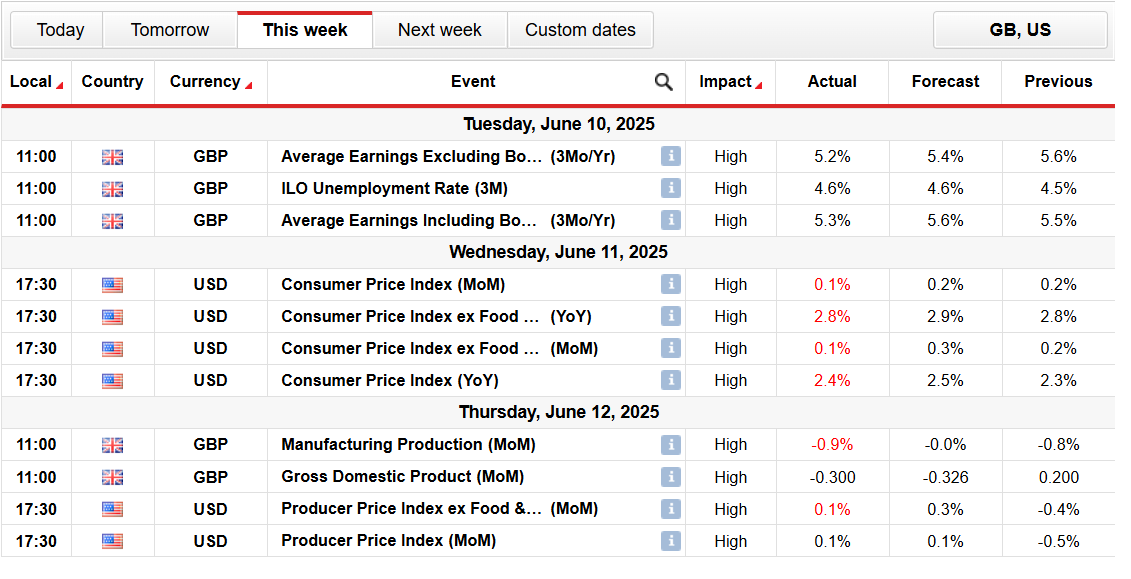

The US inflation data surprised the market to the downside, with a 0.1% rise on a monthly basis, which dragged annual inflation to 2.4%, missing the estimate of 2.5%. The core inflation also remained downbeat, increasing odds for a dovish Fed. This was further fueled by softer US PPI data and rising weekly jobless claims that deepened the USD losses and provided additional strength to the pound.

However, the rally proved to be short-lived. Geopolitical tensions ignited later in the week due to Israel’s attack on Iran, killing Iranian military officials and scientists. Iran responded in retaliation, which escalated the fear of broader conflict.

The safe-haven demand for the US dollar soared on the news that triggered a significant pullback of more than a hundred pips in the GBP/USD pair. The downward pressure was further intensified by the UoM Consumer Sentiment Index that rose to 60.5, well above the expected 53.5.

Major Events for GBP/USD in the Week Ahead

Looking ahead, next week, the market participants will focus on the upcoming central bank meetings. Both the US Federal Reserve and the Bank of England are set to announce their key policy decisions midweek. Consensus suggests no change from either the Fed, which is expected to hold rates at 4.25%-4.50%, or the BoE, which is also expected to hold rates at 4.25%.

Moreover, the US and UK retail sales data, along with UK CPI and US jobless claims, will be important to watch. Meanwhile, geopolitics and the Fed’s further commentary will also shape the outlook.

GBP/USD Weekly Technical Forecast: Bulls Supported by 20-SMA

The daily chart of the GBP/USD suggests a consolidation within a broad uptrend. The Friday pullback remained strongly supported by the 20-day SMA. Meanwhile, a strong support zone also emerges in the 1.3420-60 area. The daily RSI is at 58.00 with a tilt to the downside, which suggests further consolidation.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

On the upside, the resistance lies at 1.3600, which is a round number ahead of 1.3635, which is a fresh 39-month top. Breaking the level may gather enough traction to test 1.3700.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.