In 2020, MicroStrategy (now doing business as Strategy) and its co-founder Michael Saylor embarked on a novel concept. They began using the company’s capital to buy Bitcoin, the world’s largest cryptocurrency.

Saylor believed that the token’s finite supply could make it a hedge against inflation and, therefore, a smart investment. Saylor’s bet would pay off far better than anyone could have imagined. MicroStrategy stock has rocketed roughly 2,970% (as of June 9) since the company’s first Bitcoin purchase, and the company gained enough credibility that it could raise fresh capital from the capital markets to go out and buy Bitcoin. The company now owns over 2.5% of all outstanding Bitcoin tokens and refers to itself as a Bitcoin treasury company.

Seeing the company’s success, as well as Bitcoin’s continued appreciation, other companies are now taking a page from MicroStrategy’s playbook. The struggling video game retailer GameStop (GME 0.14%), which saw its share price explode during the meme stock craze in 2020 and 2021, recently made a big purchase of Bitcoin too. Can this strategy save the struggling stock?

GameStop’s wild ride

It’s been a long and chaotic journey for GameStop, the brick-and-mortar giant of the video game universe. As foot traffic declined in malls and digital video game purchases became more common, GameStop stock struggled, leading many institutional investors to make big short bets against the stock.

Image source: Getty Images.

In 2019, legendary investor Michael Burry, who correctly bet against the housing market right before the Great Recession, took a sizable position in GameStop, believing that shares were undervalued. Still, short interest continued to climb, at one point reaching over 63% of outstanding shares. Once the pandemic hit, essentially closing the economy for months and making the outlook for retail even more negative, it looked like the stock could be doomed.

However, the emergence of viral YouTubers like Keith Gill (Roaring Kitty) and the popular Reddit subgroup WallStreetBets encouraged retail investors to load up on the stock. This group of investors also refused to sell the stock, in order to create the mother of all short squeezes. From a low of $3.97 per share in 2019, GameStop soared to close to $500 per share at one point before Robinhood and other online brokerages suspended the ability to buy shares in what would lead to a controversial series of events. GameStop stock has remained volatile, although the company’s market cap remains over $13 billion.

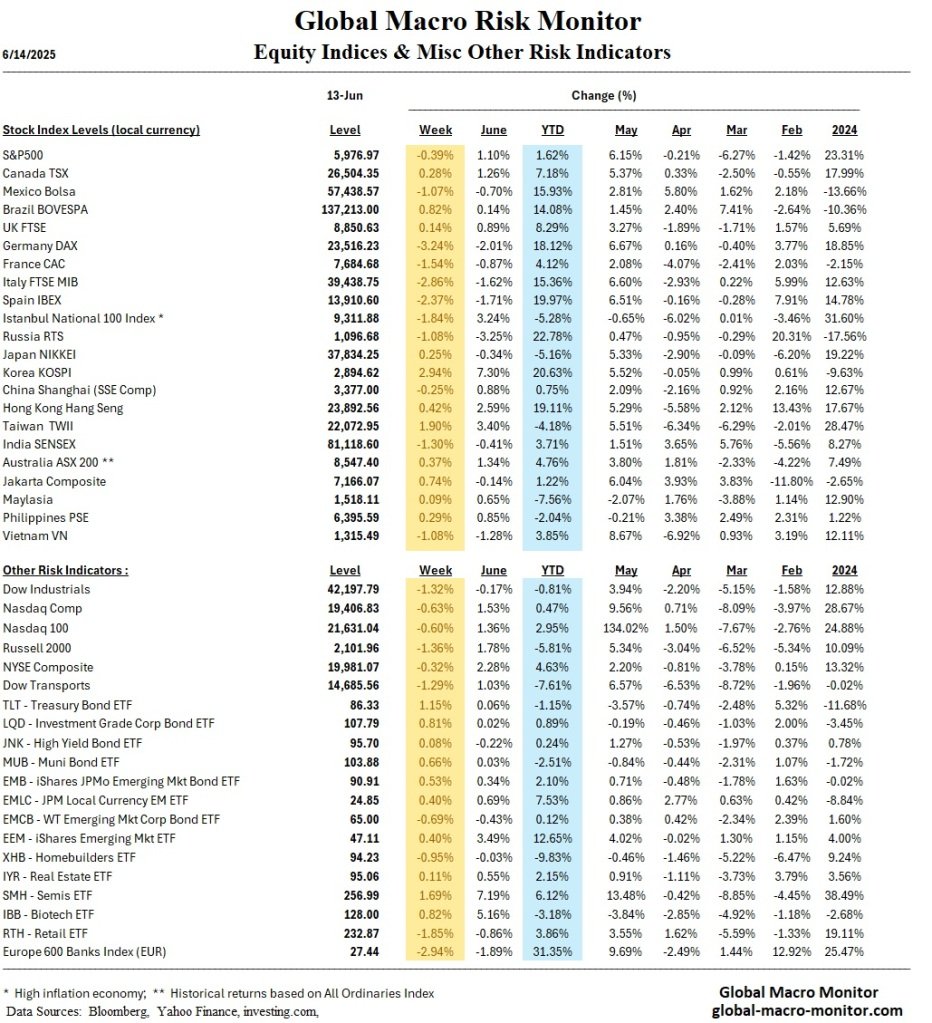

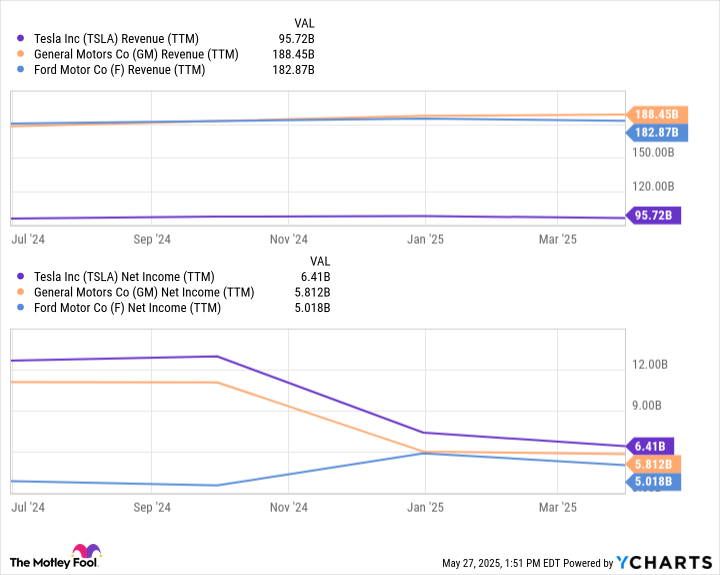

Data by YCharts.

Today, Ryan Cohen, the co-founder of Chewy and formerly an activist investor in GameStop, is now CEO, but the core business is still struggling to find direction. GameStop managed to report a profitable year in fiscal 2024 as management slashed expenses and tried launching into some more modern businesses. However, net sales fell roughly 27.5% for the year.

In the company’s recently reported fiscal 2025 first quarter, GameStop generated nearly $45 million of net income, a significant improvement from the $32 million loss it reported a year ago. However, revenue fell 16.9%, and the improvement largely came from lowering expenses.

Can buying Bitcoin save the company?

In March, GameStop announced it would raise $1.3 billion in capital through convertible senior notes in order to purchase Bitcoin. The company made its first $500 million-plus purchase of Bitcoin at the end of May. Cohen attributed the company’s decision to start buying Bitcoin to broader economic risks in the prevailing market.

“If the thesis is correct, Bitcoin and gold as well can be a hedge against global currency devaluation and systemic risk,” Cohen said at a Bitcoin conference in Las Vegas earlier this year. “Bitcoin has certain unique advantages compared to gold, the portability aspect of it. It’s instantly transferable across the globe. […] It’s instantly verified via the blockchain. […] There’s the scarcity element of it as well.”

Analysts have been skeptical about whether this strategy can really work, and GameStop still seems to be at least somewhat propped up by meme traders. Wedbush analyst Michael Pachter recently issued a research note assigning GameStop an underperform rating, primarily due to a “baffling” valuation gap between GameStop and MicroStrategy. While MicroStrategy trades at roughly 1.8 times the value of the Bitcoin it owns, GameStop trades at roughly 2.4 times its cash value.

The purchase of Bitcoin does not make GameStop a buy. The core business, while having made some improvements, does not appear to have a clear or sustainable long-term strategy.

Sure, if GameStop keeps buying Bitcoin and its price keeps rising, then the stock may continue to move higher. But now, what was already an extremely volatile stock to begin with is essentially becoming a levered play on Bitcoin. This is far too risky a name for retail investors to own when they can always purchase Bitcoin themselves or a spot exchange-traded fund instead of GameStop.