- The Euro steadies amid lower US yields and easing French political instability, but upside remains limited due to geopolitical risks.

- Any renewed geopolitical tensions, like the US-China trade frictions, could support the dollar and weigh on the euro.

- Traders look ahead to the Consumer Price Index and jobless claims for clear policy direction.

The EUR/USD weekly forecast shows a neutral to moderately bullish momentum this week, as the euro strengthens amid easing political tensions in France. Meanwhile, the dollar remains under pressure amid lower yields and revived trade war fears.

–Are you interested in learning more about crypto robots? Check our detailed guide-

The pair pulled back towards the 1.1650 level from the weekly top of 1.1730, as the dollar slightly rebounded. However, the cooling US yield, with the 10-year treasury falling below 4% weighs on the dollar.

From France, PM Sebastian Lecornu’s survival of two no-confidence votes and the delay in pension reforms have calmed the political upheaval. Still, the French government attempts to advance a strict year-end budget through parliament. If it’s successful, it could revive volatility and limit the euro.

The ongoing US-China trade frictions are a key global risk factor. Any further pressure could cap euro gains and trigger safe-haven demand for dollars.

This persistent instability has dampened investor confidence and strengthened expectations for further Fed easing, which could likely weaken dollar growth. Meanwhile, any easing in Europe’s fiscal challenges and risk sentiment could cause the euro to recover.

EUR/USD Key Events Next Week

The major key events in the coming week include:

- Initial Jobless Claims

- Continuing Jobless Claims

- Consumer Price Index

- Eurozone PMIs

- US PMIs

Traders await the initial and continuing jobless claims and consumer price index next week for insights into expectations of Fed rate cuts and the economic outlook. However, the primary focus will remain on the PMI readings to gauge the business activity in both the US and Europe.

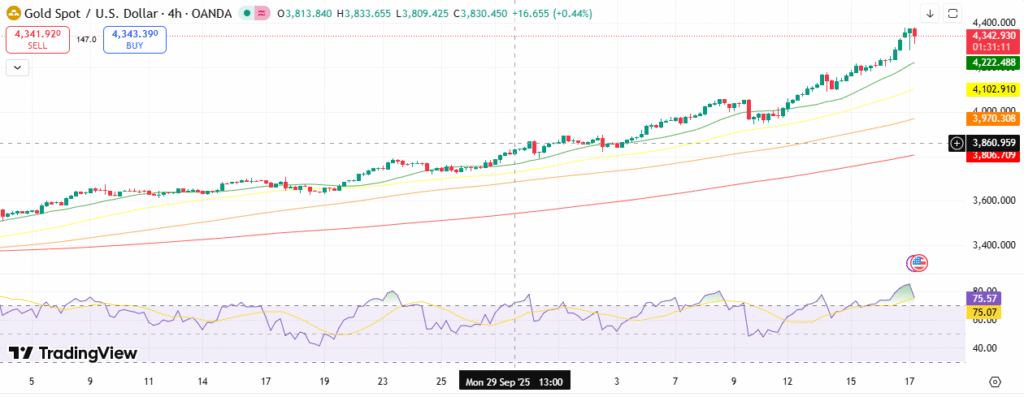

EUR/USD Weekly Technical Forecast: Selling Pressure Under 1.1700

The EUR/USD weekly technical outlook indicates a mild bearish bias after pulling back from the 1.1700-1.1720 zone. The pair stays pressured below the 1.1685 support level and the 20-day MA, reflecting sellers dominating the market. Overall, the pair maintains a medium-term sustained phase. The support sits at the 1.1500 and 1.1380 levels.

–Are you interested in learning more about buying Dogecoin? Check our detailed guide-

The RSI is at 47, signaling neutral to mildly bearish momentum in the near term. A decisive breach above 1.1720 could extend gains towards 1.1800. Failure to sustain above the 1.1600 level could trigger a further downtrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.