- The GBP/USD price analysis indicates a pause in the pound’s rally.

- Economists expect 130,000 new US jobs in May.

- Dollar weakness this week allowed its peers, like the pound, to climb.

The GBP/USD price analysis indicates a pause in the pound’s rally ahead of the pivotal US nonfarm payrolls report. Market participants are locking in profits ahead of a volatile report. Meanwhile, the pound has had a strong week due to trade optimism and dollar weakness.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

The US will release its monthly employment report, likely showing the impacts of Trump’s tariffs. Economists expect 130,000 new jobs in May. This would be a drop from April, when the country added 177,000 jobs. Meanwhile, the unemployment rate might hold steady at 4.2%. A poor report will increase Fed rate cut expectations, dragging the dollar lower. On the other hand, an upbeat report would be a surprise that would boost the greenback.

The pound has had a strong week as traders cheered the exemption of the UK from the aluminum and steel tariffs. The UK signed a trade deal with the US, keeping it safe from Trump’s aggressive tariffs.

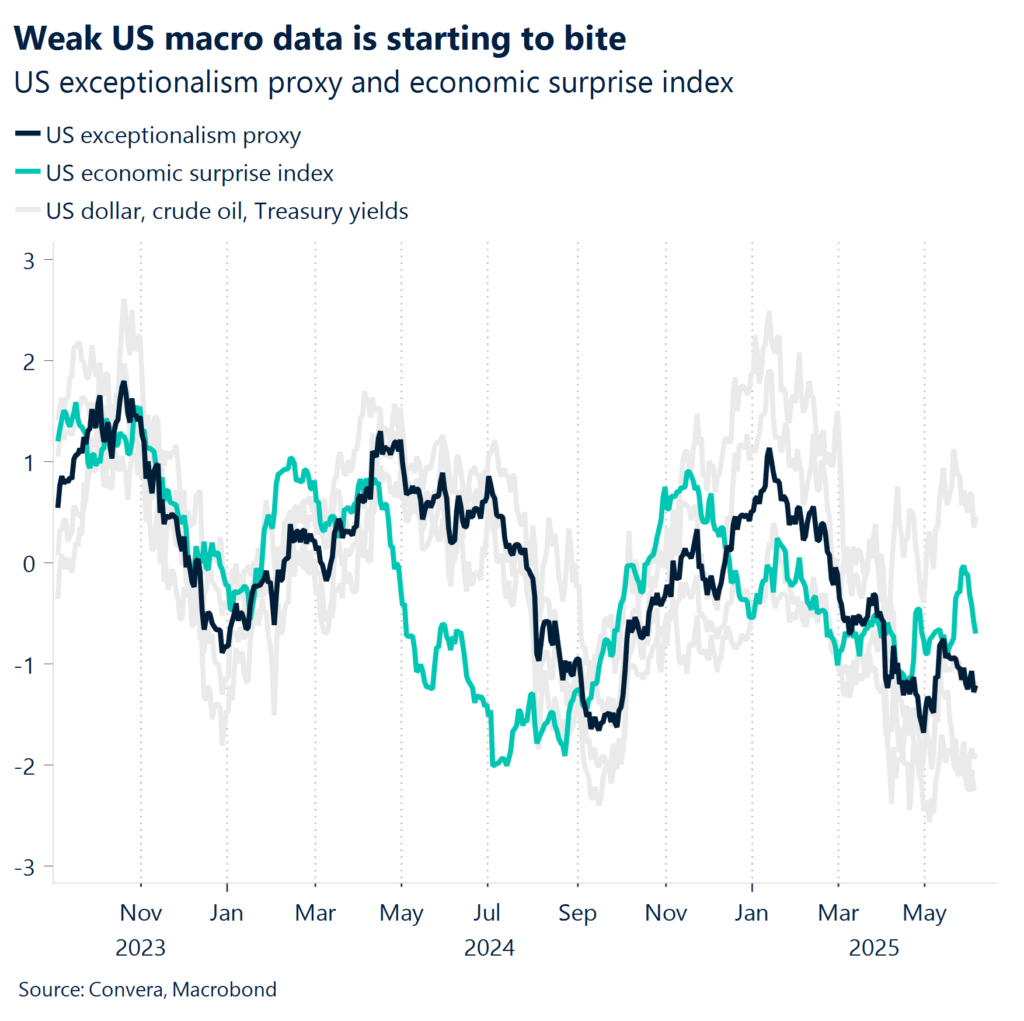

Furthermore, dollar weakness allowed its peers like the pound to climb. The dollar fell after weak employment and business activity data led to a surge in rate cut expectations.

GBP/USD key events today

- US average hourly earnings m/m

- US nonfarm employment change

- US unemployment rate

GBP/USD technical price analysis: Bears test the SMA after RSI divergence

On the technical side, the GBP/USD price is challenging the 30-SMA support after meeting the 1.3603 key resistance level. At this pivotal level, bulls are almost equally matched with bears. Moreover, the RSI trades near 50, indicating almost equal momentum.

–Are you interested to learn more about Australian forex brokers? Check our detailed guide-

Previously, the price was trading in a strong uptrend above the 30-SMA. However, this changed when the price neared the 1.3603 resistance level. Bears gained enough momentum to push the price below the 30-SMA. However, they failed to continue below the 1.3425 key support level. As a result, bulls took back control.

Although the price made a new high, the RSI made a lower one, a sign that momentum had faded. After that, bears made a solid bearish candle that is currently at the SMA. A break below the SMA will allow GBP/USD to retest the 1.3425 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.