Written by the Market Insights Team

U.S. expands trade agreements amid global market rally

Kevin Ford – FX & Macro Strategist

Global equity markets rallied yesterday following the announcement of a U.S.–Japan trade agreement, which joins recently finalized deals with the U.K., China, and Vietnam. The Japan deal is being positioned as a “win-win,” reducing tariffs on Japanese imports, including automobiles, to 15%, down from previously threatened levels exceeding 25%. In return, Japan will purchase U.S.-made aircraft and rice and commit to a $550 billion sovereign wealth fund that will invest in the United States under the direction of President Trump.

Attention is now shifting to ongoing negotiations with the EU, Canada, Mexico, and South Korea.

It seems the EU and U.S. are close to finalizing an agreement that would impose 15% tariffs on European imports, mirroring the terms of the Japan deal. Brussels is considering the offer to avoid a potential increase to 30% tariffs by August 1. Select goods, including aircraft, spirits, and medical devices, may be exempt. EU exporters have been facing an additional 10% duty since April, on top of average existing tariffs of 4.8%. If implemented, the deal would lock in current rates, with car tariffs dropping from 27.5% to 15 %.

Should talks fall through, the EU is preparing a €93 billion countermeasure package, which could impose retaliatory tariffs of up to 30%.

The impact on FX has been largely muted. The Canadian dollar made modest gains against the US dollar, without any major macro catalyst and no evident progress on trade talks. For Canada, the situation remains unclear. However, the CUSMA trade agreement appears to be providing some insulation, helping to keep regional markets relatively stable.

Dollar retreats despite trade deals

George Vessey – Lead FX & Macro Strategist

US President Trump’s newly announced trade agreements with Japan and the Philippines are beginning to sketch out the contours of a reworked tariff regime across Asia. The headline deal with Japan sets a 15% tariff rate on imports — including autos, which account for over a quarter of Japan’s exports to the US and represent the bulk of the bilateral trade imbalance.

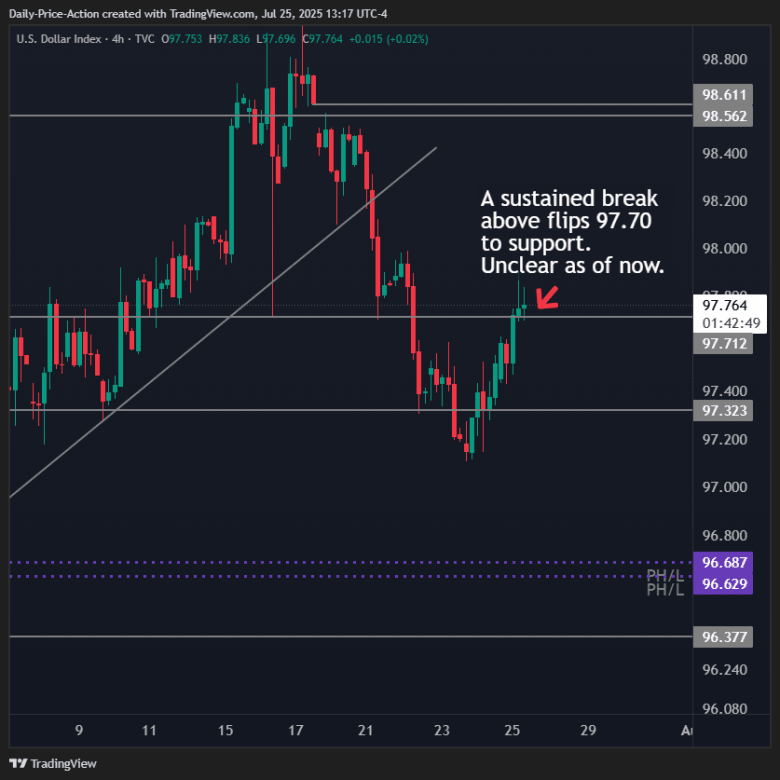

While the Japan deal has eased immediate trade fears, it hasn’t reversed the dollar’s recent softness – the US dollar index dropped for a fourth session running – a reflection of broader uncertainty around Fed policy and independence, global growth, and the durability of these tariff truces.

The Japan deal also raises hopes for the European Union, which is in the final stages of its own negotiations with Washington. EU officials are reportedly preparing to accept a 15% tariff to avoid the threatened 30% rate set to kick in next week.

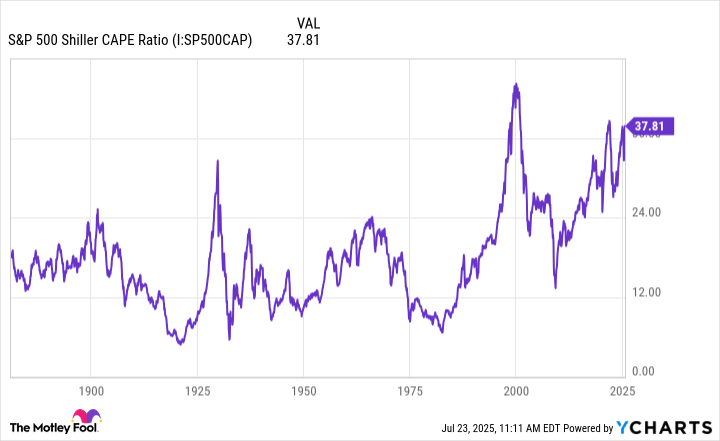

Taken together, these developments mark a shift toward greater predictability after months of tariff brinkmanship that saw rates spike to 145% on China and nearly 50% on smaller Asian exporters. Markets welcomed the news: Asian equities posted their strongest rally in a month, led by Japanese automakers, with the Nikkei surging over 3.5%, whilst the benchmark US equity index closed at yet another record high.

To reiterate, despite the positive headlines, the US dollar failed to rally meaningfully. The dollar index slipped to a two-week low near 97.34, as traders viewed the tariff relief as already priced in and remained cautious amid narrowing rate differentials. The yen briefly strengthened on speculation the Bank of Japan may tighten policy, while the euro, pound and Aussie dollar gained on improved risk sentiment.

Overall FX volatility has been rather subdued of late, but beneath the surface, the lull may be deceptive — a classic calm before the August storm. President Trump’s looming tariff deadlines align with a seasonal spike in FX turbulence: August is historically the peak month for JPMorgan’s Global FX Volatility Index, and volatility tends to ramp up in the back half of the year. With market positioning stretched and geopolitical nerves fraying, a fresh round of turmoil could be just around the corner.

ECB’s message matters more

George Vessey – Lead FX & Macro Strategist

Today’s European Central Bank (ECB) meeting is expected to be a summer pause, not a policy pivot. After eight rate cuts since mid-2024, the deposit rate sits at 2.00%, right in the middle of the ECB’s neutral range. With inflation hovering near the 2% target and no new staff projections due until September, policymakers are widely expected to hold rates steady.

The key focus will be on forward guidance. ECB President Christine Lagarde is likely to reiterate that policy is in a “good place” and that decisions will remain data-dependent and meeting-by-meeting. However, the tone may tilt dovish given rising disinflation risks, a stronger euro, and uncertainty around US-EU trade negotiations.

Markets are split on the next move: a September rate cut is seen as increasingly likely, especially if trade tensions escalate or inflation undershoots. The ECB’s own projections show inflation dipping to 1.6% in 2026, below target. Adding pressure to the disinflation narrative is the strength of the euro.

The euro has rallied about 14% year-to-date versus the dollar, peaking near $1.18, and traders are watching for any signal that the ECB is uncomfortable with its strength. If Lagarde hints at concern over FX levels or trade risks, EUR/USD could pull back. But if the ECB strikes a more hawkish tone or downplays tariff threats, the euro may extend gains toward $1.20.

In short, expect a quiet decision, but a lively press conference. This partially explains why EUR/USD volatility is the lowest this year into a policy meeting.

EUR/GBP dips amid tariff relief

Antonio Ruggiero – FX & Macro Strategist

Sterling is showing signs of firming against the dollar, emerging above the 50-day moving average and closing higher than yesterday. Today’s price action is building more structure above that level. Although the pair remains below the 21-day average, these moves are encouraging and suggest the potential for further upside.

Meanwhile, EUR/GBP declined yesterday, after pairing back some gains following announcements that the EU and the U.S. have made substantial progress on a trade deal.

The decline began as a trade deal with Japan was announced late Tuesday, and it can be viewed from two angles; both tied to the same announcement and complementing one another. On one hand, the U.S.-Japan agreement adds pressure to the EU, which still lacks a concrete deal—highlighting its relative lag and weighing on the euro. Sterling, in contrast, is better protected, having secured a deal already. On the other hand, the deal reignited hopes for more agreements with key partners. Earlier in the week, we saw the euro rallying on built-up anxiety around stalled trade talks. But now, with deals beginning to materialize, it’s not surprising to see some of those gains unwind.

Even so, EUR/GBP remains comfortably above its moving averages, with technical indicators pointing to continued bullish momentum. At this stage, the euro continues to be the main beneficiary from U.S. developments, more so than the pound.

Risk appetite swells, equities surge

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: July 21-25

All times are in ET

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.