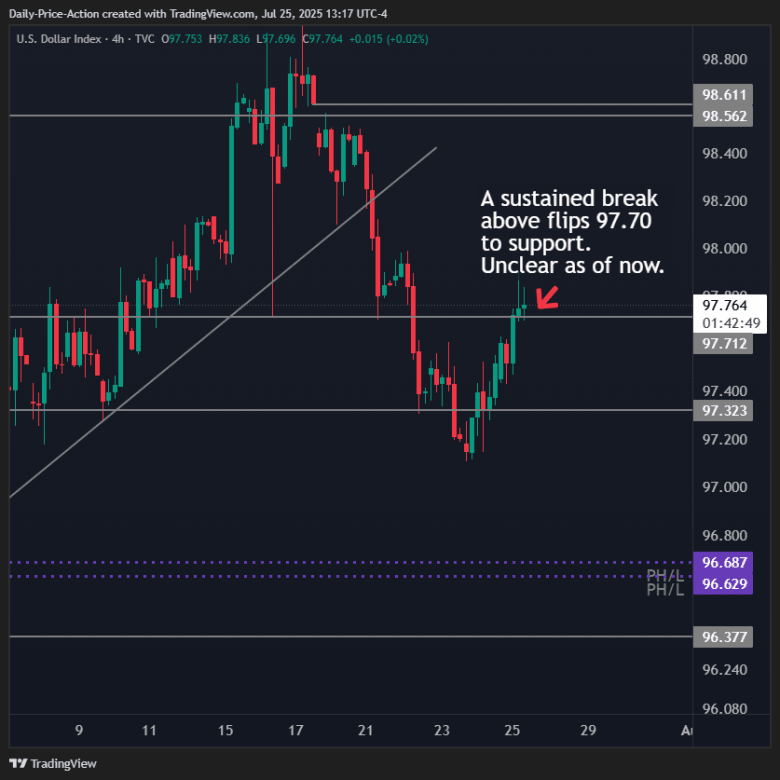

- The US dollar has strengthened a bit against the British pound during the trading session on Thursday, as we have seen strength in the United States overall.

- With this being the case, I look at this chart and recognize that we are still very much in an uptrend, but it would not surprise me at all to see this market go sideways in general, because the British pound has been so bullish for so long.

- The 50 Day EMA is in the neighborhood, offering a little bit of interest, but it’s also worth noting that the 50 Day EMA has flattened out a bit, so we may be getting ready to simply consolidate.

The 1.3350 level underneath is support, but we also have an uptrend line between here and there that could come into the picture. If we break down below the uptrend line, I don’t initially think that’s a signal to start selling yet, and it would take a breakdown on the daily chart below the 1.3350 level to start shorting. It is very possible that we could just simply go sideways, drifting through the trendline, which is a sign that the market might be trying to work off some of the froth, or at least sort out where it wants to go next.

British Pound Outperforms

Over the last year or so, despite the fact that it did fall against the US dollar, it’s worth noting that the British pound had outperformed most other currencies. Because of this, if we do see the British pound start to struggle against the US dollar with any type of repetitive behavior, then I’m going to be looking to buy the US dollar against most other currencies, not just here.

Ultimately, this is a market that could be a bit of a harbinger as to what happens with the greenback, as you are measuring the US dollar against such a strong currency. That being said, if we break above the 1.36 level then I see nothing to keep this market from going to the 1.3750 level as well.

Ready to trade our daily Forex GBP/USD analysis? We’ve made this UK forex brokers list for you to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.