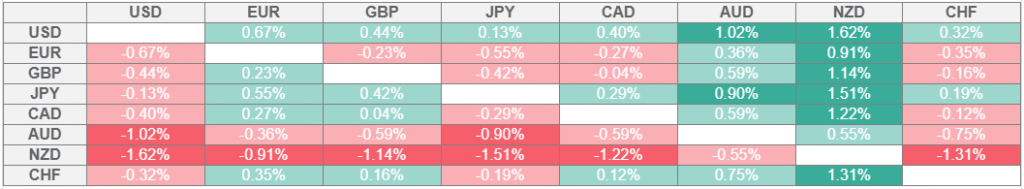

Bullish View

- Buy the GBP/USD pair and set a take-profit at 1.3785.

- Add a stop-loss at 1.3450.

- Timeline: 1-2 days.

Bearish View

- Sell the GBP/USD pair and set a take-profit at 1.3450.

- Add a stop-loss at 1.3785.

The GBP/USD exchange rate continued its recent rally after the US economic data pointed to stagflation and the UK released a surprisingly strong GDP data. It was trading at 1.3552 on Monday, up sharply from this month’s low of 1.3136.

UK Inflation Data Ahead

The GBP/USD exchange rate continued rising after the UK published its jobs and GDP data. A report by the Office of National Statistics (ONS) showed that hiring slowed, even as wage growth continued. UK payrolls dropped for six consecutive months, while vacancies continued their downtrend.

At the same time, wage growth continued, leading to concens that inflation will be stickier for longer than expected. Another report showed that the UK economy grew at a faster pace than expected. It grew by 0.3% in Q2, better than the median estimate of 0.2%, and lower than the 0.7% growth in Q1.

The next key data to watch will be the upcoming UK consumer inflation data on Wednesday. Economists expect the data to show that the headline consumer inflation rose from 3.6% in June to 3.7% in July, while the core figure rose to 3.8%.

These numbers will confirm the view that the economy was in a stagflation period, which is characterized by high inflation and high unemployment rate. Stagflation will make it difficult for the Bank of England (BoE) to deliver its interest rate decision.

The GBP/USD exchange rate rose after US published strong consumer inflation data. The report showed that the headline consumer price index (CPI) remained at 2.7%, while the core CPI moved from 2.8% in June to 3.1%.

GBP/USD Technical Analysis

The 12-hour chart shows that the GBP/USD exchange rate bottomed at 1.3135, forming a double-bottom pattern. It has now crossed the 50-period and 100-period moving averages, which have now formed a bullish crossover.

The MACD indicator has moved above the zero line, while the Relative Strength Index (RSI) has rallied above 50. Therefore, the pair will likely continue rising as bulls target the key resistance at 1.3787, its highest point on July 1.

A move above that level will point to more gains, with the next key level to watch being at 1.3800. A move below the 50-period moving average at 1.3450 will invalidate the bullish forecast.

Ready to trade our free trading signals? We’ve made a list of the best UK forex brokers worth using.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.