Bearish view

- Sell the GBP/USD pair and set a take-profit at 1.3400.

- Add a stop-loss at 1.3625.

- Timeline: 1-2 days.

Bullish view

- Buy the GBP/USD pair and set a take-profit at 1.3625.

- Add a stop-loss at 1.3400.

The GBP/USD exchange rate attempted to recoup some of the losses made last week following the Federal Reserve interest rate cut. It was trading at 1.3515 on Tuesday morning as traders wait for a statement from Jerome Powell, the Federal Reserve’s Chair.

Jerome Powell Speech Ahead

The GBP/USD exchange rate has pulled back in the past few days following the Bank of England and the Federal Reserve interest rate decisions.

In its decision, the BOE decided to leave interest rates unchanged at 4.0% as officials warned about the country’s inflation, which has remained above the bank’s target of 2.0%.

The bank is concerned about the country’s inflation rate and the impact of more cuts, which would worsen the situation. At the same time, it is concerned about stagflation in the country as recent data showed that the economy was largely stagnant.

Meanwhile, in the United States, the Fed decided to slash interest rates by 0.25 % for the first time this year, with officials signaling that they will be open to more cuts in the next few meetings.

The next important catalyst for the GBP/USD pair will be a statement by Jerome Powell, the bank’s chairman, who will likely talk about the last decision and provide hints on what to expect this year. Powell has changed his tone recently and argued that the labor market was starting to crack.

Other Fed officials like Michele Bowman and Raphael Bostic will also talk and share their opinions on policy. On Monday, Stephen Miran supported more rate cuts, while Beth Hammack warned against more cuts, citing the stable labor market and high inflation.

The GBP/USD exchange rate will also react to the upcoming flash manufacturing and services PMI numbers.

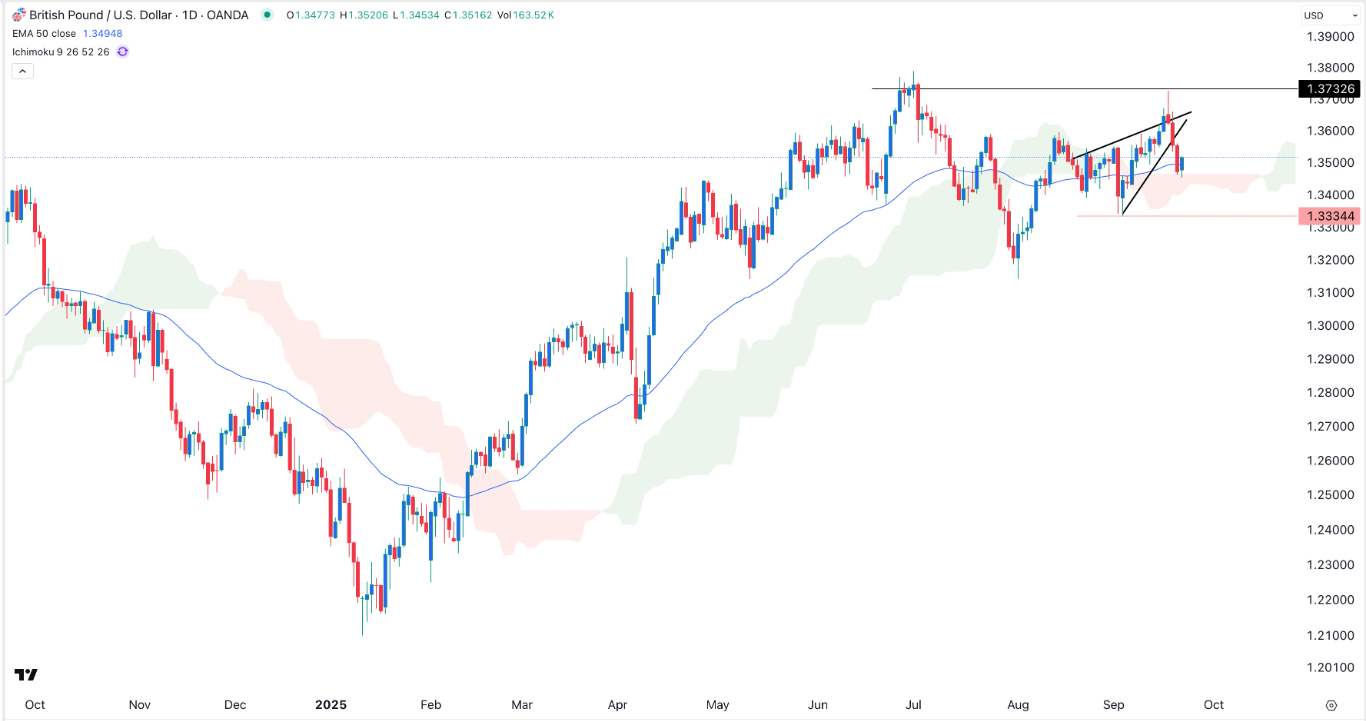

GBP/USD Technical Analysis

The GBP/USD exchange rate has plunged in the past few days as the market reflected on the recent Fed and BoE interest rate decisions. It moved from a high of 1.3732 on September 17 to a low of 1.3462.

The pair then found support at the 50-day Exponential Moving Average (EMA) and the upper side of the Ichimoku cloud indicator.

It remains below the lower side of the ascending wedge pattern, which is a common reversal sign. Therefore, the most likely scenario is where it resumes the downtrend and retests the support at 1.3400.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best UK forex brokers in the industry for you.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.