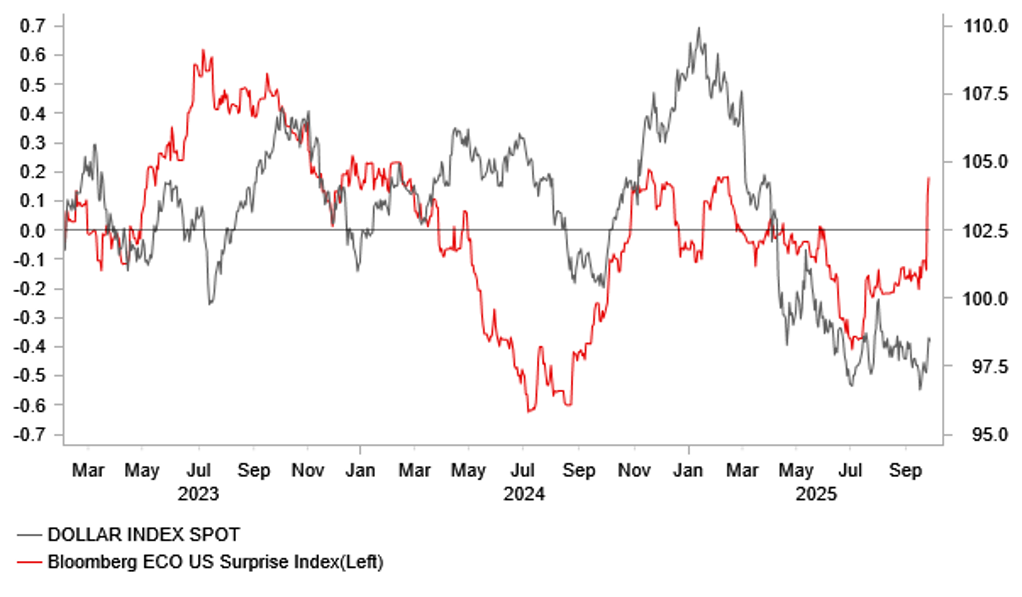

It’s been some time since US data has surprised to the upside and driven both yields and the US dollar higher but the data yesterday and on Wednesday certainly did surprise to the upside and given positioning has been so skewed of late toward weakening economic data in the US we have seen a notable rebound for the dollar just when volatility is hitting new lows in FX and bonds. The Bloomberg Economic Surprise Index below highlights the scale of upside surprise and the data certainly adds to the importance of the labour market data next week. Further strength in labour market data would add to the surprise and likely see a further position squeeze in FX. The second chart below shows the CFTC non-commercial US dollar positioning, which in the latest week revealed the biggest dollar short position since early 2021.

We would be surprised to see a sudden turnaround in the labour market and after the scale of weakness reported in recent weeks, including the near-1mn benchmark downward revision, it is unlikely we will see a turnaround when you consider that the monetary stance in the US remains restrictive. But from month to month of course it is difficult to predict NFP data and following the upside surprises this week any positive data next week would certainly reinforce the current positive momentum for the dollar. Short-term risks have certainly shifted following the data-driven rebound of the dollar with the dollar highs from the start of August in sight.

While an argument can be made that the revised GDP data relates to backward looking performance as far back as Q2, the initial claims data is more telling in that it points to evidence that the labour market is not deteriorating markedly and while labour demand has clearly weakened, there remains limited evidence of a pick-up in firing. A jump in Texas claims due to fraud that previously lifted claims reversed but still only accounted for half the drop. Initial claims now are at the lowest level in two months. The durable goods orders data also points to activity holding up, possibly helped by easing uncertainty related to trade.

If the labour market data was to prove better than expected next week, it would certainly undermine the primary argument put forward by Fed Chair Powell to cut rates further and force the Fed to give more weight to the upside inflation risks. We should now expect FX and rates to be much more sensitive to incoming labour market data next week. Market pricing now implies an 80% probability of a cut in October and 80% probability of two cuts this year. Stephen Miran yesterday again called for faster rate cuts given policy is “excessively restrictive” but he could be further isolated if we see more data like we saw yesterday and Wednesday (new home sales +20% MoM). If the market was to remove one of the two cuts for this year from market pricing, we could well see EUR/USD drift further lower to 1.15-1.16 area (based on an assumed EU-US spread move). Still, a sustained rebound in activity still seems unlikely to us and hence we see limited scope for dollar gains to extend beyond a further 1%-2% from here.

US ECONOMIC SURPRISE INDEX HAS SURGED – WILL USD FOLLOW

Source: Bloomberg, Macrobond & MUFG GMR

![President Lee Jae Myung, third from left, claps after ringing the opening bell at the New York Stock Exchange in New York on Sept. 25. [YONHAP]](https://koala-by.com/wp-content/uploads/2025/09/06215569-0f32-4307-9b84-50a96876e239.jpg)