- The EUR/USD weekly forecast points to a higher likelihood of a September Fed rate cut.

- The US CPI increased by 2.7% annually.

- US wholesale inflation was much hotter than expected in July.

The EUR/USD weekly forecast points to a higher likelihood of a September Fed rate cut that is weighing on the dollar.

Ups and downs of EUR/USD

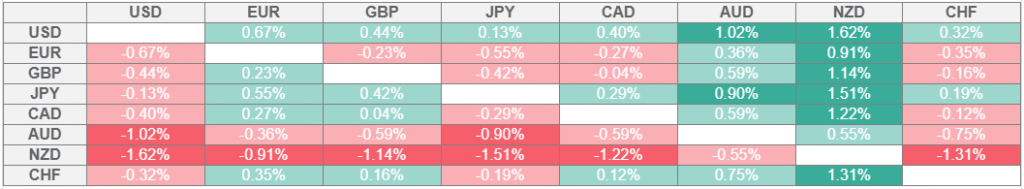

The EUR/USD price had a bullish week as the dollar fell amid an increase in Fed rate cut expectations. Rate cut bets rose during the week as data revealed soft inflation and poor consumer spending.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The US CPI increased by 2.7% annually, compared to the forecast of 2.8%. The report had a huge impact since it came after poor employment figures in the previous week. At the same time, retail sales came in below estimates, indicating weaker consumer spending.

However, wholesale inflation was much hotter-than-expected in July, dashing hopes for a massive cut in September. Still, traders are almost fully pricing a 25-bps rate cut.

Next week’s key events for EUR/USD

Next week, traders will only watch the FOMC meeting minutes and the Jackson Hole Symposium. The minutes will show the tone during the last meeting. Moreover, it might contain clues on future policy moves.

At the same time, Powell will likely speak at the symposium. Traders will wait to see whether his tone has become more dovish after the latest set of economic data. The labor market has slowed down significantly, and inflation is softer.

EUR/USD weekly technical forecast: Bulls return after morning star pattern

On the technical side, the EUR/USD price trades above the 22-SMA, with the RSI over 50, suggesting a bullish bias. Moreover, the price is about to retest the 1.1750 key resistance level. A break above would strengthen the bullish bias and continue the previous uptrend. On the other hand, if the resistance holds firm, the price might bounce lower to start a downtrend.

–Are you interested to learn more about forex tools? Check our detailed guide-

Bears recently broke out of a major trendline that had defined the recent rally. However, the decline could not go past the 1.1400 support level. Instead, the price made a morning star pattern, indicating a likely bullish reversal. Soon after, bulls took charge by pushing the price above the 22-SMA.

He bullish reversal pattern is a sign that bulls have regained momentum after a deep pullback. Therefore, it increases the chance that the price will break above the 1.1750 resistance level to continue the uptrend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.