Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

CPI, Fed in focus

Financial markets were in wait-and-see mode overnight with market moves muted ahead of today’s Australian inflation numbers and the overnight interest rate decision from the US Federal Reserve.

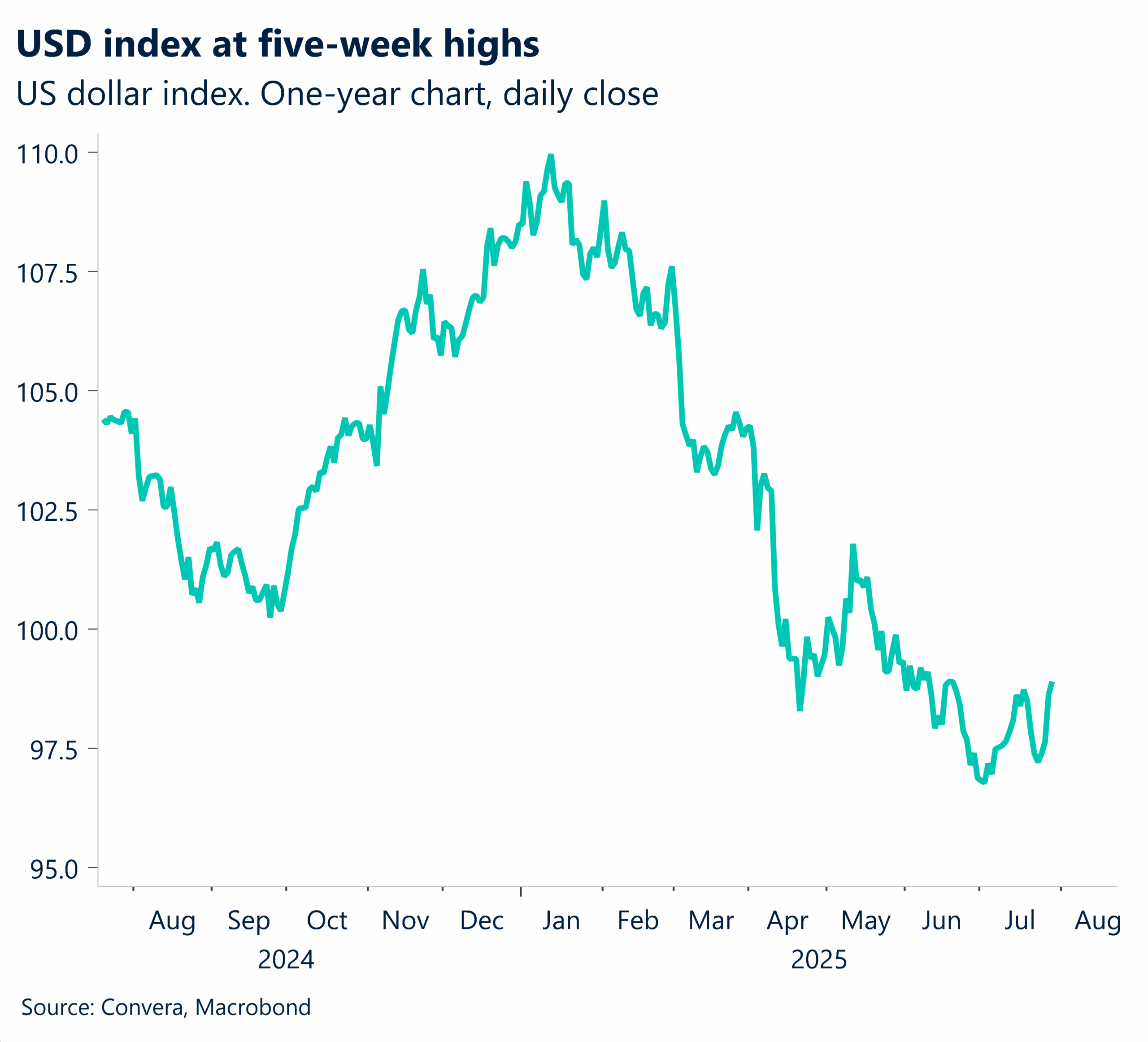

US shares eased while the US dollar was mostly higher with the USD index up for the fourth straight session as the greenback index hit a five-week high.

The AUD/USD and NZD/USD both fell 0.2%.

The USD/CNH gained 0.1% while USD/SGD gained 0.%.

Today, Australian quarterly inflation will be key ahead of the 12 August meeting at the Reserve Bank of Australia. The headline number is expected to fall from 0.9% to 0.8% in the June-quarter according to Bloomberg estimates while the annual rate is forecast to fall from 2.4% to 2.2%.

The trimmed mean, most closely watched by the RBA, is forecast to fall from 2.9% to 2.7% for the year. The numbers are due at 11.30am AEST.

Overnight, the Fed decision is due at 4.00am with markets seeing only a 3.0% chance of an interest rate cut. The market sees a 66% chance of a cut in September, however.

Aussie weaker as Trump pushes global tariff spike

Ahead of Friday’s tariff deadline, President Donald Trump signaled this week that most US trade partners without individual deals will soon face tariffs of 15–20%.

This follows his earlier blanket 10% rate announced in April. He said the new ‘global tariff’ would be rolled out to nearly 200 countries.

Starting Friday, some nations—including Brazil—have already been hit with rates as high as 50%. Meanwhile, talks with India, Pakistan, Canada, and Thailand are still ongoing, as they seek reduced terms with Washington.

Currency markets aren’t standing still. Expect higher volatility in the coming weeks.

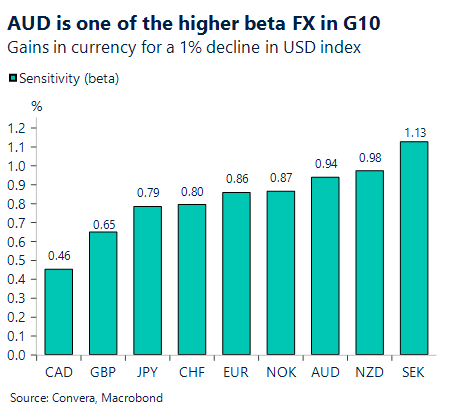

Looking at high beta AUD/USD, the pair has pulled back after hitting recent eight-month highs.

It’s now hovering just above its 50-day EMA at 0.6506. If downward pressure builds, the next key support sits at the 100-day EMA mark of 0.6461.

USD/SGD edges higher as US softens export stance with China

The US has hit pause on technology export restrictions to China in a bid to keep trade talks on track, and to help pave the way for a meeting between President Donald Trump and China’s Xi Jinping later this year, according to the Financial Times.

FT also noted that Washington has yet to approve export licenses for H20.

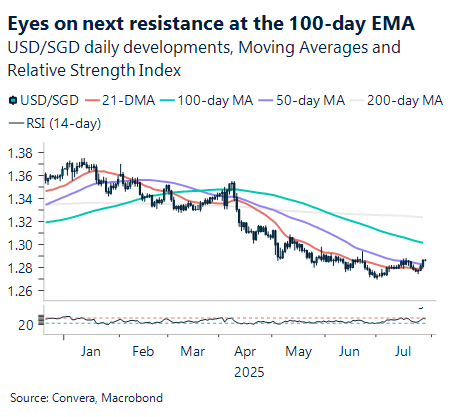

In APAC currency moves, USD/SGD nudged the 50-day EMA at 1.2863.

As we’ve highlighted before, this could be an opportune moment for USD buyers.

Eyes now turn to the next resistance level at the 100-day EMA mark of 1.2979.

USD higher for fourth day

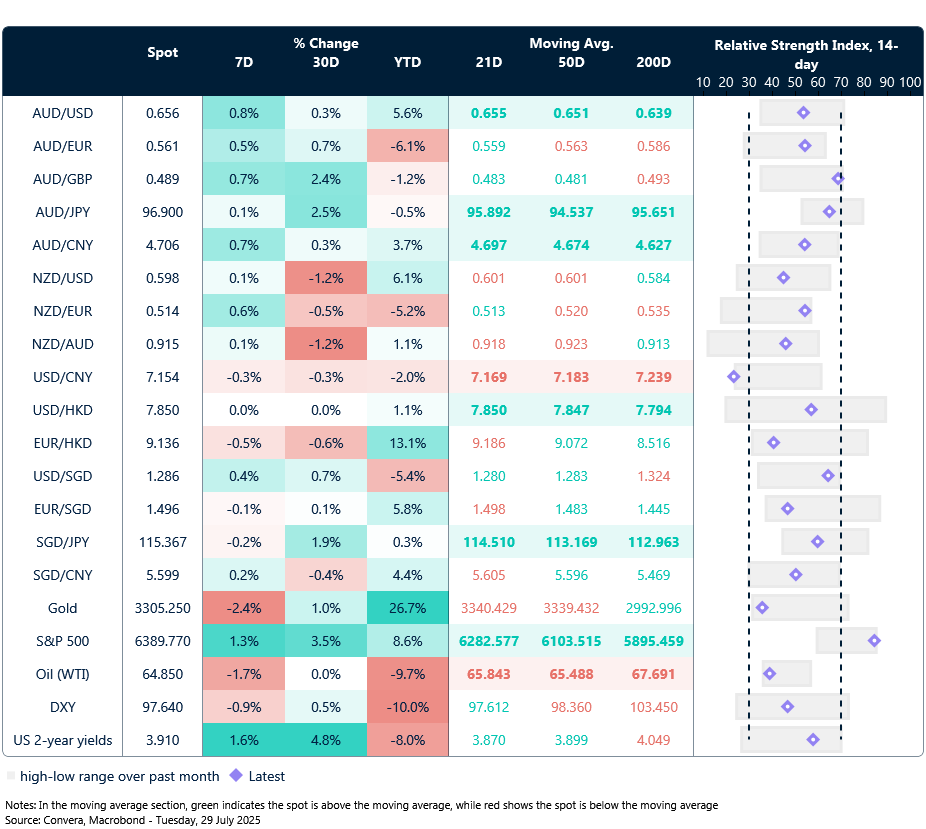

Table: seven-day rolling currency trends and trading ranges

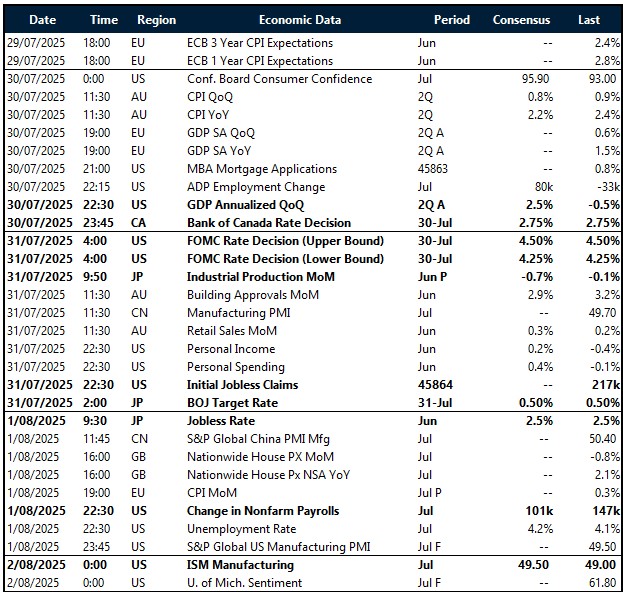

Key global risk events

Calendar: 28 July – 2 August

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.