Bearish view

- Sell the GBP/USD pair and set a take-profit at 1.3435.

- Add a stop-loss at 1.3700.

- Timeline: 1-2 days.

Bullish view

- Buy the GBP/USD pair and set a take-profit at 1.3700.

- Add a stop-loss at 1.3435.

The GBP/USD exchange rate wavered on Monday morning as traders waited for the upcoming Bank of England (BoE) and Federal Reserve interest rate decisions later this week. The pair was trading at 1.3575, a few points below the year-to-date high of 1.3630.

BoE and Federal Reserve decisions

The GBP/USD pair will be in the spotlight this week as the BoE and the Fed deliver their decisions. It will also be in focus after forming a rising wedge pattern, signaling a potential pullback.

The Federal Reserve will go first on Wednesday, with analysts expecting it to leave interest rates unchanged between 4.25% and 4.50%.

Like in the other monetary policy meetings, the bank’s officials have maintained their wait-and-see approach as they observe the impact of Trump’s tariffs on imported goods.

Data released last week showed that inflation rose slightly in May, a month that the tariffs came into effect. The headline consumer inflation rose from 2.3% in April to 2.4% in May, lower than the median estimate of 2.5%. Core inflation remained at 2.8%.

The bank’s decision comes as it faces substantial pressure to deliver a big interest rate cut. He has called for it to cut by a full point, arguing that high rates were putting the US at a disadvantage.

The other key catalyst for the GBP/USD pair will come out on Wednesday when the Office of National Statistics (ONS) publishes the latest consumer price index (CPI) data. Economists expect the data to reveal that the country’s inflation moderated slightly, but remained above the 2% target in May.

The BoE will then deliver its interest rate decision on Thursday, with most analysts expecting it to leave them unchanged. The general view is that the bank will cut in its August meeting.

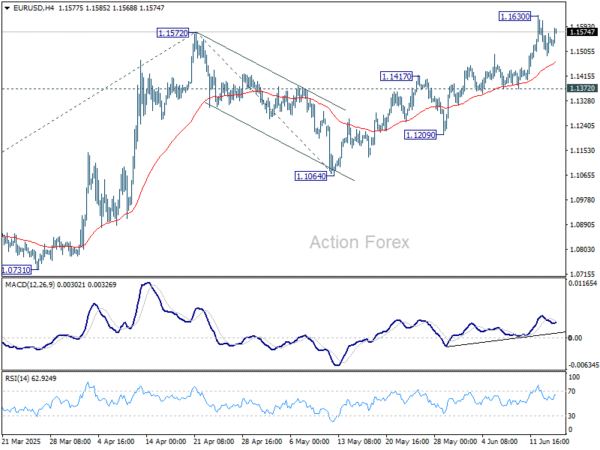

GBP/USD technical analysis

The daily chart shows that the GBP/USD exchange rate has been in a bullish trend in the past few weeks. It moved to a high of 1.3631 last week, much higher than the year-to-date low of 1.2100.

On the positive side, the pair has formed a cup-and-handle pattern, a popular continuation sign. It has also remained above the 50-day and 25-day Exponential Moving Averages (EMA).

The pair has also formed a rising wedge pattern, comprising of two ascending and converging trendlines. This wedge is nearing the confluence level, pointing to a bearish breakdown. The Relative Strength Index (RSI) and the MACD indicators have formed a bearish divergence point.

Therefore, the pair will likely have a bearish breakdown, potentially to the upper side of the cup at 1.3435.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best UK forex brokers in the industry for you.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.