Bearish view

- Sell the GBP/USD pair and set a take-profit at 1.3250.

- Add a stop-loss at 1.3450.

- Timeline: 1-2 days.

Bullish view

- Buy the GBP/USD pair and set a take-profit at 1.3450.

- Add a stop-loss at 1.3250.

The GBP/USD exchange rate retreated slightly ahead of the upcoming UK inflation data. It moved below the important support level at 1.3400, down from the year-to-date high of 1.3795.

UK Inflation Data Ahead

The GBP/USD pair dropped slightly ahead of the closely-watched UK inflation numbers, which will provide more color on the state of the economy and what to expect from the Bank of England (BoE).

Economists expect the data to confirm that inflation continued rising in September. The headline Consumer Price Index (CPI) is expected to come in at 3.8%, up from the previous 4%. Core inflation is expected to move from 3.6% in August to 3.7% in September.

If these estimates are accurate, it means that consumer prices are moving further away from the Bank of England’s target of 2.0%. It will also confirm further that the UK is in a stagflation period characterized by rising inflation and slow economic growth.

The next important UK news will come out on Friday when the country publishes the latest retail sales numbers. Economists expect the data to show that the country’s retail sales slowed from 0.5% in August to minus 0.2% in September.

These numbers will help the Bank of England when making its interest rate decision next month. Analysts expect the bank to leave rates unchanged as cutting may worsen the inflation situation.

The GBP/USD pair also reacted to the relatively stronger US dollar. Data shows that the US dollar index rose to $99.96, up from the year-to-date low of 96.41. It has risen as traders wait for talks between the US and China. In a statement on Tuesday, Donald Trump said he expected a good meeting with Xi, but tempered expectations, warning that it might not happen.

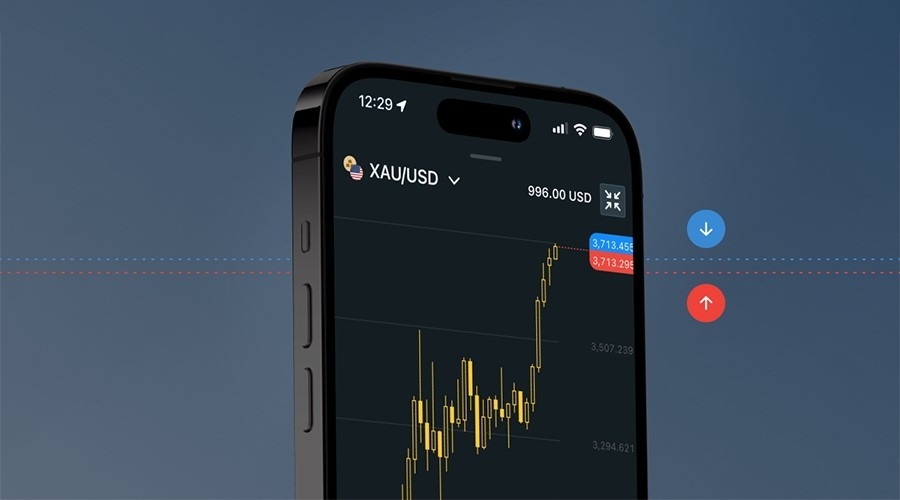

GBP/USD Technical Analysis

The daily timeframe chart shows that the GBP/USD exchange rate has come under pressure in the past few days. It remained below the 50-day Exponential Moving Average (EMA), while the Percentage Price Oscillator (PPO) has moved below the zero line.

The pair has formed a double-top-like pattern whose neckline was at 1.3141, its lowest level in July. Therefore, the most likely scenario is where it continues falling, with the next key support level to watch being at 1.3250. A move above the resistance at 1.3450 will invalidate the bearish outlook.

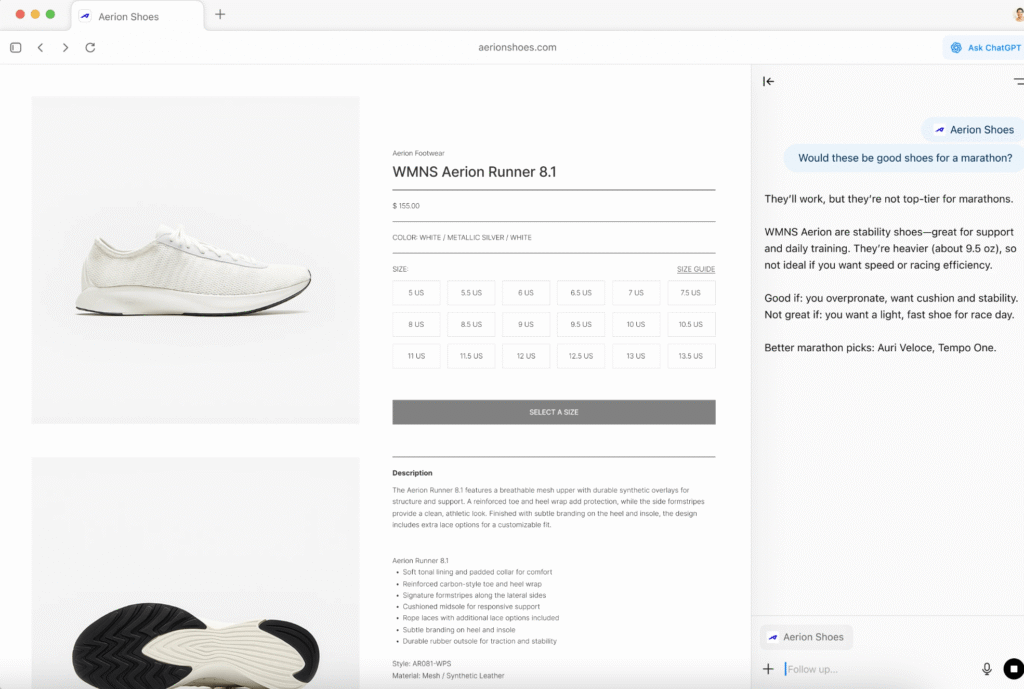

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best UK forex brokers in the industry for you.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.