- The EUR/USD weekly forecast indicates a looming end to the ECB’s rate cuts.

- The US economy added 139,000 new jobs compared to the forecast of 130,000.

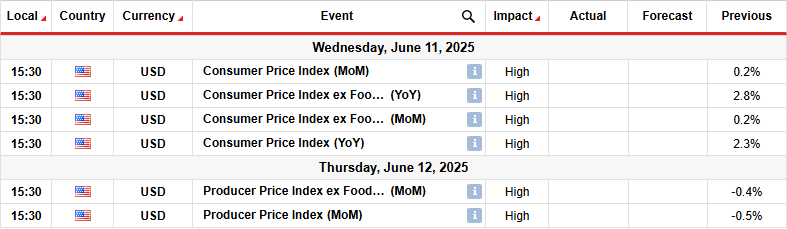

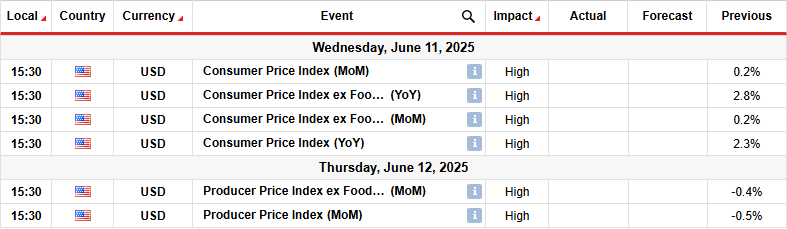

- Next week, traders will focus on US inflation data.

The EUR/USD weekly forecast is bullish as the situation indicates a looming end to the ECB’s monetary easing cycle.

Ups and downs of EUR/USD

The EUR/USD pair hit new highs during the week but closed well below the levels. The rally came after the European Central Bank meeting, where policymakers cut rates and signaled an end to the easing cycle.

–Are you interested to learn more about crypto signals? Check our detailed guide-

ECB’s Christine Lagarde said the central bank was now in a good place to handle any adverse effects of Trump’s tariffs. As a result, the euro surged. However, it pulled back on Friday after data revealed that the US labor market remains resilient despite tariffs. The economy added 139,000 new jobs compared to the forecast of 130,000. As a result, Fed rate cut expectations eased.

Next week’s key events for EUR/USD

Next week, traders will focus on reports from the US, which will provide an update on the state of consumer and wholesale inflation. Previous readings have shown that inflation is easing. However, policymakers have maintained caution, waiting to see whether Trump’s tariffs have increased price pressures. If this is the case, rate cut expectations will decline, boosting the dollar.

On the other hand, if inflation continues its decline, policymakers will gain confidence to predict the timing of the next rate cut.

EUR/USD weekly technical forecast: Bulls weak around 1.1500 resistance

On the technical side, the EUR/USD price has rebounded to trade above the 22-SMA. At the same time, the RSI has broken above 50, into bullish territory. However, bulls still face solid resistance at the 1.1500 key psychological level.

–Are you interested to learn more about forex robots? Check our detailed guide-

Initially, the price was trading in a strong uptrend, keeping above the 30-SMA. However, this changed once bulls reached the 1.1500 key level. Here, bears gained enough momentum to break below the 22-SMA. However, they failed to sustain a move below the SMA, pausing at the 1.1104 support.

At this point, bulls took back control, aiming to retest the 1.1500 key level. However, the RSI indicates weaker bullish momentum, suggesting that the bulls may not have sufficient strength to break above 1.1500. If this is the case, it might drop back below the SMA next week, aiming for lower lows.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.