- The British pound initially tried to rally during the trading session on Thursday, breaking to the 1.35 level.

- The 1.35 level is a large, round, psychologically significant figure, and it area that has been important multiple times.

- By giving up that level, it shows that the British Pound continues to struggle holding onto the gains that so many traders expect, now that the Federal Reserve is likely to be cutting rates multiple times between now and next summer.

Price and Hype

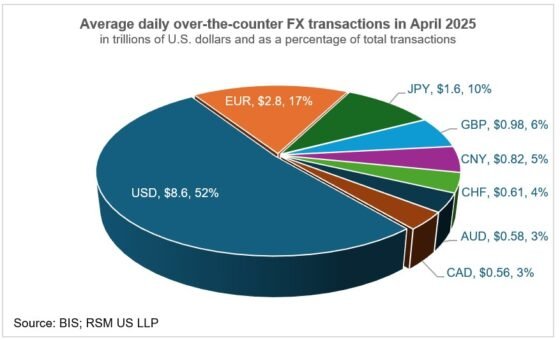

Keep in mind that the only way to make money in the currency markets is to get the direction of prices correct. I’ve been hearing recently that the US dollar is no longer going to be the world’s reserve currency, and that the US dollar is going to start plunging in value. This was mainly due to the fact that the Federal Reserve is going to start cutting interest rates, but it was funny how reality and nonsense collide. While I don’t necessarily think that the US dollar is guaranteed to go higher in value, the reality is that we formed a shooting star on September 17, which coincides with the reaction to the FOMC press conference. In other words, traders are starting to think that the US dollar was oversold for a multitude of reasons.

The first thing of course is the fact that many out there are still buying into this narrative, but the markets seem to be ignoring them and moving in the direction of more of a “risk off market.” Keep in mind when there are issues out there with the global economy, the US dollar tends to be one of the first place people run to, as there is demand for the US Treasury market, which of course takes US dollars. Furthermore, when the US economy stumbles, it’s not exactly like Europe or the United Kingdom avoid that same fate. Ultimately, I’m watching the 1.34 level for a potential breakdown, because if we do break below that level, then it’s possible that we could go looking to the 1.33 level, where the 200 Day EMA is hanging about. On the other hand, if we turn around and break above the 1.35 level on a daily close, then maybe we make another run toward 1.36 level, but it is worth noting that every time we rallied, we tend to fail.

Ready to trade the Forex GBP/USD analysis and predictions? Here are the best forex trading platforms UK to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.