FedEx’s quarterly report is every fear that could be realized during the second-quarter earnings season rolled into one.

The stock market is a game of “what have you done for me lately?” or, more accurately, “what are you going to do for me in the future?” So when the US shipping giant posted better-than-expected fourth-quarter earnings but an ugly outlook for the three months ending August, shares tumbled (though they’ve pared losses to about 2.6% as of 10:55 a.m. ET).

The FedEx conference call was dominated by one key line of questioning: how much is spending changing depending on the tariff outlook? Was there a drop-off in spending and then a big rush to buy after levies were scaled back? Or a massive spike in demand ahead of potential tariffs that then subsided? In other words: was your success a one-off, or is it repeatable?

Those are some queries that seeped into first-quarter earnings discussions, despite Liberation Day coming after the end of March. Most notably, look at Apple’s iPhone sales. Some other instances where management faced questions surrounding pulled-forward demand in the Q1 reporting period included Texas Instruments, Power Integrations, Intrepid Potash, and Mobileye, to name a few.

“Whether or not there is consumer pull forward is TBD,” Chief Customer Officer Brie Carere said, while adding that activity over the quarter was also quite lumpy. “Customs entries in May were double the January through April average.”

If FedEx is any indication, these questions are going to get asked more and more often during the upcoming reporting period.

While executives may not have all the answers, FedEx’s poor guidance for the current quarter, as well as how poorly the stock is doing relative to the overall market, speaks volumes. The stock, which has a reputation as something of an economic bellwether given its connections to global trade and consumer demand, is trading at its lowest level relative to the S&P 500 since 2001, when the US was in recession after the dot-com bubble burst.

It’s dangerous to extrapolate from any one company’s results, and FedEx’s underperformance includes company-specific issues and is certainly not a pure signal of impending US economic doom. But its C-Suite is far from the only one that continues to fret about the potential impact of levies on US imports and retaliatory measures from other countries.

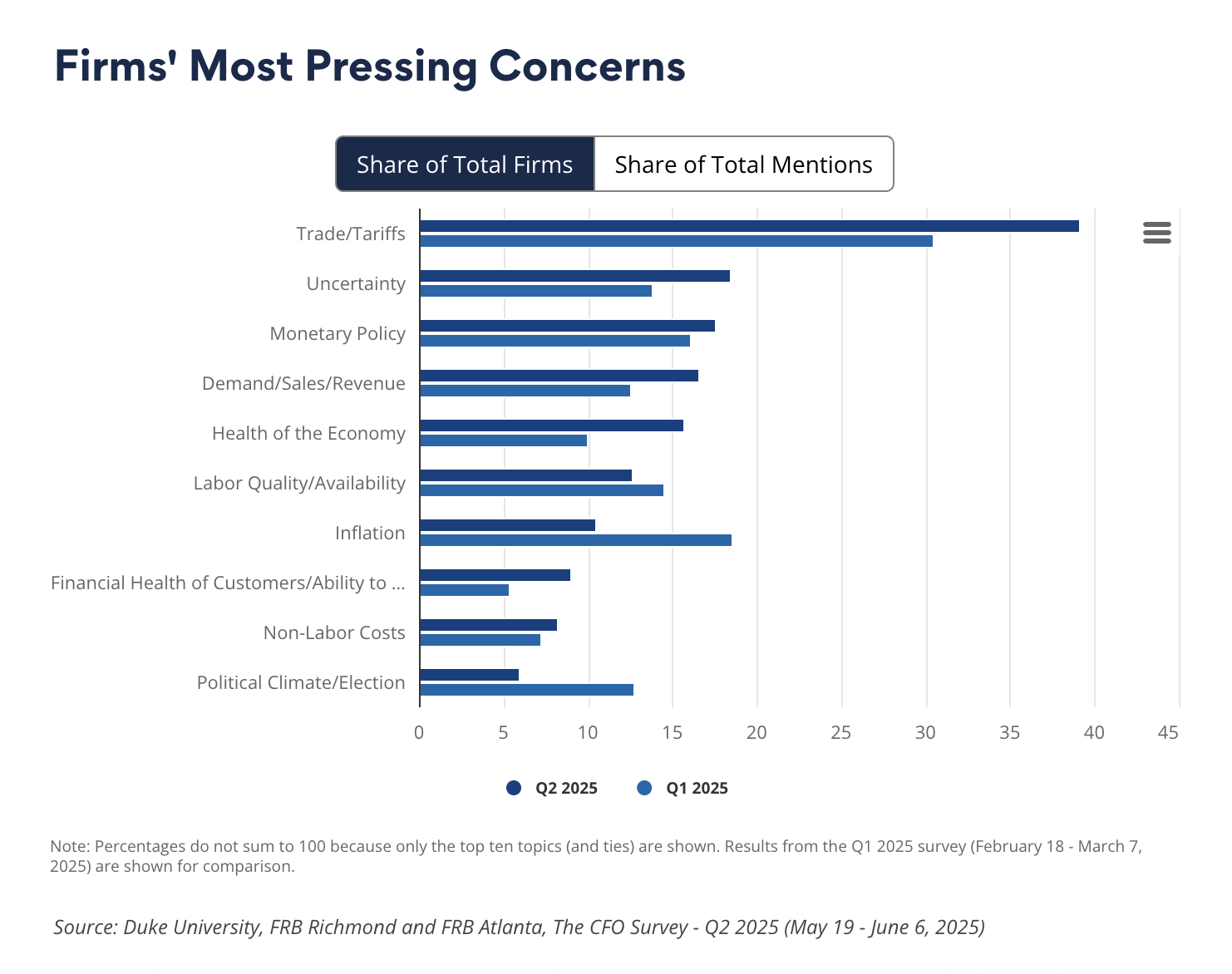

The recent release of the Q2 CFO Survey reveals an increased level of angst around tariffs in corporate boardrooms. The share of firms that cited trade or tariffs as their most pressing concern picked up from Q1 to Q2.

Of note: this survey was conducted between May 19 and June 6, a period when the S&P 500 was already about 20% above its early April lows, reciprocal tariffs had already been watered down, and a trade truce with China had been reached.

Tariffs, in the eyes of the stock market, are a solved problem. In the eyes of US executives, they are not.

“We have a referendum on global supply chains every single day,” FedEx president and CEO Rajesh Subramaniam said, which is obviously not an ideal operating environment, to say the least.

In addition to “what have you done for me lately?” the stock market is also a game of “what’s in the price?”

And that’s where another tidbit from FedEx bears monitoring: its capex budget for the 12 months ending May 2026 came in about half a billion below expectations, at $4.5 billion.

One firm’s capex is another firm’s profits. Because investment outlays are depreciated over time by the spender but recognized immediately as revenues by the recipient, capex has an accretive effect on overall earnings.

Thanks in large part to increased confidence in the longevity of the AI boom, S&P 500 12-month forward capex estimates are at all-time highs. So are earnings-per-share forecasts.

The good news is that FedEx, a decidedly un-AI company, is not as representative of the market-cap-weighted S&P 500, which is dominated by megacap tech firms.

The bad news is that sufficiently negative macroeconomic dynamics come for every firm, as we saw quite clearly during March and early April.

And the OK news is that it’s not clear FedEx is an especially potent macro bellwether, or whether the US economy is in the midst of a drawn-out slowdown or suffering a more severe loss of momentum.

We’ll have to wait for the real start of earnings season in a few weeks to find out.