By Mike Dolan

What matters in U.S. and global markets today

By Mike Dolan, Editor-At-Large, Finance and Markets

Edgier world markets appeared to bat away the latest testy exchanges in the re-heated U.S.-China trade war, helped by dovish soundings from the Federal Reserve boss that included signals about an imminent end to its balance sheet rundown.

As gold spiraled on to new highs, in what global fund managers see as the most crowded trade on the planet, U.S. Treasury yields and the dollar fell after Fed Chair Jerome Powell fretted about a softening labor market and said the central bank may soon halt the reduction of bonds held on its balance sheet – a process known as quantitative tightening.

“We may approach that point in coming months,” Powell said, adding that “some signs have begun to emerge that liquidity conditions are gradually tightening.”

Whatever liquidity concerns Powell was watching, it wasn’t showing up in the latest sweep of bumper earnings from the big U.S. banks on Tuesday – with more updates on Wednesday’s diary.

But the Fed direction is helping markets navigate the outage of economic data during the government shutdown and also the fresh barbs in the U.S.-China trade standoff, with President Donald Trump saying he was considering terminating some trade ties with China – singling out cooking oil as one.

U.S. stock futures rallied ahead of Wednesday’s bell and the VIX volatility gauge retreated, with global equity and bond markets rallying broadly too. Even though new tensions in the trade row may already raise questions about its forecasts, the International Monetary Fund nudged up its world economic outlook for 2026.

Despite the trade anxiety and another worrying set of deflationary signals from China, equity markets in Shanghai and Hong Kong jumped more than 1% on hopes of more economic stimulus plans at next week’s Communist Party plenum.

In Europe, French stocks and bonds and the euro advanced also on Prime Minister Sébastien Lecornu’s decision to delay pension reforms until after the 2027 election, a move that gave investors more confidence the shaky government can avoid another destabilizing election soon. LVMH’s return to growth in the third quarter helped the luxury sector and France’s CAC40 index hit its highest since March.

-

The IMF nudged its 2025 global growth view higher and flagged that, while the worst spring scenarios were dodged, the outlook is clouded by policy uncertainty, rising trade frictions and eroding trust in institutions – risks magnified by the U.S. data blackout. Officials warned that renewed U.S.-China tariff escalation could materially slow output even as near‑term momentum looks firmer.

-

A solid investment‑banking backdrop helped big lenders deliver mostly upbeat Q3 results – Wells Fargo rallied, Citigroup’s profit rose on record revenue, and BlackRock’s AUM hit a record – supporting broader risk sentiment even as JPMorgan and Goldman dipped on profit‑taking. The read‑through: capital‑markets activity and fee lines are a tailwind into year‑end, but managements remain wary of headline‑risk around tariffs and the economy’s fog of limited official data.

-

Fed Chair Jerome Powell said the labor market remains in “low‑hiring, low‑firing” mode and left the door open to further cuts, with markets now leaning toward two quarter‑point reductions by December and an end to QT coming into view. The combination of easier‑Fed bets and trade jitters catapulted spot gold above $4,200 for the first time.

In today’s column, I discuss why the “phoney trade war” may be ending – and why the real impacts may now start to emerge and a nervier winter could bring back market volatility.

Today’s Market Minute

* Deflationary pressures persisted in China, with both consumer and producer prices falling in September, supporting the case for more policy measures as a prolonged property market slump and trade tensions weigh on confidence.

* The U.S. and China on Tuesday began charging additional port fees on ocean shipping firms that move everything from holiday toys to crude oil, making the high seas a key front in the trade war between the world’s two largest economies.

* Oil prices edged lower on Wednesday, as investors weighed the International Energy Agency’s prediction of a supply surplus in 2026 and trade tensions between the United States and China that could curtail demand.

* The abrupt cuts to U.S. federal clean energy incentives alongside fresh support for coal and gas-fired power will trigger a swell in North America’s emissions in the coming decades as the U.S. generation mix remains fossil fuel reliant, writes ROI global energy transition columnist Gavin Maguire.

* China is once again rolling out the big cannon of curbs on metals and minerals vital to the global energy transition, as well as key components in weapons and electronics. Read the latest from ROI Asia commodities columnist Clyde Russell.

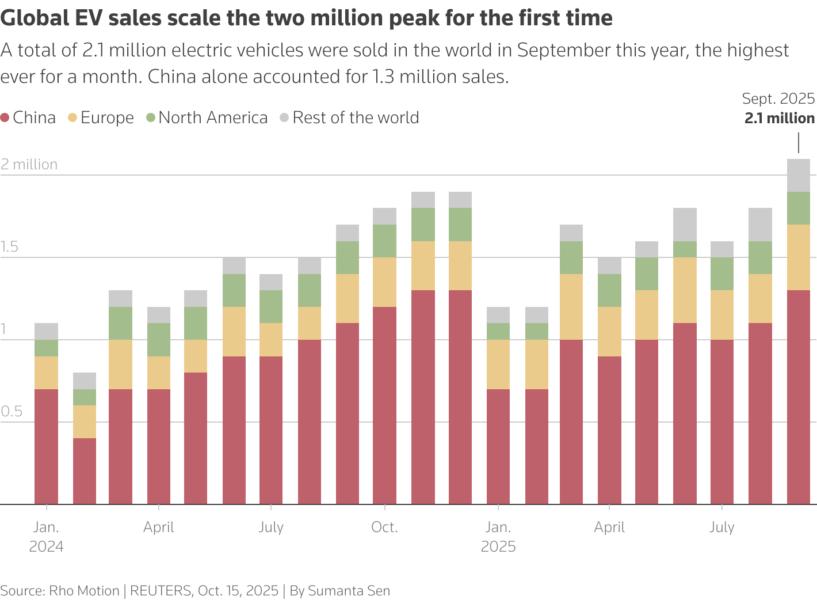

Chart of the day

Global sales of fully electric and plug-in hybrid vehicles rose 26% in September from a year ago to a record 2.1 million units, driven by strong demand in China and a late U.S. tax-credit rush, market research firm Rho Motion said on Wednesday. China accounted for about two-thirds of global sales with about 1.3 million units, while North America also hit a record as U.S. buyers moved to secure incentives before they expired.

Today’s events to watch

* Federal Reserve issues the Beige Book on economic conditions (2:00 PM EDT) New York Federal Reserve’s October manufacturing survey (8:30 AM EDT) September real weekly earnings (8:30 AM EDT); Brazil Aug retail sales (8:00 AM EDT)

* Federal Reserve Board Governors Stephen Miran and Christopher Waller both speak, while Kansas City Fed President Jeffrey Schmid and Atlanta Fed boss Raphael Bostic also speak; European Central Bank Vice President Luis de Guindos speaks; Reserve Bank of Australia Governor Michele Bullock speaks

* International Monetary Fund and World Bank meetings in Washington. The Institute of International Finance holds its annual meeting in parallel.

* U.S. corporate earnings: Bank of America, Morgan Stanley, PNC, Citizens, Synchrony, Abbott Laboratories, Prologis, United Airlines, JB Hunt

* U.S. President Donald Trump welcomes Argentina’s president Javier Milei to the White House

Want to receive the Morning Bid in your inbox every weekday morning? Sign up for the newsletter here . You can find ROI on the Reuters website , and you can follow us on LinkedIn and X.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.