- On Thursday of this past week the GBP/USD touched the 1.35900 area before seeing a rush lower and causing the currency pair to go into the weekend around 1.34365.

- The highs reached this past Thursday touched marks seen on the 10th of July, but didn’t come anywhere next to the highs produced on the 1st of July when the 1.37850 ratio was challenged.

- The fall in the GBP/USD which started on Thursday showed velocity, and when the 1.35000 level was penetrated below, the currency pair kept selling.

- The GBP/USD has correlated to the broad Forex market well and will continue to do so. However, what day traders should take note of is that the GBP/USD is showing a slightly higher degree of price velocity compared to some other currencies. Perhaps financial institutions remain nervous about the economic prospects of the U.K under the current government’s leadership.

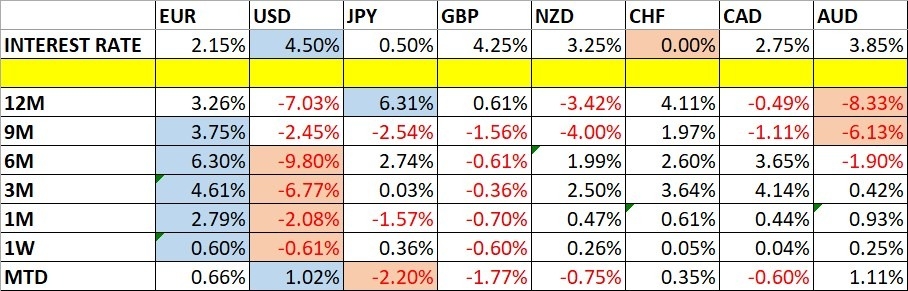

The U.S Federal Reserve will release its FOMC summary this coming Wednesday. The Fed is not expected to cut interest rates this week, but financial institutions have been leaning into the prospect of an interest rate cut by September and lower rates over the mid and long-term. However, uncertainty remains the mantra of the Federal Reserve. And the tariff talks which continue to be heard from the U.S White House is the reason the Fed is staying so cautious. The Fed is worried about the prospect of potential inflation.

While risk taking has been seen in U.S equity indices and the USD has seen weakness continue, cautious signs still exists in the broad marketplace. If the Fed stays uncertain this week about its future actions, the GBP/USD and other major currency pairs may see a shift in sentiment. Perhaps some of the strong selling this past Thursday after near-term highs had been generated again was a reaction to the thought financial institutions had overbought the GBP/USD and other major currencies.

Tomorrow’s opening and trading into Tuesday will be intriguing and a guide regarding the thinking of large traders going into Wednesday’s Fed pronouncements. From a three month and certainly a six month perspective, the GBP/USD has been bought with an optimistic bullish stance. Friday’s return to ratios below the 1.35000 could prove to be cautious positioning. If selling sustains the lower elements of the GBP/USD early this week, this could set up the GBP/USD for a buying reaction if financial institutions get a confirmation of outlook.

- However, the problem for the GBP/USD and other major currencies is that outlook is murky.

- The Fed in some analysts eyes should have cut interest rates a few months ago.

- Interest rates in the U.S remain high. How long can the Fed keep the Federal Funds Rate elevated?

- The risk of U.S inflation is real, but it remains only a risk and not proven yet.

The GBP/USD certainly sold off on Friday which may have caused some bullish speculators to surrender. However, traders should know there are no one way avenues in Forex or other financial assets being wagered on. Reversals are common, because shifts in behavioral sentiment frequently happen. The shadow of the Federal Reserve is real, the potential of tariff effects causing inflation is worrisome. Yet, the GBP/USD has remained within an elevated price range most of its mid-term trading cycle.

If the GBP/USD maintains value above the 1.34000 level this could be a sign that financial institutions remain active in their belief the USD needs to remain within a weaker Forex mode. Traders should be prepared for volatility this week because of the Federal Reserve decision coming and tariff banter from the White House. And there are jobs numbers coming from the U.S on Friday which typically are a centerpiece when trading Forex. However, traders must brace themselves and understand while there will be a lot of news flow in the coming days, a lot of it may just be noise. Speculators need to remain calm and understand dynamic price movement will be seen in the coming days.

Ready to trade our weekly forecast? Check out the best forex trading company in UK worth using.