EUR/USD Analysis Summary Today

- Overall Trend: Neutral with an upward bias.

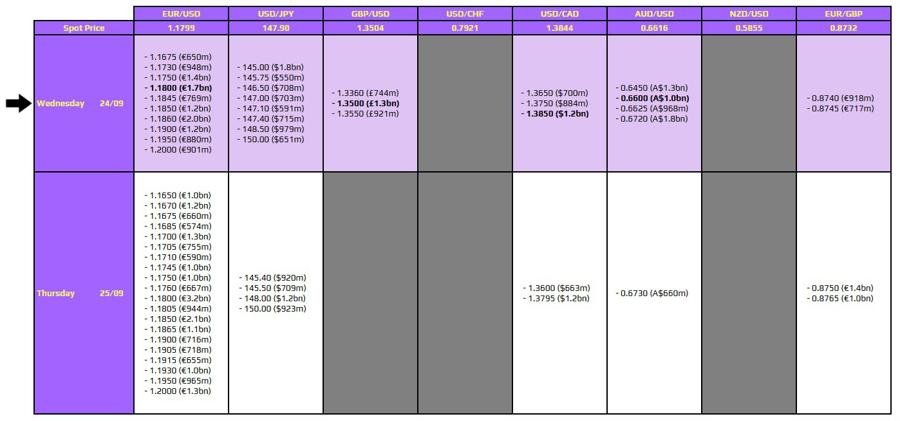

- Today’s Support Levels: 1.1760 – 1.1700 – 1.1650.

- Today’s Resistance Levels: 1.1840 – 1.1900 – 1.1980.

EUR/USD Trading Signals:

- Sell EUR/USD from the 1.1880 resistance level. Target: 1.1600. Stop-loss: 1.1970.

- Buy EUR/USD from the 1.1680 support level. Target: 1.1810. Stop-loss: 1.1620.

Technical Analysis of EUR/USD Today:

the EUR/USD pair is trying to hold steady at and above the 1.1800 resistance level, even with recent confirmations about the future path of US interest rate cuts. Yesterday, Federal Reserve Chairman Jerome Powell urged caution on further policy easing. He stated that the outlook for US rate cuts remains uncertain as the Fed faces the challenge of containing inflation while supporting a weakening labor market.

Powell also noted that the inflationary effects of tariffs have so far been minimal, which leaves room for a less restrictive policy if needed. Meanwhile, the new Fed Governor, Stephen Miran—who called for a larger 50-basis point cut at last week’s meeting—warned that policymakers might be underestimating how restrictive policy is and risking jobs without more aggressive action.

Investors are now looking to the upcoming Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, for additional guidance.

Will the Euro-Dollar Rise in the Coming Days?

According to the daily chart, the EUR/USD is in a neutral-to-bullish position. Holding above the 1.1800 resistance level will support this outlook. The current state of technical indicators confirms this bias; the 14-day RSI is at 57, moving upward and away from the neutral line, awaiting a catalyst to begin a rally. The MACD indicator’s lines are also steadily moving higher. Over this timeframe, the psychological resistance at 1.2000 will remain an important target for bulls, which could happen if they first successfully push toward the 1.1880 and 1.1920 resistance levels, respectively.

The EUR/USD bearish scenario will strengthen on the daily chart if bears manage to pull the currency pair back to the support levels of 1.1720 and 1.1650. Today, the pair will react to the German IFO index reading at 11:00 AM Egypt time, followed by the US new home sales figures at 5:00 PM Egypt time. The pair will also continue to be influenced by the ongoing statements from Federal Reserve officials throughout the week.

Trading Tips

Dear TradersUp trader, be careful. The EUR/USD’s upward path is at a critical stage. A failure to rally again could lead to a strong sell-off. Therefore, it’s crucial to carefully monitor the factors influencing currency prices and avoid taking risks, no matter how strong the trading opportunities seem.

What Happened Recently in EUR/USD Trading?

According to trusted trading platforms, the euro’s exchange rate fell slightly to around $1.18, as investors analyzed conflicting Purchasing Managers’ Index (PMI) data and assessed its potential impact on European Central Bank policy. Based on the economic calendar, the Eurozone’s HCOB Composite PMI rose to 51.2 in September, in line with the 51.1 forecast, indicating the fastest private sector growth in the Eurozone in 16 months. Growth in the services sector exceeded expectations, while the manufacturing sector contracted, falling short of forecasts.

At the country level, data from France was disappointing, while German data was better than expected. The European Central Bank recently signaled that its interest rate-cutting cycle may be over, citing persistent inflation risks related to tariffs, services costs, food prices, and fiscal policy. The market is now awaiting a series of speeches from both ECB and Fed officials for more clarification.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.