It wasn’t so long ago that trading was considered a niche activity that little was understood about by the masses – but fast forward to today, and a growing number of affluent individuals are dipping their toes in in the hopes of securing enhanced financial freedom and long-term wealth.

As trading becomes more accessible than ever before, it’s now simple for just about anyone to get started – although doing so is not something that should be taken lightly, as a good level of knowledge and skill is required to protect yourself from any unnecessary losses.

Nevertheless, its popularity is soaring, and trading on the forex market – the largest currency market in the world – is enjoying a particular surge in numbers. Here, we take a closer look at what it is and how to get started – but most importantly, whether it’s really worth trying in 2025.

Forex trading: All you need to know

Forex is the largest currency market in the world in terms of trading volumes and revenues, and its high liquidity, along with a daily trading volume of over 7.5 trillion US dollars, are just some of the reasons for its appeal.

The first step to starting forex trading is finding a reliable trading platform like MetaTrader 5 apk. Then, you’ll need to develop a suitable trading strategy, learn the basics of the market and how it works.

Currencies in the forex market are always traded in pairs, and the movement of currency pairs measures the value of one currency against another. There are two different types of currency pairs to be aware of, known as major and minor currency pairs. About 75 per cent of the trading volume of the market is made up of the major pairs – which are those that include the USD. Examples of major currency pairs are: EUR/USD, GBP/USD, USD/CAD, AUD/USD, USD/CHF, USD/JPY and NZD/USD. On the other hand, minor currency pairs are those that do not include the USD.

The forex market operates 24 hours a day, five days a week, which makes trading much more accessible, as no matter what time of day you work, you can always trade when you’re not. Such non-stop trading is possible due to the division of the whole process into four trading sessions: American, Asian, Pacific and European. The principle of margin trading is at the heart of forex trading, and is known as leveraged trading. It is mandatory for a trader to trade with the help of a broker, which also allows traders to use borrowed money to make trades.

Advantages of trading on the forex market

Trading on the forex market offers a huge number of advantages for both beginners and experienced traders. The market offers a variety of trading tools and dynamism, as well as freedom in choosing strategies and the possibility to start with minimal investments. High liquidity and the possibility to earn in any market conditions are also seen as major benefits.

The importance of forex trading platforms: MetaTrader 5

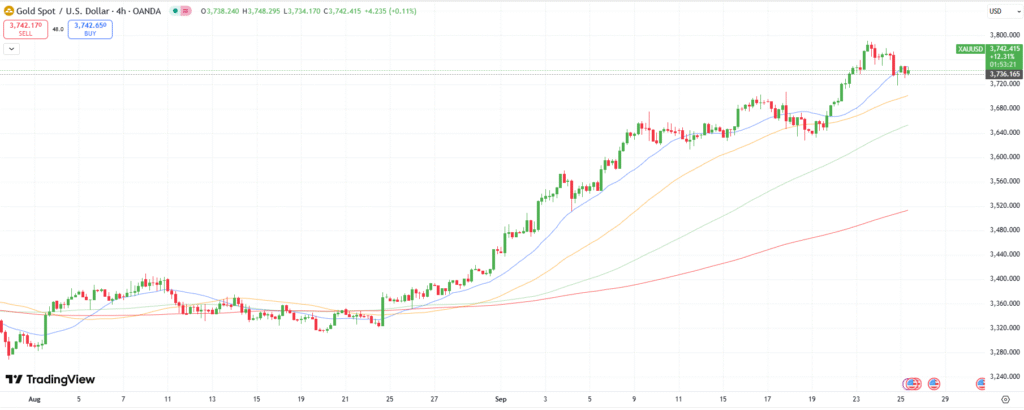

A reliable forex trading platform is a prerequisite for buying and selling assets. The value of trading assets on forex changes every second, and a good trading platform makes it possible to track all the slightest changes and keep abreast of the market’s movements in real time.

A quality trading platform shows the main pairs and exchange rates, the latest news, the status of your personal account and up-to-date information about your transactions, ensuring you have all the data you need in one place so that you can make informed decisions in time as well as potentially boosting your profits.

MetaTrader 5 has become the top choice of many traders, providing a huge number of tools for analysing the market and managing trading accounts. This allows users to trade not only on the forex market, but also on stock exchanges, offering enhanced flexibility for those eager to diversify.

MetaTrader 5 has the edge over many other trading platforms because it offers advanced backtest statistics and visualisation capabilities, ongoing support from MetaQuotes, and the possibility to trade derivatives. It also allows users to trade with the help of trading advisors – programs that work according to the algorithm set in the code.

Overall, the platform can be considered an entire ecosystem for convenient trading on financial markets, combining an array of advanced tools to make trading a pleasant and exciting process.

Forex for beginners: Where to start

As we’ve touched upon, a major advantage of the forex market is the fact that it is highly accessible even to complete beginners; all you need to start trading is access to the internet and a small amount of money for your initial investment.

Trading on the forex market is impossible without opening an account with a forex broker. Many reliable brokers provide tutorials and a plethora of useful information to help you learn and improve along the way – so be sure to take some time to learn the ropes and understand the market before diving in. Opening a demo account to start with is a great way to get hands-on experience of how trading works and test your trading strategy without risking any capital.

Avoid taking large risks and high leverage, at least in the early stages of trading; these should be utilised only when you have a good feel of the market and have begun to implement a well-thought out strategy, with clear goals and objectives in mind.

One of the most important factors for success in trading is the ability to control your emotions, which can be far more difficult than you might think. It’s important to stick strictly to your pre-determined strategy and avoid impulsive decisions to avoid making any costly mistakes, so staying disciplined is key, even when it feels hard.

Disclaimer: Investing money carries risk, do so at your own risk and we advise people to never invest more money than they can afford to lose and to seek professional advice before doing so.