Broker solutions and liquidity infrastructure provider Fortress Core has announced an exclusive strategic partnership with trading platform developer TradeLocker, making TradeLocker the official front-end interface for all of Fortress Core’s White Label clients. The parties said that this strategic move solidifies Fortress Core’s commitment to delivering a truly end-to-end, next-generation brokerage infrastructure, from onboarding to execution.

Through this partnership, all Fortress Core White Label clients will now benefit from TradeLocker’s modern, trader-first features, including:

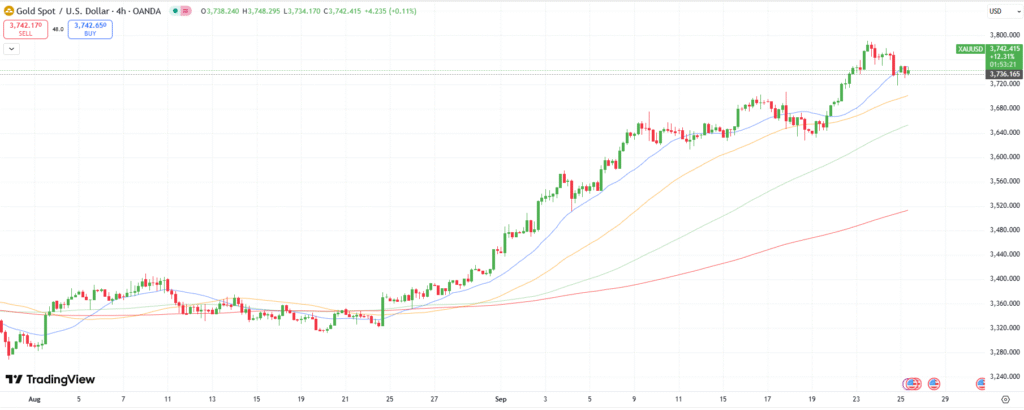

- Advanced TradingView charting tools

- Custom brokerage setup

- Built-in support for Prop Challenges

- Backtesting & automation tools in the Bot Studio

- Seamless cross-device experience, including fully integrated mobile trading apps for iOS and Android

Fortress Core said that this exclusive front-end integration enhances its existing back-end and risk architecture. Together, this stack offers a plug-and-play white label solution for brokerages and prop firms that is fast, scalable, secure, and now mobile-optimised.

Dany Mawas, CEO & Co-founder of Fortress Core said,

Dany Mawas, CEO & Co-founder of Fortress Core said,

“We are very excited about this new strategic partnership. TradeLocker delivers exactly what modern brokers need: lightning-fast UX, mobile-native trading, and serious prop-friendly features.

“By combining TradeLocker’s intuitive interface with the institutional-grade power of Centroid Solutions and ATFX Connect, we are offering our White Label clients a ready-to-scale brokerage solution that’s second to none. We can get you a fully operational trading infrastructure in 3 weeks time which includes all of the latest tech you want to leverage for your prop firm or brokerage.”

TradeLocker CEO Dom Bradley added,

“We’re thrilled to announce our partnership with Fortress Core. We share the same values and ambitions—to deliver a world-class experience for traders. By bringing together Fortress’ rock-solid infrastructure with TradeLocker’s connected, user-friendly platform, we’re setting the stage to deliver something truly special for Traders.”

Fortress Core’s full-stack solution empowers brokers, prop firms, and fintechs across Europe, Africa, LATAM, and Asia to launch faster, operate leaner, and scale smarter without compromising on tech, compliance, or user experience.

About TradeLocker

TradeLocker is a trader-first trading platform built for today’s brokers and prop firms. With advanced charting, mobile app, automation tools, and rapid setup capabilities, it empowers brokers to offer sleek, competitive trading environments — all with speed and flexibility.