U.S. Financial Futures Signal Cautious Optimism Ahead of Monday Market Open – June 30, 2025

(STL.News) As Wall Street prepares to ring in the final trading day of June, U.S. financial futures are pointing to a cautiously optimistic start. The early hours of Monday, June 30, 2025, indicate a mixed but slightly upward bias in equity index futures, suggesting that investors may be eyeing a stable or modestly positive open when the cash markets begin trading.

With several economic indicators and corporate earnings reports expected later this week, traders appear to be balancing upbeat sentiment from cooling inflation data against lingering geopolitical tensions and uncertainty over the Federal Reserve’s next moves.

Futures Show Upward Momentum Amid Mixed Global Cues

As of 6:00 a.m. ET, Dow Jones Industrial Average futures were up approximately 80 points, or 0.21%. S&P 500 futures added 0.17%, while Nasdaq 100 futures rose 0.25%, suggesting a modestly positive start to the session.

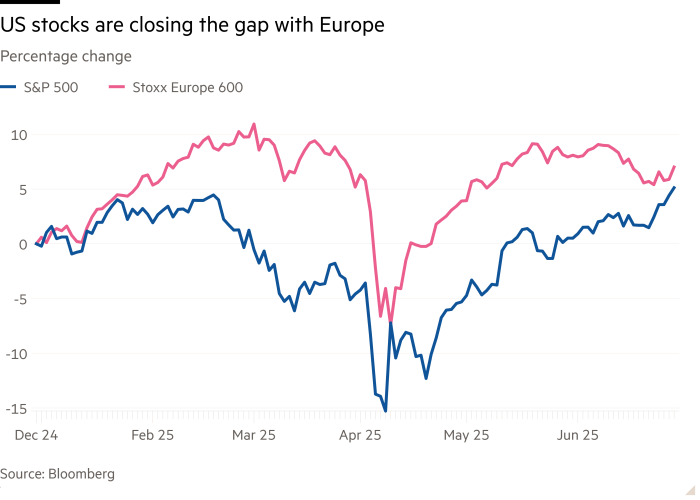

This upward movement follows last week’s flat-to-slightly-negative finish, where major indexes pulled back from recent highs amid light trading volumes and sector rotation. The Nasdaq remains the strongest performer year-to-date, thanks to persistent demand in tech and AI-linked stocks.

Asian markets closed mixed overnight, while European equities opened in the green as investors digested lower-than-expected German inflation numbers. Traders are watching closely to see if European Central Bank and Federal Reserve officials maintain their hawkish tone, despite evidence of easing inflation.

Key Drivers: Economic Data, Fed Watch, and Quarter-End Rebalancing

Several forces are influencing futures direction this morning, including anticipation of economic data releases, the end of Q2 portfolio rebalancing, and ongoing speculation about Federal Reserve policy.

This week will feature a full calendar of economic reports, starting with today’s Chicago PMI and the Dallas Fed Manufacturing Index. Later in the week, investors will scrutinize June’s ISM Manufacturing and Services data, JOLTS job openings, and—most critically—Friday’s Nonfarm Payrolls report.

“The market is still highly data-dependent,” said Laura Simmons, a senior strategist at WestBridge Capital. “Until we get clarity from the labor market and inflation metrics, futures will remain sensitive to even minor surprises in macro data.”

Meanwhile, Fed Chair Jerome Powell and other central bank officials are scheduled to speak this week, which could inject volatility depending on their tone. Futures traders have currently priced in a 75% probability of a Fed rate cut in September, according to CME’s FedWatch tool. However, a surprise hawkish comment could rattle that confidence.

Corporate Outlook: Earnings Season on the Horizon

With Q2 earnings season just two weeks away, traders are positioning themselves based on early corporate guidance and sector performance. Big banks will begin reporting in mid-July, including JPMorgan Chase, Wells Fargo, and Citigroup.

So far, analysts expect year-over-year earnings growth to resume, particularly in the technology, consumer discretionary, and communication services sectors. However, sectors like energy and materials may post weaker numbers due to lower commodity prices and global demand headwinds.

Today’s futures movement may also reflect early positioning by fund managers ahead of quarter-end. Rebalancing flows typically generate volatility as large funds adjust their equity, bond, and sector allocations to align with strategy targets. That activity can heavily influence futures prices in the last sessions of the quarter.

Geopolitical Concerns Keep Traders on Alert

While macroeconomic trends are in focus, global developments continue to cast a shadow over investor sentiment. Over the weekend, tensions remained high in the Middle East, with no clear progress in ceasefire talks between Iran and Israel. Energy traders are closely monitoring oil prices, which are currently stable but remain vulnerable to any escalation of a new conflict.

At the same time, trade negotiations between the U.S. and China have seen little advancement. Washington’s latest restrictions on advanced semiconductor exports are raising concerns among technology investors, especially those with significant exposure to international supply chains.

Despite these uncertainties, market participants appear to be maintaining a risk-on bias, at least for the start of the week. Volatility remains subdued, with the CBOE Volatility Index (VIX) hovering near 12, suggesting a relatively calm outlook among investors.

Technical Indicators and Market Outlook

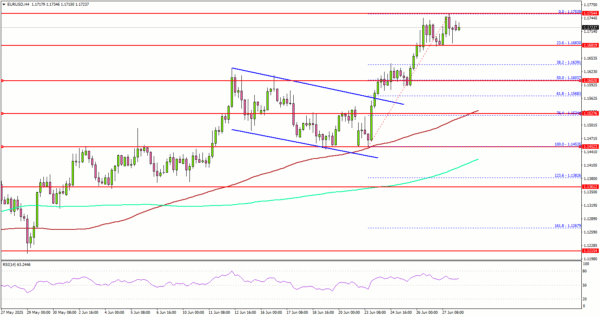

From a technical standpoint, major indexes remain within bullish patterns. The S&P 500 closed last week at 5,450, just below its all-time high of 5,480 set earlier in June. A strong open today could push the index to retest that resistance level. Support lies at 5,390, with the 50-day moving average providing further cushion at 5,325.

The Nasdaq 100 continues to show strong upward momentum, fueled by large-cap tech names such as NVIDIA, Microsoft, and Apple. Futures suggest the index could break above the 20,000 psychological level if today’s rally sustains.

Meanwhile, the Dow Jones is lagging slightly but remains structurally strong, supported by gains in healthcare and industrial stocks.

“Momentum is still intact, and technicals support a further move higher,” said Chris Bell, a market technician at Liberty Analytics. “However, low volume and thin liquidity heading into the July 4 holiday could amplify volatility.”

Investor Sentiment: Cautiously Optimistic

Overall, the sentiment remains cautiously optimistic as the second half of 2025 approaches. Institutional investors are focusing on soft-landing scenarios and potential Fed easing, while retail traders remain active in momentum-driven trades.

With futures suggesting a steady to positive start, all eyes will turn to the opening bell and whether early gains can hold or accelerate as more data and commentary become available.

For now, Wall Street appears poised to start the week with a modest tailwind, driven by improving economic indicators and hopes of lower interest rates on the horizon.

Stay tuned to STL.News for continued updates throughout the trading day, expert commentary, and breaking financial headlines.

Copyright © 2025 – St. Louis Media, LLC. All rights reserved. This material may not be published, broadcast, or redistributed.

For the latest news, weather, and video, head to STL.News.