- The GBP/USD price analysis shows a rebound in the dollar.

- US data revealed another week of declining unemployment claims.

- Data revealed a mixed performance for US business activity.

The GBP/USD price analysis shows a rebound in the dollar as employment figures further lowered expectations for Fed rate cuts. At the same time, market focus turned to the upcoming Fed meeting where Powell might maintain his cautious tone.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

The dollar recovered on Thursday after data revealed another week of declining unemployment claims. Claims fell to 217,000 last week, the second week of declines. Meanwhile, economists had forecasted an increase to 227,000. The drop pointed to continued resilience in the labor market, which might convince the Fed to keep delaying rate cuts.

Meanwhile, a separate report revealed a mixed performance for US business activity. The manufacturing PMI unexpectedly fell from 52.9 to 49.5. Meanwhile, the services PMI unexpectedly increased from 52.9 to 55.2.

At the end of the day, Treasury yields rose and the dollar gained against the pound. Market participants are more convinced the Fed will keep delaying rate cuts. As a result, they expect Powell to keep his cautious tone at the policy meeting next week.

GBP/USD key events today

Market participants do not expect any key economic releases from the UK or the US. Therefore, the pair could extend Thursday’s move.

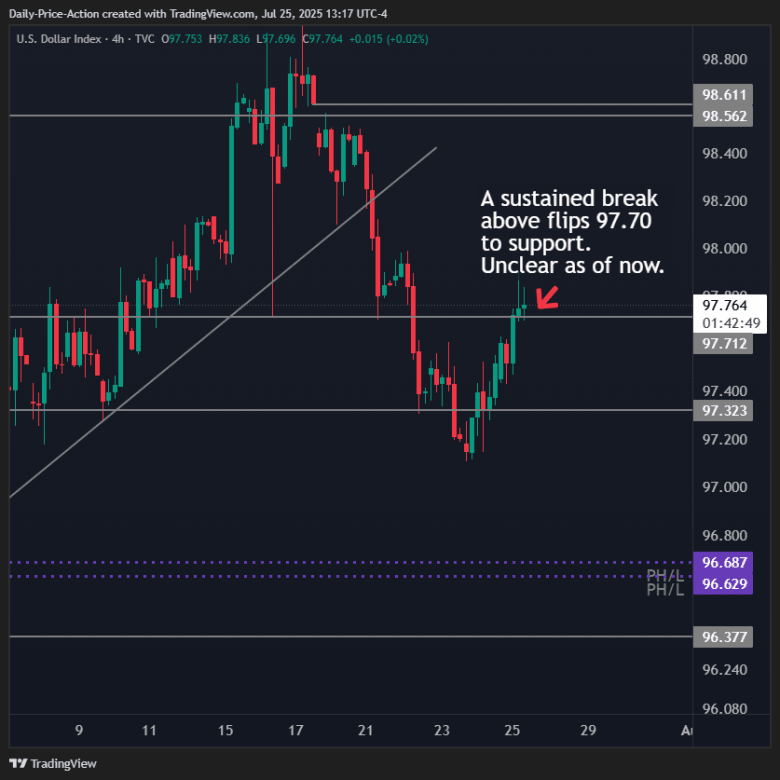

GBP/USD technical price analysis: Bears target the 1.3400 support

On the technical side, the GBP/USD price has broken below the 30-SMA, a sign that bears have taken the lead. At the same time, the RSI has broken below 50, suggesting a stronger bearish bias. Bears took charge when the price met the 0.5 Fib retracement level and bounced lower. The bounce led to a sharp decline that broke below the 30-SMA.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

GBP/USD was initially trading in a strong downtrend before bulls took charge near the 1.3400 support level. They sustained a sharp swing to the 0.5 Fib level. However, they were not strong enough to start a bullish trend with higher highs and lows. Moreover, they were unable to maintain the price above the SMA.

With bears back in the lead, the price will likely drop to retest the 1.3400 support level. A break below this level will confirm a continuation of the previous downtrend. At the same time, it would strengthen the bearish bias.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.